Sandwich history

Posted: January 28, 2026 Filed under: food Leave a comment

Picked up some beef stew with a piece of bread, and wondered if you really need two slices. Was the first sandwich more like this, a kind of Anglo taco?

The modern sandwich is named after Lord Sandwich, but the circumstances of its invention and original use are the subject of debate. A rumour in a contemporaneous travel book by Pierre-Jean Grosley, Tour to London (published 1772), formed the popular myth that bread and meat sustained Lord Sandwich at the gambling table, but Sandwich had many habits, including the Hellfire Club, and any story may be a creation after the fact. Lord Sandwich was a very conversant gambler, the story goes, and he did not take the time to have a meal during his long hours playing at the card table. Consequently, he would ask his servants to bring him slices of meat between two slices of bread, a habit known among his gambling friends. Other people, according to this account, began to order “the same as Sandwich!”, and thus the “sandwich” was born.The sober alternative to this account is provided by Sandwich’s biographer N. A. M. Rodger, who suggests that Sandwich’s commitments to the navy, to politics, and to the arts mean that the first sandwich was more likely to have been consumed at his work desk.

Islands named after Sandwich by Capt. James Cook

Lord Sandwich was a great supporter of Captain James Cook. As First Lord of the Admiralty, Sandwich approved Admiralty funds for the purchase and fit-out of the Resolution, Adventure and Discovery for Cook’s second and third expeditions of exploration in the Pacific Ocean. He also arranged an audience with the King, which was an unusual privilege for a lower ranking officer. In honour of Sandwich, Cook named the Sandwich Islands (Hawaii) after him, as well as the South Sandwich Islands in the Southern Atlantic Ocean and Montague Island in the Gulf of Alaska.

This guy came damn close to having two great things, the sandwich and Hawaii, named after himself.

Previous discussions of Captain Cook.

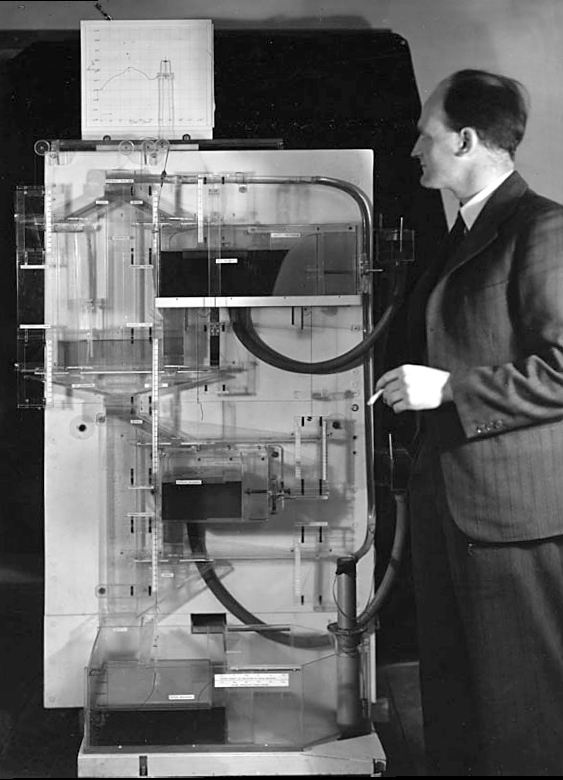

MONIAC

Posted: January 27, 2026 Filed under: money Leave a commentThere’s a visual metaphor for the process [of economists getting lost in models and trying to apply principles to reality] in the form of an amazing device called the Phillips machine, the creation of a remarkable New Zealander called Bill Phillips. After a roundabout route to the world of economics via a spell in a Japanese prisoner-of-war camp, Phillips set up a workshop in a south London garage. There, using recycled Lancaster bomber parts, he botched together a machine that used the flow of water to demonstrate the functioning of the entire British economy. There was a point at which these machines, known as MONIACs—Monetary National Income Analogue Computers—were all the rage: there are about twelve of them (no one knows exactly how many were built) in places as diverse as the central bank of Guatemala, the University of Melbourne, Erasmus University in Rotterdam, and Cambridge, England, which has the only one that works. The Phillips machines/MONIACs were fine-tuned to simulate different economic conditions: the New Zealand one, for instance, was set up to match the specific dynamics of the New Zealand economy.

That’s from How To Speak Money by John Lanchester.

(source)

Lanchester continues:

Phillips was a serious man, who partly on the basis of his machine became a professor of economics at LSE, and he had a serious specific concern in creating the MONIAC, to do with stabilizing demand inside the economy. And yet, it’s hard not to see his machine as a comic allegory of what’s called wrong in the model-making side of economics. It’s inherently comic in the way that a Roz Chast cartoon is inherently comic. The idea that this thing can simulate something as big and complicated as an entire economy—really? And yet, that’s what economic models set out to do all the time. The Federal Reserve and US Treasury are to this day reliant on models of exactly this sort; their models are built out of mathematics rather than out of bomber parts and water, but the underlying principles are the same. Credit flows and monetary supply, inflation rates and external shocks and trade imbalances and fluctuations in demand and tax changes are all modeled in an exactly analogous way.

(source, the cigarette is a great touch)

Phillips:

During this period he learned Chinese from other prisoners, repaired and miniaturised a secret radio, and fashioned a secret water boiler for tea which he hooked into the camp lighting system.[4] Sir Edward ‘Weary’ Dunlop explained that Phillips’ radio maintained camp morale, and that if discovered, Phillips would have faced torture or even death.[7]

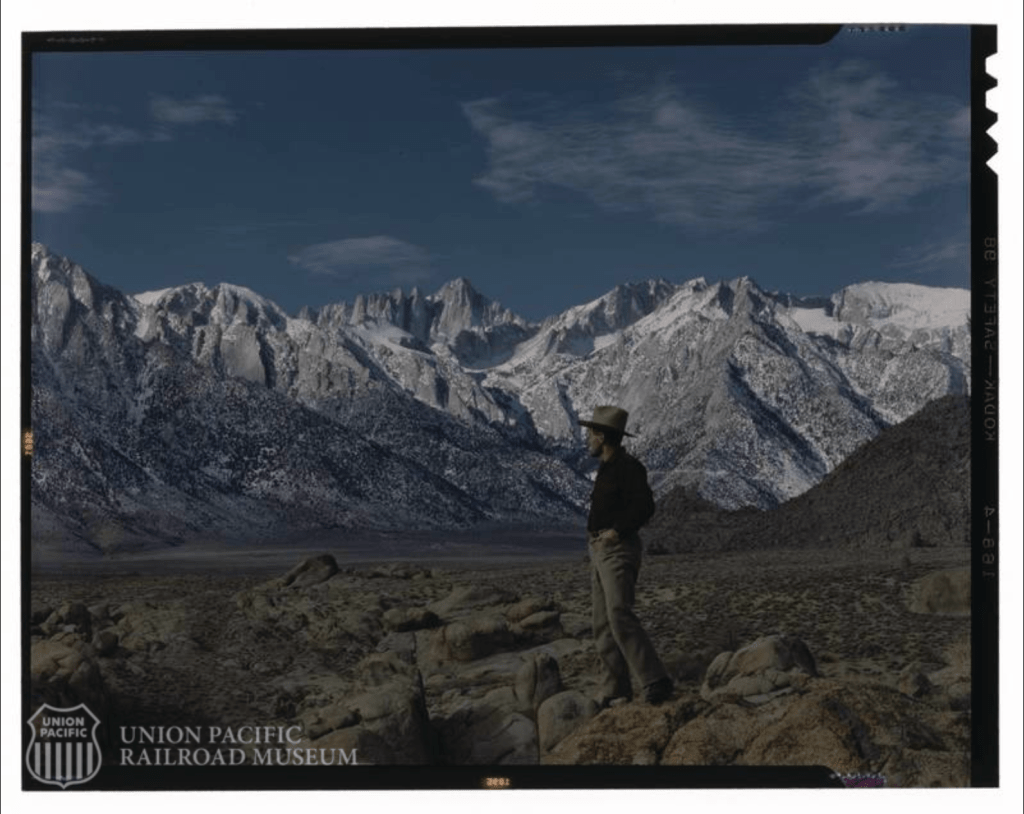

Pasadena weather report

Posted: January 26, 2026 Filed under: the California Condition Leave a comment

It could’ve been an early October day in Massachusetts.

