Publicly traded American restaurant groups

Posted: March 22, 2024 Filed under: business, food 1 Comment

Bloomin Brands (ticker symbol: BLMN) owns Outback Steakhouse and Fleming’s. 50 new Outback Steakhouses opened in Brazil since 2021.

There are 3,427 Chipotles (CMG) in the United States, with 97,660 employees. Here’s Slate recently on Chipotle’s dominance:

But despite that backlash, the fact remains that for a lot of Americans, from San Diego to New Haven and everywhere in between, Chipotle has become effectively synonymous with good Mexican eating. When the Wall Street Journal interviewed Mary Hawkins, the mayor of Madison, Mississippi—one of the tiny population centers Chipotle has in its sights—she said the town had recently polled its citizenry about the brands it would most like to see take up residence on its streets. Chipotle, perhaps unsurprisingly, came in first, and Arellano does not see that trend slowing down.

“It’s like Galactus from Marvel Comics. It’s eating up burrito cultures from across the country,” he said. “Chipotle taught an entire generation of Americans to eat a very specific style of burrito. If they want a burrito, they’re going to want the one they grew up with and neglect the other styles.”

McDonald’s (MCD) of course is the king, with 42,000 stores. Here’s Ian Borden, McDonald’s CFO, being interviewed at a UBS conference:

Dennis Geiger

That’s great. Want to go over to core menu. And you just talked about some of the opportunities at chicken I think in particular. As we think about beef, chicken and coffee and some of the biggest opportunities to kind of further your advantages on core menu anything else to kind of highlight there across those key equities?

Ian Borden

Yes. Sure. Well look I talked about core is critically important. 65% of our global system-wide sales, $17 billion brands across that core categories and I think a few headlines under each of those three. Beef obviously we’re by far the largest player in beef globally. We’ve gained share since 2019 pretty consistently across our markets. I think a couple of the key things from an opportunity standpoint in beef. Best Burger which is just a series of what I’ll call small changes in how we cook and prepare our core beef products that’s been out to about 70 markets. It’s going to be in the rest of the system by end of 2026. It’s driving significant improvements in taste and quality. Taste and quality are the two biggest drivers of consumer visits to our restaurants. So that’s impactful.

The second thing on beef that I think is worth highlighting is the opportunity we see around large burger. And it’s a good example of how I think we are more precisely understanding consumer need and then getting after that consumer need and I’ll call it a one-way approach. So we’ve tried to get after this opportunity for a number of years because we thought the opportunity was about premium burger which was wrong. And we — so we didn’t — we weren’t successful. We now understand what the opportunity is for a large more satiating-type burger. That opportunity is significant. It’s consistent across many of our large markets.

And we have innovated a couple of products that we’re in the process of piloting. We’re going to pilot those products in two or three what we call market zeros. We’re then going to — if those products work we’re then going to scale one solution to that opportunity globally where in the past you would have seen us probably try and get after that opportunity in 20 different markets in 20 different ways and then you don’t have the ability to build a global equity that you can drive at scale. So that’s a little bit about beef.

McDonald’s is essentially a real estate company with a restaurant system they can affix and then turn over to franchisees.

The Darden Group (DRI) owns: Ruth’s Chris Steak House, Eddie V’s and The Capital Grille, Olive Garden Italian Restaurant, LongHorn Steakhouse, Bahama Breeze, Seasons 52, Yard House and Cheddar’s Scratch Kitchen. Until July 28, 2014, Darden also owned Red Lobster. Darden has more than 1,800 restaurant locations and more than 175,000 employees, making it the world’s largest full-service restaurant company. (says Wikipedia). There are 77 Ruth’s Chris and 562 Longhorn Steakhouses.

Brinker (EAT) has Chili’s and Maggiano’s Italian Grill. They’re having a killer year, surprising to me to learn, as the local Maggiano’s is closed and troughs of Italian slop don’t seem in fashion. But my heart still warms at the thought of Chili’s. Norman Brinker was a pioneer of the casual dining space.