You might find it odd to see a Union Civil War monument in southern California, Pasadena wasn’t even founded until 1874. But it was founded by people from Indiana, the experience was probably quite real to them.

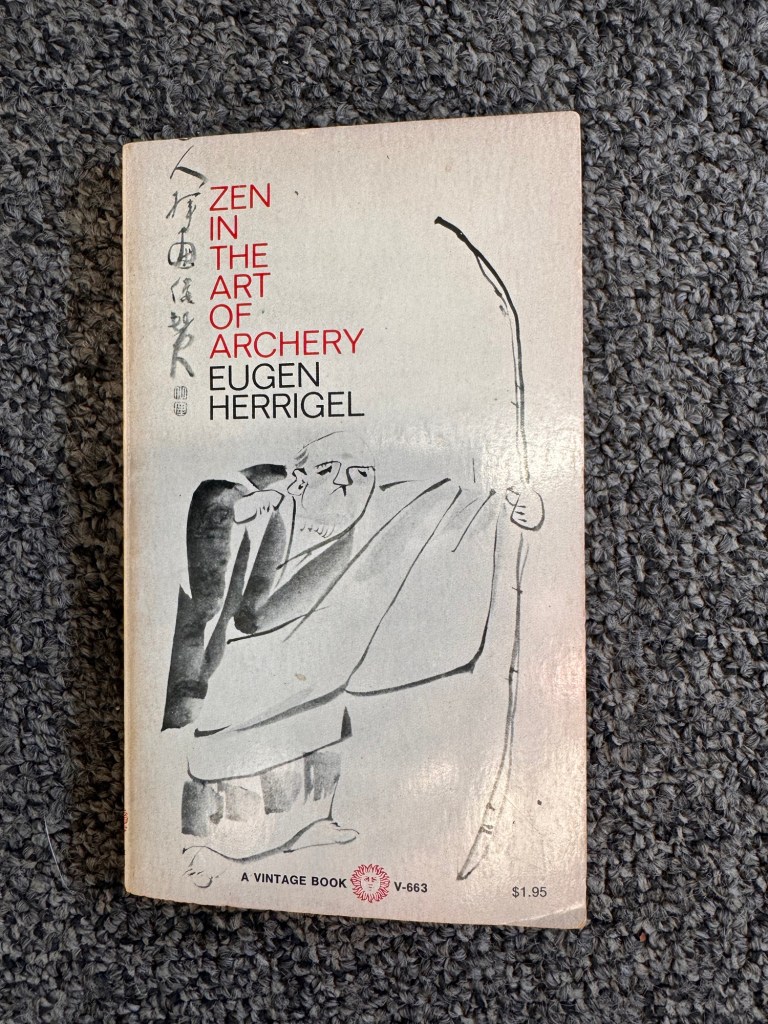

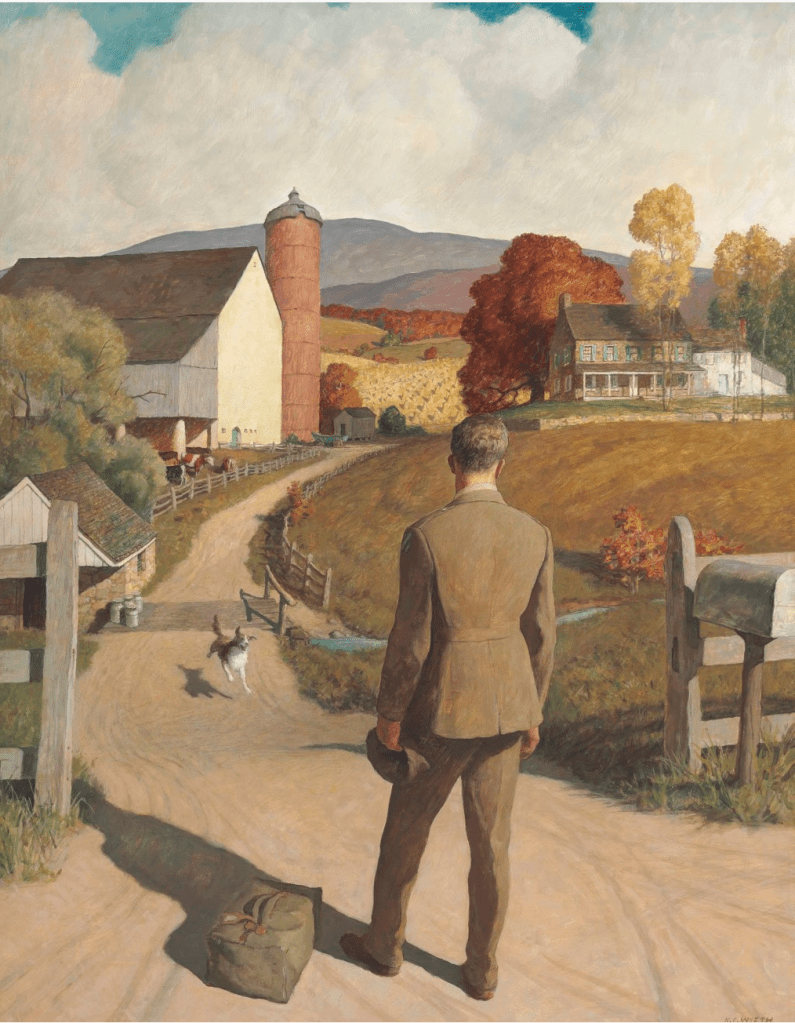

N. C. Wyeth

Posted: January 26, 2026 Filed under: art history 1 CommentSeeing what the son of Needham’s paintings were fetching lately at auction (high six-low seven figures).

more here.

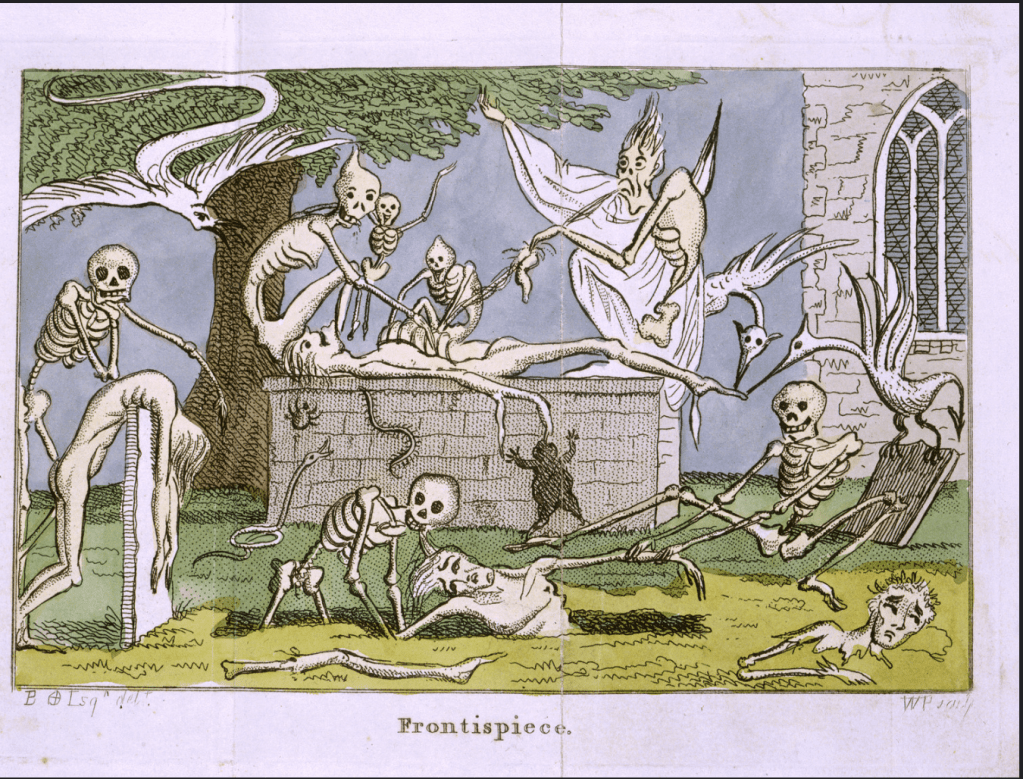

A potential cover of Ramona:

Captain Gronow

Posted: January 21, 2026 Filed under: Clubs Leave a comment

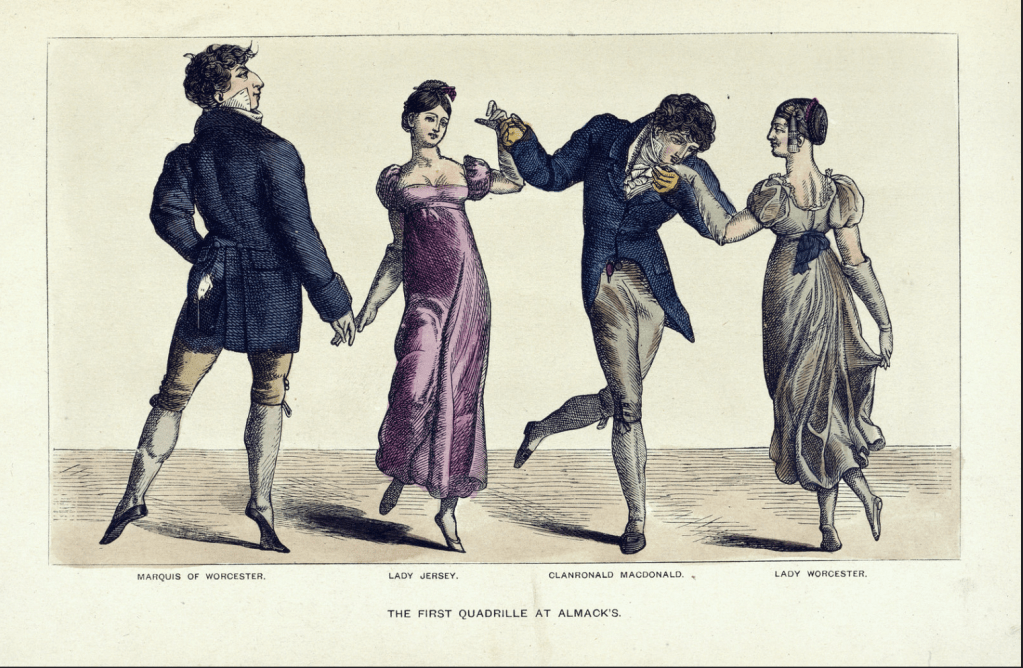

one thing (the TV series Mr. Loverman, the island of Antigua) led to another (William Clark’s Ten Views in the island of Antigua, The British Library’s Flickr page) and I’m looking at this great party from the Reminiscences of Captain Gronow, formerly of the Grenadier Guards and M.P. for Stafford, being Anecdotes of the Camp, the Court, and the Clubs, at the close of the last War with France, related by himself)

He was a remarkably handsome man, always faultlessly dressed, and was very popular in society. His portrait appeared in shop windows with those of Brummell, the Regent, Alvanley, Kangaroo Cook, and other worthies. With the exception of Captain Ross he was the best pistol shot of his day, and in early life took part in several duels. He married first, in 1825, an opera dancer, Antoinine, daughter of Monsieur Didier of Paris. By his second wife, Amelia Louisa Matilda Rouquet (a Breton aristocrat), whom he married in 1858, aged 63, he had four children. According to the Morning Post, he left his widow and infant children “wholly unprovided for” at his death, aged 70 in Paris on 22 November 1865.[1]

Lunch bums

Posted: January 7, 2026 Filed under: Hollywood Leave a comment

He skipped lunches since they interfered with his work and he felt they often made him tired. He was therefore dismissive of actors who ate lunch, believing that “lunch bums” had no energy for work in the afternoons.

Reading about the director Michael Curtiz, who directed 102 movies (does that include shorts?) in Hollywood, including Casablanca, and Elvis in King Creole.

During filming, Presley was always the first one on the set. When he was told what to do, regardless of how unusual or difficult, he said simply, “You’re the boss, Mr. Curtiz.”[86]

Best food in the world?

Posted: January 3, 2026 Filed under: America Since 1945, food Leave a commentSometimes it’s half a leftover burrito you forgot you had in the fridge.

Los Angeles in 1850

Posted: January 1, 2026 Filed under: the California Condition Leave a comment

Cowboys, gamblers, bandits, and desperados of every description brought to the Los Angeles of the 185os a tone of border-town mayhem. Rough statistics indicate that in 1850 a murder occurred for every day of the year. The Reverend James Woods, a scholarly Massachusetts Presbyterian, arrived in October 1854, hoping to bring the gospel and social order. Despite the beauty of surrounding vineyards and orange trees, he noted, Los Angeles was a hellhole, a valley of dry bones, a city not of angels but of demons. An orgy of murder fills the diary Reverend Woods kept during his desperate ministry of six months. In his first two weeks alone, ten Angelenos met violent ends. Ordinary citizens walked the streets armed with pistols, bowie knives, and shotguns. Cruelty was everywhere. He was horrified to find an Indian servant girl dying in the street, abandoned by a household wishing to avoid burial expenses. A young cowboy, David Brown, sentenced to hang for the shooting of Pinckney Clifford, refused to see Woods, telling the sheriff he would rather have a bear in his cell than a minister. Shortly after, Brown was dragged from the jailhouse and lynched. The mob was led by Stephen Clark Foster, mayor of Los Angeles and a Yale man.

Matty Groves

Posted: January 1, 2026 Filed under: Uncategorized Leave a commenthttps://www.youtube.com/watch?v=1it7BP5PckI

A holiday

A holiday

The first one of the year…

Any Helytimes reader will know Shady Grove, but what about the ancestor across the Atlantic?