Dine (DIN) owns IHOP (1,787 restaurants), Applebee’s (1,654) and Fuzzy’s Taco Shop (137 branches). The local IHOP near me is closing. A few years ago I tried an Applebee’s and was dissatisfied with the experience. I’ve never even seen a Fuzzy’s. As for pancakes, feels like they peaked as a food in like 1880?

Domino’s has 20,197 franchises. Their stock (DPZ) over the last twenty years returned investors something like 2,600% (vs 239% for the S&P 500). The key is the easy to use app.

Restaurant Brands International (QSR) has Burger King, Tim Horton’s, Popeyes, and Firehouse Subs, for a total fo 30,375 franchises. Noted investor and Harvard administration gadfly Bill Ackman has a big position in QSR, as well as Chipotle. In his recent Lex Friedman podcast he noted that some of his biggest wins have been in restaurants.

Shake Shack (SHAK) has expanded very fast, they now have 440 stores. I remember going to the very first branch in the summer of 2009, before starting my new job on 30 Rock. Who was in line behind me but Scott Adsit?!

Texas Roadhouse (TXRH) is booming, returning 738% for investors since founding. The story of founder W. Kent Taylor is worthy of its own post, when I have the time. I listened to a couple podcasts, one with Jerry Morgan, current CEO and one with VP of communications Travis Doster, and they project a “fun with purpose” coherent and vigorous company culture inspired by Kent Taylor’s vision.

Starbucks (SBUX) has 10,628 company owned stores and 18,216 licensed. Personally I consider that a drug dispensary rather than a restaurant.

Wendy’s (WEN) has 7,095 restaurants worldwide. Their new CEO Kirk Tanner made some noise recently with his comments about AI order-taking and flexible pricing, which the company then walked back. It sounded kinda fun to me (what if you could get a deal at an off hour or something) and made for many a meme. Kirk Tanner seems to get in the news a lot: Wendy’s doing drone delivery was a headline on Drudge the other day. Those all seem like distractions or possibly stunts? Wendy’s big play at the moment is expanding into breakfast.

Wingstop (WING) is growing fast: 1,996 restaurants. The stock has doubled in the last year. The people love wings!

Yum Brands (YUM) with KFC, Pizza Hut, Taco Bell, and Habit Burger is on another level. They opened 4,754 new units last year.

Jack in the Box (JACK) swallowed Del Taco a few years ago. Here’s CEO Darin Harris speaking about the culture of servant leadership. I like what I hear!

New York hot dog chain Nathan’s and Chicago hot dog chain Portillo’s are both public companies, NATH and PTLO respectively. I’m not bullish on the future of hot dogs myself. If I were on the board of Nathan’s (I’m not) I’d lean into the hot dog eating contest aspect. That could be completely the wrong way to go, who knows, but they’ve got to take a swing.

I’ve never seen a Kura Sushi, but some investors appear to be optimistic about the technology-enabled Japanese sushi concept – the stock (KRUS) is up 41% this year.

Casey’s (CASY) runs some 2,500 gas station pizza joints in the Midwest. The Casey’s in Corning, Iowa was the only place to eat one Sunday night last summer. It was not bad at all! Iowan amigo Brooks tells me it’s beloved, that you should try the sausage pizza. Not much more is easily available to me on founder Donald Lamberti other than that he is in the National Sprint Car Hall of Fame. “Kind of a monopoly on many, many tiny markets”? A growing business.

Flanigan’s (BDL) is a Florida chain famed for their dolphin sandwich (don’t stress, it’s actually mahi mahi). Why it’s publicly traded doesn’t make sense to me, but there you go. I’ve never been, I collected a firsthand report or two that suggested it’s a real good time, if not necessarily Wall Street’s most ambitious concern.

Some amateur investor types love RCI, aka Rick’s (RICK), a chain of strip clubs, on the thesis that it’s kind of hard to launch a new strip club, as nobody wants ’em in their neighborhood. I’m not sure Bombshells counts as restaurants, but a publicy traded strip club joint with an expressive CEO is a noteworthy indicator.