The song dates to at least 1613, and under the title Little Musgrave and Lady Barnard is one of the Child ballads collected by 19th-century American scholar Francis James Child

What I love about this song is how it reveals character. Lord Darnell’s wife, Matty, the sniveling servant, Lord Darnell, they all reveal who they are in their actions. Honor, honesty, humor, strength, foolishness, loyalty. It all comes out.

2025 in Helytimes

Posted: December 31, 2025 Filed under: America Since 1945, railroads and restaurants, southern california lunch, the California Condition, writerlore 1 Comment

Writers should stagger end of year posts, some people should do theirs in July so January isn’t a flood of the same content. Maybe next year!

How did Jimmy Carter, Dick Cheney, John Thune and Ronald Reagan get and administer power?

What was it like to be around Abe Lincoln?

What was the experience of a Civil War battle actually like?

What was Hemingway thinking with Across the River and Into the Trees?

If Kansas City isn’t cool, why are there a bunch of songs about it?

Which is better, the song “Islands in the Stream” or the posthumous novel of that title?

How did the house of Savoy go from Charlamagne-era minor dukes to kings of Italy, and how did they lose it?

What can Matthew McConaughey, Paul Cezanne, Bruce Springsteen, Henry Adams and Raising Cane’s founder Todd Graves teach us?

Why is the NFL so dominant?

Questions that were on our mind this year, we went diving and whatever shells we found and brought to surface we present here.

Some selections from 2025:

He was on our mind going through 2024-25.

On the LA fires.

An important Reagan advisor and California political figure.

- Living Room on the tracks

- Lincoln in New Orleans (featuring final answer on was Abraham Lincoln gay?)

a review of Richard Campanella’s incredible book on the topic

Texas wines are fun and good!

On Carter’s, the kids clothing brand, their history as a window into economic history.

a catchy song.

some amazing lore from Charles Goodnight.

A deep dive on a Civil War mystery

why is Chili’s crushing it? Railroads and Restaurants is a newsletter I mean to start, it’ll cost $500 a year.

the secret of power

If my goal were to generate the most views, I’d split this site into two: one would be advice adjacent stuff about writing, Writerlore, the other would be Warren Buffett/Charlie Munger Deep Cuts. That’s what gets eyeballs.

sad death of a beloved general. The War of the Rebellion was on my mind, especially real “you are there” moments

Two Louisianans

gratifying reception to Common Side Effects

The most vivid book I can remember reading

looking into the origin of a phrase

Savoy in history and myth was a theme this year

Did some deep cut Hemingway reading this year

This piece probably took me the longest, but seemed to generate zero interest

research with LLMs into a mythical beer

a memorable Southern California lunch, November 1826. Southern California Lunch would be another good spinoff.

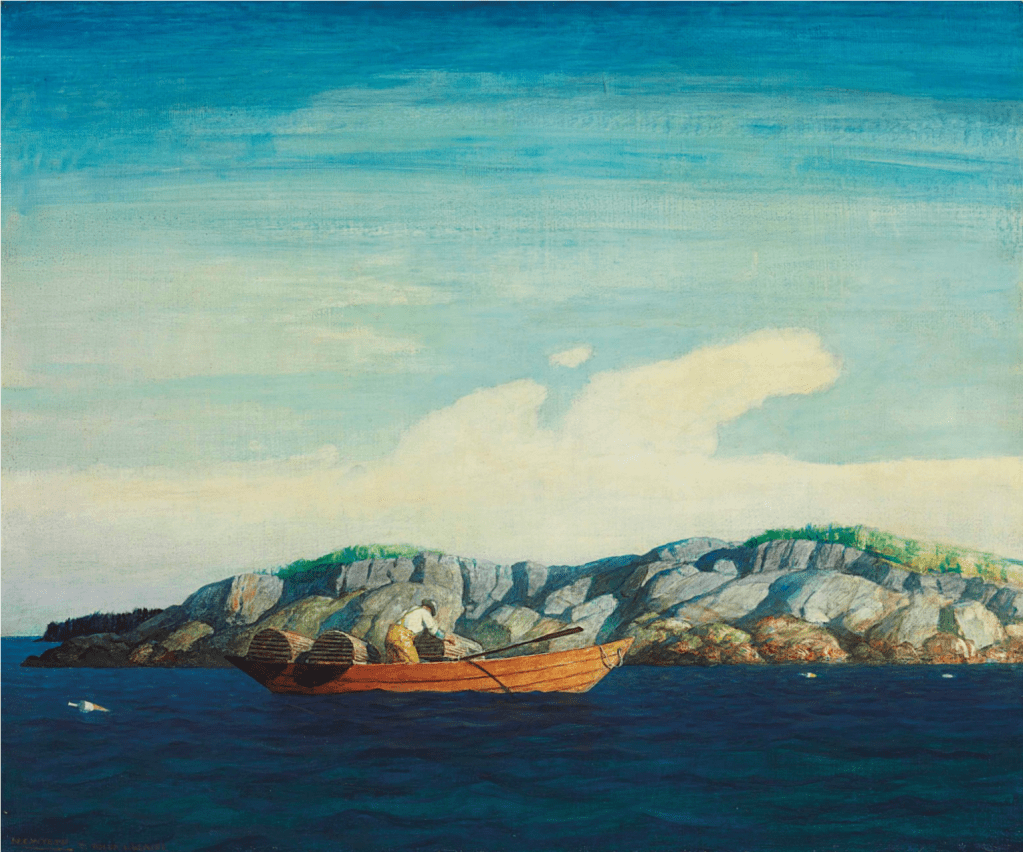

how deep can we go into one painting

Homage to a Yankee

which is better, book or song?

been meaning to follow up

Review of some biographies of Ernest Hemingway

some Juneetenth trivia

dispatch from Greenpoint, NY

genuine

a journey in etymology

strangely popular, not sure why

advice from the movie star-philosopher

what was Columbus’s goal, really?

Hollywood forever.

glimpses from New England

origin of Woody Allen’s famous 80% of life is showing up quote

a musical transmission through time

a Midwest character and a northeasterner

another Midwest character and a northeasterner

scraps from a master and fellow scatterbrain.

used Perplexity to teach me to write a Python script to index every post. It worked?

Truman loved a drink

The death of the most powerful Vice President in US history prompts a look at his rise.

on the invasive cow of early California

views of growth

Charlie Parker and California’s mental asylums

some samples of the kind of columnist who doesn’t really exist anymore.

one investigation leads to another

a mysterious power broker from the Dakotas.

More on Starkweather

Kansas City in story, song, and reality

dive into a rising fast food chain

literary anecdote is catnip for readers

a minor Anglo-Irish family through the generations

how jokes enter history as facts.

football: why is it so great? This one generated a lot of positive feedback

a spooky Christmas song

how to learn about the Jefferson era

are we spoilt brats?

a Christmas miracle from Whitney Houston, Jimmy Iovine, Rick Rubin

were all the revolutionaries criminals? was the American Revolution just like The Town or The Departed? An alliance of Boston and Virginia mobs?

Further adventures in Santa Barbara

Posted: December 29, 2025 Filed under: the California Condition, Uncategorized Leave a comment

Into the vibe at the library of the Natural History Museum

Santa Barbara is not an indoor town. But we found ourselves in a historic rain and so made do.

Rozzi’s Pizza is quite tight, though it’s not especially “Santa Barbara” (it’s New York, pizza by the slice.)

Corazon Cucina burritos, delivered, hit as well. (The “Cali Burrito”: asada/steak, French fries, salsa, crema has broken containment from San Diego and rules all over the Mission burrito (rice and beans).)

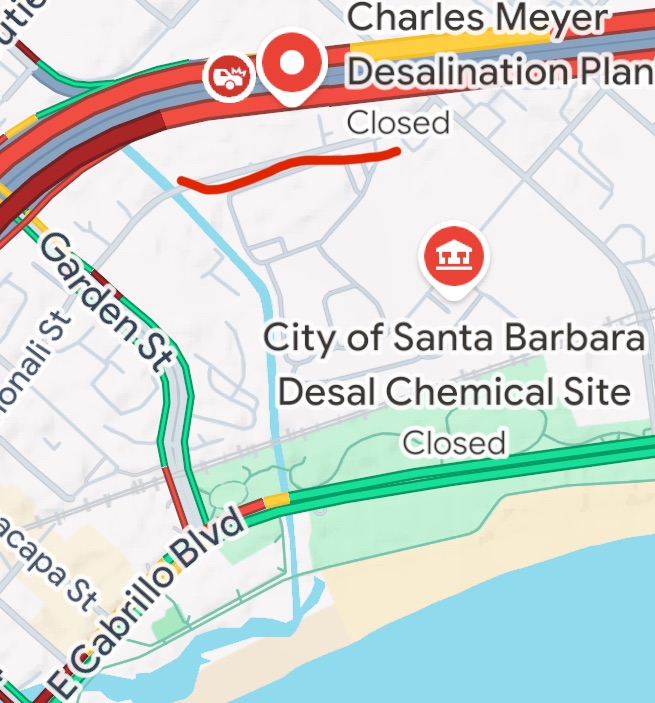

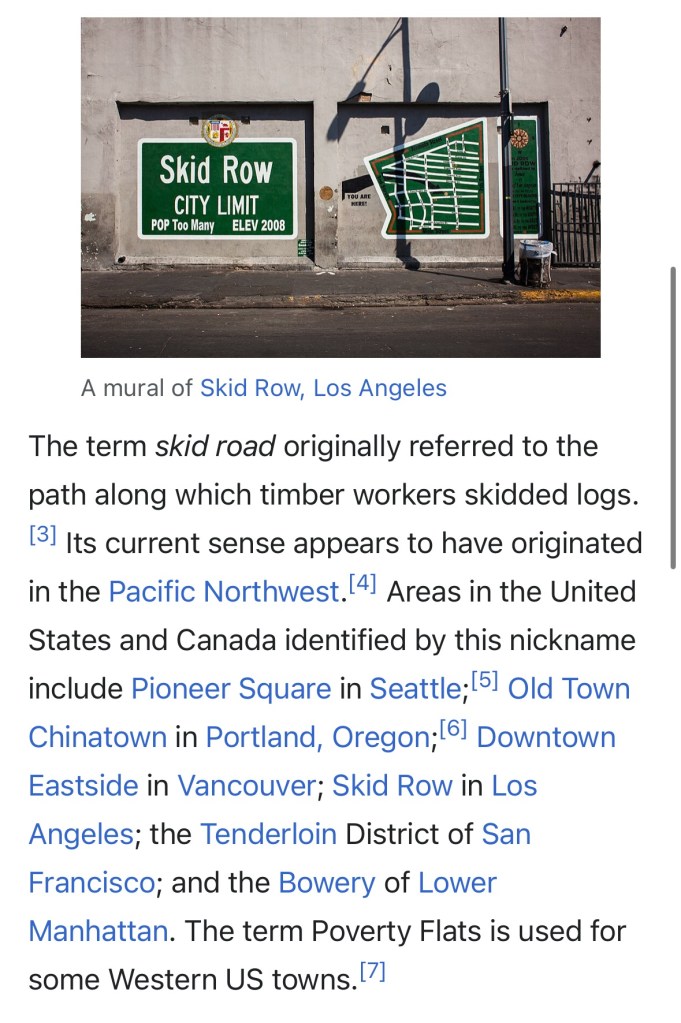

A wrong turn led me over here, the Skid Row of Santa Barbara?

Anywhere long distance trains roll through will have some strange customers.

That’s about all I have to add to our previous coverage, 25.5 Hours (and 300 years) in Santa Barbara and Santa Barbara County

Paul Revere, Silversmith

Posted: December 28, 2025 Filed under: Uncategorized Leave a comment

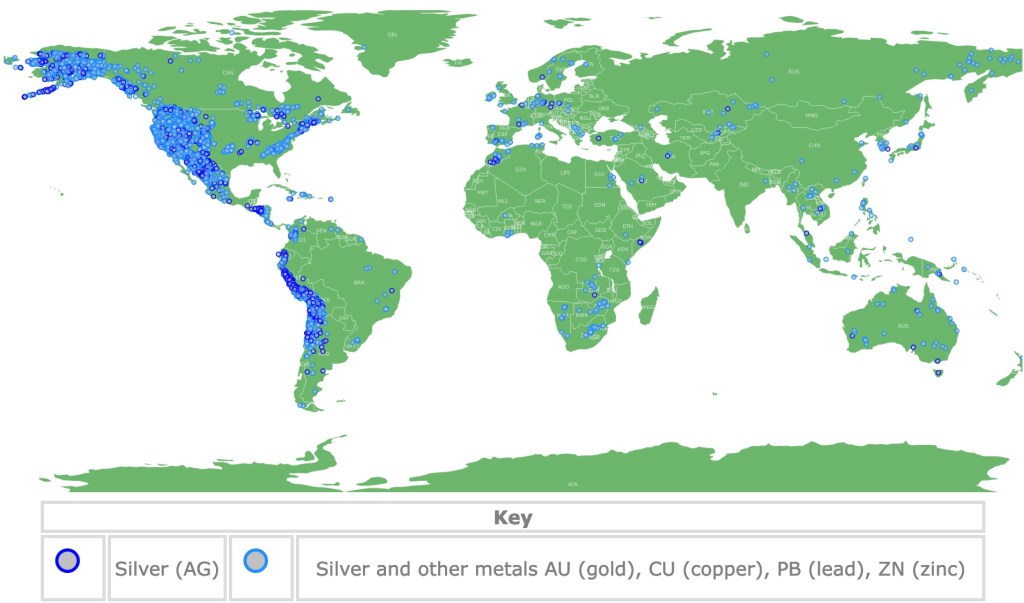

The ports also brimmed with silversmiths. We think of silversmithing as a classic “ye olde” profession; Paul Revere was a silversmith, and, generally, they outnumbered lawyers in Colonial America. But why were any there at all, given that the land had little by way of silver mines? The answer, Mark Hanna explains, is that silversmiths worked as fences, transmuting “pirate metal” into respectable wealth. The first mint in the thirteen colonies was established in 1652 by John Hull, who made Massachusetts pine-tree shillings from Spanish bullion. Hull was a silversmith; his brother Edward was a pirate.

source, “Were Pirates Foes of the Modern Order – Or Its Secret Sharers?” by Daniel Immerwahr in The New Yorker. That article is partly pegged to a book, Pirate Nests and the Rise of the British Empire, 1570-1740 (Published by the Omohundro Institute of Early American History and Culture and the University of North Carolina Press) by Mark G. Hanna.