Anyone been to a Chuy’s (CHUY)?

On May 31, 2001, then President George W. Bush’s twin daughters, Jenna Bush and Barbara Bush, were cited for using fake IDs at the Barton Springs Road Chuy’s, which put Chuy’s in the national spotlight

Next time in Austin maybe. What’s the gameplan for Chuy’s? From their recent earnings call:

As we look ahead, we will continue to do what we do best to provide our guests with fresh, made from scratch food and drinks at an incredible value. Despite weather issues across the country that has impacted the restaurant industry in January, we believe the initiatives we put in place to drive long-term sustainable top line growth and profitability has positioned us well to weather these near-term challenges.

With that, let me provide some update on our growth drivers. Starting with menu innovation. As we mentioned on our last call, we introduced our first barbell approach to the CKO platform during the fourth quarter, and we were very pleased with how well it was received by our guests. In fact, this was our second most successful Chuy’s Knockouts campaign to-date.

Following this success, we were thrilled to introduce to our guests the next CKO iteration in late January with Shrimp & Crab Enchiladas with Lobster Bisque sauce as a higher-priced CKO menu item, along with Macho Nachos and the Cheesy Pig Burrito. Again, early feedback continues to be positive as our CKOs are resonating well with both new and returning guests.

Alongside our exciting CKO offering, we recently added several new menu items to our permanent menu, including reintroducing the Appetizer Plate and adding the Burrito Bowls. If you recall, Burrito Bowls were part of our CKO platform during the second and third quarter of 2023 and this menu

etc etc. Good luck Chuy’s!

And of course, Cheesecake Factory (CAKE), much mocked, but enduring. Ate there the other day with some colleagues. You know what? My Santa Fe Salad was good. What do we think of this?:

Much lunch conversation turned on this.

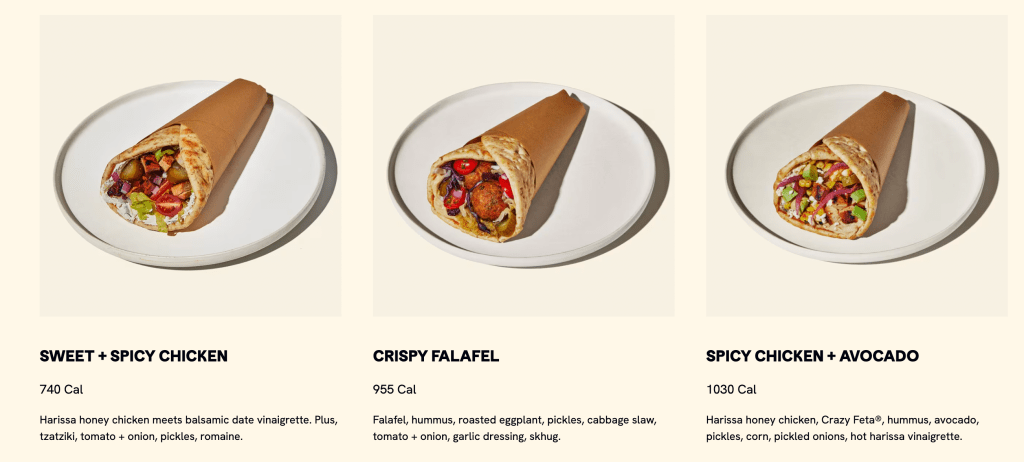

CAVA is a new Mediterranean restaurant concept from the East Coast. A new one appeared here in LA. I tried it. Their operating system was not perfect (in fairness, think this is a new branch). Kinda salty?

The stock seems to excite investors, possibly because everyone is looking for “the next Chipotle.” Appears to be up 5% just today! I checked in with one of my Vibes Reporters:

i have had cava once. ok but didnt feel the need to go back

Kinda how I felt? The pita chips are fun. I just don’t think Mediterranean food will have quite the appeal of Chipotle.

Sweetgreen (SG) is a salad deal, I’ve tried that one. Somehow, I always feel gross afterwards.