The role of the silversmith in early America, as in medieval Europe, was complex, combining artisanship with the roles of banker, lender, hoarder, and smuggler. Silversmiths in England traditionally took the brunt of the blame for currency debasement because of the large volume of bullion that passed through their hands. In the colonies, silversmiths were highly respected and powerful men. As mintmaster and owner of trading vessels, Hull understood better than most the intricacies of the piratical market, making him one of the wealthiest men in New England.

…

Pirate metal was transfused into the colonial economy by fences, the most common being silversmiths. This helps explain the disproportionate number of silversmiths in regions allegedly suffering from a monetary crisis: metallic scarcity actually created a positive labor market for these artisans. At a time when pirate booty was welcome and alleged pirates rarely faced trial, there were more silversmiths than lawyers in the colonies. Scholars have identified at least 178 silversmiths who were active before 1740. As the currency problem grew into a perceived epidemic, following Gresham’s Law, individuals held on to full-weight Spanish specie and traded in clipped coins or commodities. Making matters worse, bullion in the form of cobs or bits was easy to counterfeit, fueling unease in the currency market.…

Colonial leaders like John Winthrop did not actively foster sea marauding but still considered the Spanish loot that arrived in Boston Harbor a sign of God’s providence.

Though like every Boston schoolchild I knew Paul Revere was a silversmith, it never occurred to me to wonder where he got any silver, since there weren’t really major silver deposits in the British Empire or New England.

One point Hanna makes is that pirating wasn’t necessarily a lifelong career, you might pirate for awhile and then become respectable:

Swashbuckling yarns about attacks in the Indian Ocean must be tempered by the fact that some of these men bought land in the Delaware Bay, married local Quaker women, took to farming, and won political positions.

Immerwahr tells us the sad fate of Captain Kidd, who got caught on the wrong side of a shift:

London also found that pirates interfered with the East India Company, the chartered trading firm that would become the bridge to Britain’s conquest of India. This was Kidd’s great crime. His theft of the Quedagh Merchant, which had been transporting goods owned by a high-ranking Mughal official, provoked fury on the subcontinent. The Mughal emperor insisted that, if the English wanted to continue operating there, justice must be served. Lord Bellomont’s arrest of Kidd, in 1699, was a sacrifice made on the altar of English trade.

The Crown’s crackdown meant that William Kidd faced a jury in London, not one in pirate-coddling New England. “I am the innocentest person of them all,” Kidd protested. He made much of the French pass that the Quedagh Merchant had carried, which in his view made it fair game. This defense might have worked a generation ago. But now? Kidd’s acts had been “the most mischievous and prejudicial to trade that can happen,” the judge told the jury. Kidd was convicted and sent to Execution Dock in Wapping.

Do You Hear What I Hear

Posted: December 24, 2025 Filed under: Christmas, music Leave a commentJimmy Iovine talking to Rick Rubin on Tetragrammaton podcast. The backstory is Iovine’s dad loved Christmas, so when he died, Jimmy decided to make a Christmas album (it became A Very Special Christmas):

“and I just like, for example, Whitney Houston. I went to North Carolina.

She did a show there and she met me in the studio on the way to soundcheck. Let me tell you something. I didn’t know miracles existed until I recorded that woman’s voice.

She walked out there. She sang a song in church. It was Do You Hear What I Hear as a kid.

She knew the song. She went out there. I can’t explain this to layman, but you didn’t need a microphone or tape.

It was so powerful and extraordinary. She sang it in one take. She comes in and says, what do you need?

I said, I’m not going to tell you this, but she said, I’m going to sing it one more time. She did all the backing vocals. She was gone in an hour.

And it was so inspiring. If you get a chance, you should listen to it. Do you hear what I hear?

Let’s listen to it right now.

That’d be great. When you hear this, it’s going to blow your mind.

She makes it sound completely effortless.

Really beautiful.

Just comes out.

Well, she’s a miracle. I mean, she’s a miracle. What an incredible, incredible gift she had, and she gave everybody else.”

Tetragrammaton with Rick Rubin: Jimmy Iovine, Nov 26, 2025

https://podcasts.apple.com/us/podcast/tetragrammaton-with-rick-rubin/id1671669052?i=1000738489216&r=2927

Listen here.

Merry Christmas everyone. Remember to let your children smoke one cigarette today.

Steinbeck on the two Christmases

Posted: December 22, 2025 Filed under: America Since 1945, Steinbeck, the California Condition Leave a commentWriting about the quiz show scandal in The Fifties, David Halberstam says:

It was a traumatic moment for the country as well. Charles Van Doren had become the symbol of the best America had to offer. Some commentators wrote of the quiz shows as the end of American innocence. Starting with World War Two, they said, America had been on the right side: Its politicians and generals did not lie, and the Americans had trusted what was written in their newspapers and, later, broadcast over the airwaves. That it all ended abruptly because one unusually attractive young man was caught up in something seedy and outside his control was dubious. But some saw the beginning of the disintegration of the moral tissue of America, in all of this. Certainly, many Americans who would have rejected a role in being part of a rigged quiz show if the price was $64 would have had to think a long time if the price was $125,000. John Steinbeck was so outraged that he wrote an angry letter to Adlai Stevenson that was reprinted in The New Republic and caused a considerable stir at the time. Under the title “Have We Gone Soft?” he raged, “If I wanted to destroy a nation I would give it too much and I would have it on its knees, miserable, greedy, and sick … on all levels, American society is rigged…. I am troubled by the cynical immorality of my country. It cannot survive on this basis.”

This isn’t quite accurate, as far as I can tell – “Have We Gone Soft?” was an article by the Jesuit Thurston N. Davis, included as part of a larger symposium, in the February 15, 1960 New Republic, you can read it here. No matter.

Steinbeck’s phrase or the rough idea of it stuck with me since I read The Fifties back in high school (in Frank Guerra’s class, American Since ’45, the best class in my high school (we used to call it “Guerra Since ’45” since a lot of it was Coach Guerra’s personal memories of era, which were terrific and much appreciated, as Frank Guerra was one of the most charismatic teachers at the school and the head football coach. We’re straying)).

The other day I realized I had a copy of Steinbeck’s letters on my shelf. It might have the quoted letter in it.

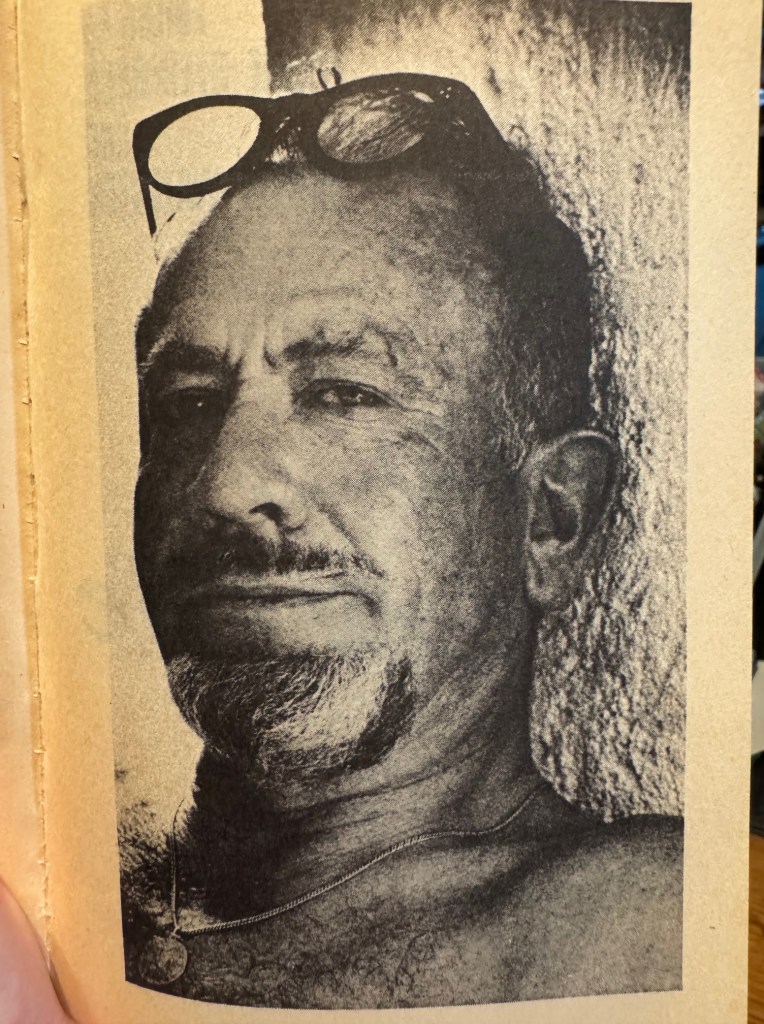

On the cover Steinbeck looks kind of like a stodgy old GK Chesterton sort of guy:

but inside there’s a photo of him where he looks more like the louche California artist:

He looks kind of like the late Brian Reich. Those two poles of Steinbeck are there in the book.

Here’s a bit more of that quoted letter:

New York

[November 5] 1959

Guy Fawkes Day

Dear Adlai:

Back from Camelot, [I think Steinbeck is referring to literal Camelot here, like King Arthur country in the UK, Steinbeck was obsessed with King Arthur and he’d just gone there to research] and, reading the papers not at all sure it was wise. Two first impressions. First a creeping, all-per-vading, nerve-gas of immorality which starts in the nursery and does not stop before it reaches the highest offices, both corporate and governmental. Two, a nervous restlessness, a hunger, a thirst, a yearning for something unknown-per-haps morality. Then there’s the violence, cruelty and hypocrisy symptomatic of a people which has too much, and last the surly, ill-temper which only shows up in humans when they are frightened.

Adlai, do you remember two kinds of Christmases? There is one kind in a house where there is little and a present represents not only love but sacrifice. The one single package is opened with a kind of slow wonder, almost reverence.

Once I gave my youngest boy, who loves all living things, a dwarf, peach-faced parrot for Christmas. He removed the paper and then retreated a little shyly and looked at the little bird for a long time. And finally he said in a whisper, “Now who would have ever thought that I would have a peach-faced parrot?”

Then there is the other kind of Christmas with presents piled high, the gifts of guilty parents as bribes because they have nothing else to give. The wrappings are ripped off and the presents thrown down and at the end the child says-“Is that all?”

Well, it seems to me that America now is like that second kind of Christmas. Having too many THINGS they spend their hours and money on the couch searching for a soul. A strange species we are. We can stand anything God and Nature can throw at us save only plenty. If I wanted to destroy a nation, I would give it too much and I would have it on its knees, miserable, greedy and sick. And then I think of our “Daily” in Somerset, who served your lunch. She made a teddy bear with her own hands for our grandchild. Made it out of an old bath towel dyed brown and it is beautiful. She said, “Sometimes when I have a bit of rabbit fur, they come out lovelier.” Now there is a present. And that obviously male Teddy Bear is going to be called for all time MIZ Hicks.

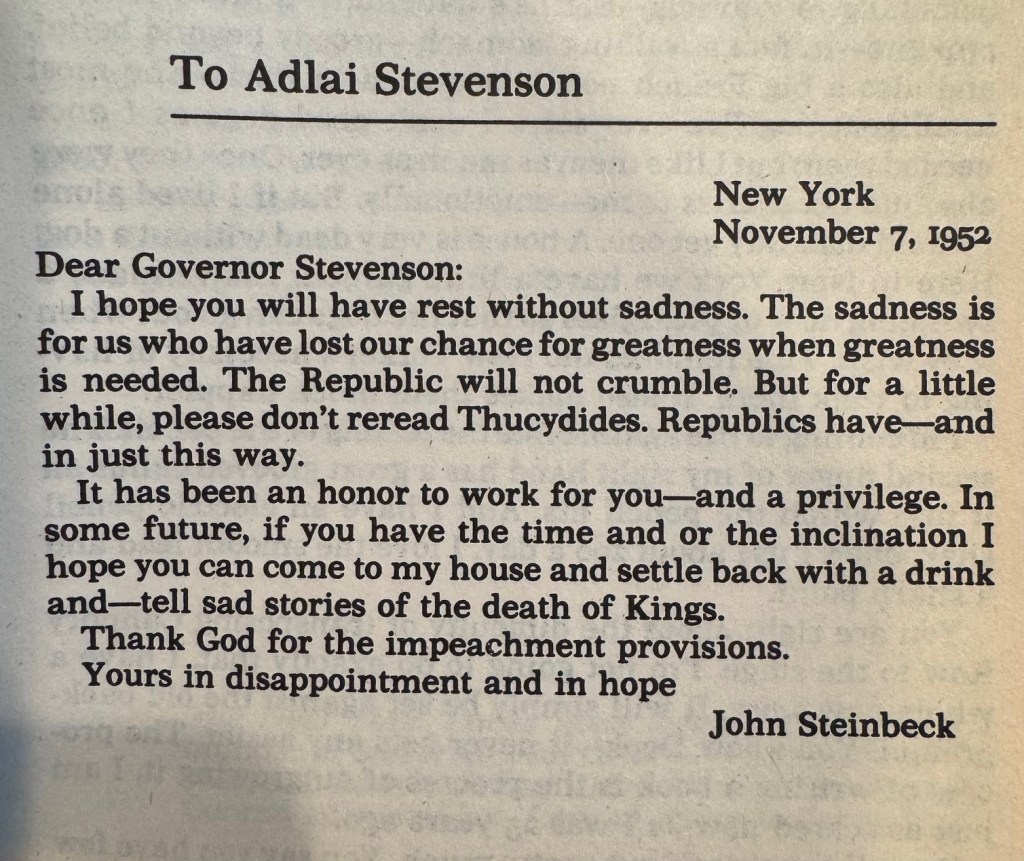

Kind of a conservative idea in a way. Yet Steinbeck is writing to Adlai Stevenson, the Democratic candidate for president. Steinbeck did some speechwriting for Adlai. When Adlai lost to Eisenhower in 1952, Steinbeck wrote him this one:

It seems a bit drastic in retrospect, Eisenhower is mostly regarded as a pretty good president, certainly by comparison, although he did overthrow a few foreign governments (see discussion of Guatemala in Hely’s The Wonder Trail.) But I guess they really felt this at the time.

Yet, only a few hundred pages later in the book, in 1966, Steinbeck is writing to LBJ telling him not to get discouraged by anti-Vietnam War protestors:

I know that you must be disturbed by the demonstrations against policy in Vietnam. But please remember that there have always been people who insisted on their right to choose the war in which they would fight to defend their country. There were many who would have no part of Mr.

Adams’ and George Washington’s war. We call them Tories.