On the other end of the spectrum is Cracker Barrel (CBRL) serving Southern-inspired slop to old people. Valueline reports:

Macroeconomic factors have impacted Cracker Barrel Old Country Store’s sales. Elevated inflation, though now apparently easing, has stressed the company’s customers. Many of these customers are in the 65-and-older demographic, commonly characterized as a fixed-income category. Management is working to bring in more of a younger crowd into Cracker Barrel restaurants and in-location retail shops,

Good luck guys, but this looks to me like the past, not the future:

Then again, Cracker Barrel has (had?) their loyalists:

From 1977 to 2017, married couple Ray and Wilma Yoder drove a combined total of more than 5 million miles (an average of 342 miles per day) to visit 644 Cracker Barrel locations. When the company opened their 645th restaurant, in Tualatin, Oregon, in August 2017 (on Ray Yoder’s 81st birthday), it flew the Yoders out for the grand opening and presented them with custom aprons and rocking chairs, among other gifts.[52][53]

Yoshiharu (YOSH) is a Southern California ramen concept I have yet to try. There’s also Noodles & Company (NDLS). Why is their ticker symbol not NOOD? Missed opportunity. The noodles game seems too competitive to me, talk about low margins.

But then again look at the big winners here: MCD, DPZ, CMG. Burgers, pizza, burritos. You couldn’t come up with businesses with more competition, no barriers to entry. And yet these three systematized delivery and managed quality control in such a way as to create unstoppable empires.

I began this post as I was reading Value Line’s restaurant issue and enjoying contemplating the massive scale of these restaurant chains. As an occasional restaurant consumer I can engage with these places and sense their vibe, it’s a sector I can know in a way I can’t know, say, semiconductors or industrial products. So it’s an engaging, practical and delicious topic for our continued education in business.

Restaurant Business might be the next frontier to explore. They have a daily podcast!

Growing at exactly the right pace and to exactly the right size seems like the key for restaurant stocks. On his Invest Like The Best podcast, Patrick O’Shaughnessy interviewed Capital Management’s Anne-Marie Peterson. She talked restaurants:

So restaurants are different from retail because it’s not as easy to scale. There aren’t a bunch of large cap restaurant chains unlike retail. The franchise model is pretty powerful and what Chipotle has done is pretty powerful, too. But the similarities are like real estate matters, the store experience matters. But in a tight labor market, it’s tough.

And what’s interesting about McDonald’s — I have such an affection for that company. It works everywhere. They have one concept. I think it’s 60% or 70% of their operating income is from rent. They’re a landlord. They control the real estate. The others didn’t, so that’s why they’ve endured. They had a big insight about like let’s own the real estates so our franchisees don’t get whipped around with pricing, and we can co-invest with them in the experience.

And now digitals. The mobile ordering is enhancing the productivity and reducing even those kiosks. That need for labor and in a tight labor market, it’s big. The little guys can’t invest. They have some external dynamics now that are contributing to scale. But it’s really interesting.

Rory Sutherland brought up McDonald’s automated screens on Rick Rubin’s Tetragrammaton podcast. He wondered if they might allow for customers to make certain shameful orders they feel bad about saying to a person. I’ve tried out the automated screens, they work great at getting you your junk, but they make the world a little less human.

Remember when Eric Schlosser’s book Fast Food Nation came out in 2001? Absolutely everybody was reading it. They made a movie (pretty good! Richard Linklater). Yet here we are, almost twenty five years later, eating more fast food than ever.

I was reading The Lorax to baby and it reminded me of Schlosser.

Here’s a more comprehensive list of restaurant stocks as I’ve skipped a few, notably Denny’s (DENN, slumping), Red Robin (RRGB, hopeless), El Pollo Loco (LOCO, stop trying to make citrus-marinated chicken happen), BJs, a few others.

“Treat” shops such as Krispy Kreme are beyond the scope of this post.

Texas Roadhouse is excellent. The highlight of their menu is their grilled meats: steak, chicken, and pork chops. They’re very good and you can get them “smothered”, with grilled onions, mushrooms, and white country gravy. – Tom Schreffler