There were many also who called General Jackson a butcher. Some of these showed their disapproval by selling beef to the British. Then there were the very many who de nounced and even impeded Mr. Lincoln’s war. We call them Copperheads. I remind you of these things, Mr. President, because sometimes, the shrill squeaking of people who simply do not wish to be disturbed must be saddening to you. I assure you that only mediocrity escapes criticism.

The context there was that Steinbeck’s son was headed to Vietnam.

After his service John IV apparently became an anti-war advocate and Buddhist practioner:

He wrote about his experiences with the Vietnamese and GIs. Steinbeck took the vows of a Buddhist monk while living on Phoenix Island in the Mekong Delta, under the tutelage of the Coconut Monk, a silent tree-dwelling mystic yogi who adopted Steinbeck as a spiritual son. Amid the raging war, Steinbeck stayed in the monk’s “peace zone”, where the 400 monks who lived on the island hammered howitzer shell casings into bells.

Steinbeck’s politics are a whole academic mini-field: type “Steinbeck’s politics” into Jstor and 1,339 results come up.

The shifting meanings of conservative and liberal and associated ideas are interesting. If Hemingway and Fitzgerald had lived long enough, I’m sure their political transitions would’ve been quite interesting as well. I’m interested in the idea of America as a spoiled child on Christmas morning.

From an interview with William Souder, author of Mad At The World: A Life of John Steinbeck:

Library of America: Let’s start with your very evocative title. What was Steinbeck so mad about?

William Souder: It’s tempting to say “everything,” and let it go at that. Steinbeck was, in so many ways, America’s most pissed-off writer. In grade school, he befriended a classmate who was shy and got picked on. When he was asked why he wasted time with a boy nobody else liked, Steinbeck answered simply, “Because somebody has to take care of him.” Steinbeck could never abide a bully. Later, as a writer, Steinbeck filled his stories with people who were marginalized in a world he perceived in stark black-and-white.

Steinbeck believed in good and evil, and he was convinced that morality was inversely proportional to your lot in life. Being good too often meant having little to show for it, he thought. This was especially true during the Great Depression, when millions of honest, hard-working citizens were dispossessed and displaced—many of them Dust Bowl refugees who ended up toiling for appallingly low wages in California’s farm fields. Steinbeck investigated the plight of the “Okies” and saw firsthand their squalid roadside camps, haunted by disease and starvation. The migrants were brutalized by the landowners who needed them and also despised them.

In 1938, Steinbeck, who thought the confrontations between the migrants and the landowners’ squads of vigilante enforcers could escalate into civil war, began work on a novel about the situation, focusing it on the oppressive tactics of the big farm interests. After a few months he tore up the manuscript and started over, telling the story this time from the point of view of the oppressed—a family named Joad from Oklahoma. Steinbeck, seething and telling himself again and again to work slowly and carefully, wrote The Grapes of Wrath, long since acclaimed as one of the greatest books in the American canon, in a rage and in a rush. He didn’t have to push himself. He was fueled by anger.

Elmore Leonard on what Steinbeck taught him.

Our previous coverage of John Steinbeck.

Garry Wills on Henry Adams

Posted: December 20, 2025 Filed under: America, history Leave a commentAfter finishing The Education of Henry Adams, I was like what do I do with this?

Here’s a brilliant guy at the end of his life talking about how he and everybody he knows is a failure and totally lost. An autobiography of a sort, except the guy never mentions his wife except when saying her tomb had become a tourist attraction? Barely mentions his children? The guy he admired the most, Clarence King, had (extratextual research reveals) a very weird and intriguing personal situation?

Garry Wills Henry Adams and the Making of America really put the whole story in context for me. Wills book is mostly a summary of Henry Adams’s six volume history of the USA in the Jefferson era. Wills says Henry Adams history is misunderstood: everyone (he particularly calls out Richard Hofstadter) only read volume one, so they didn’t get it. They assume Henry Adams is pro-John and JQ Adams, and anti-Jefferson, but he’s not. Henry Adams actually didn’t like his grandfather, who was severe and harsh with him when he was a kid. He especially didn’t like Abigail Adams, who’d been mean to his (Henry’s) beloved grandmother Louisa.

Abigail:

“I never knew a man of great talent much given to laughter.”

Booo.

But Adams never defended the Federalists. He despised Hamilton, and he told his Harvard students, “You know, gentlemen, John Adams was a demagogue” (S 1.216). His attitude toward his grandfather, John Quincy Adams, was far more caustic—he called him an opportunist in politics and “demonic” in his family relations.

Did Charles Sumner have the caning coming?

But the part of Sumner’s speech that drew the most attention was his personal slur against Senator Andrew Butler of South Carolina. Butler had a lisp, and Sumner mocked “the loose expectoration of his speech” in favor of slavery. This maddened a cousin of Butler, Preston Brooks, who served in the other chamber. The thirty-six-year-old Brooks waited outside the Senate to attack the forty-five-year-old Sumner.

(still, this is a bit much:)

Sumner was pinioned behind his desk. Only by wrenching the desk from the floor, to which it was firmly bolted, could the bleeding Sumner rise, and then, as he staggered about, Brooks rained more blows on him till the cane broke, after which he continued beating him with the thick end of it.

Henry Adams was one of the first American historians to really go into the archives and dig stuff up. In the Education he kinda minimizes this part of his life, but he was a really pioneering historian, processing huge volumes of material for the first time.

In the early days of America, it was the free states who were always talking about “states rights”:

Thus, in truth, states’ rights were the protection of the free states, and as a matter of fact, during the domination of the slave power, Massachusetts appealed to this protecting principle as often and almost as loudly as South Carolina.

The historians of these days were inspired by Tacitus’s history of Germania, and interpreted this to describe a kind of proto-democracy that was very feminist:

The Teutonists honored as their founding text the only work of anthropological sociology to have survived from classical antiquity, The Germans’ Rise and Territory (c. 98 C.E.) by Senator Cornelius Tacitus, a book commonly known as the Germania. 2 Describing a people basically different from his own, Tacitus collected everything he could find out about the Germans’ religion, education, family conditions, and what influence those conditions had on political and military affairs.

…

And women, though not trained to fight, accompanied their men into battle to inspire them.

Travel in the days of Jefferson:

Adams has an even harsher picture to draw, of canals not built (J 911), of steam engines of a more advanced kind being neglected (J 7-53), of roads so lacking that “between Baltimore and the new city of Washington, it [the road] meandered through forests” (J 11). In the southern states the difficulties and perils of travel were so great as to form a barrier almost insuperable. Even Virginia was no exception to this rule. At each interval of a few miles the horseman found himself stopped by a river liable to sudden freshets and rarely bridged. Jefferson, in his frequent journeys between Monticello and Washington, was happy to reach the end of the hundred miles without some vexatious delay. “Of eight rivers between here and Washington,” he wrote to his attorney general in 1801, “five have neither bridges nor boats.”

Some context for the Education:

Early in the twentieth century Adams presented his Education as a sequel to his book on medieval art, Mont Saint Michel and Chartres. He was charting a decline, from medieval unity to modern multiplicity, since he had come to believe in historical entropy, the fission of things no longer able to cohere. Those who go backward to the History from the Education look for some similar decline—from an age of Federalist statesmen, say, to the courting of separate clienteles, from the Revolution’s impulse to the growth of partisan politics. In short, from Adams to Jefferson.

The South vs the North at the time:

The difference had one clear cause: slavery. Traveler after traveler noted the shock of moving from an area of free farms and neat cities into fields where slovenly shacks were not tended by the owners of human property. This had struck Adams himself when he first traveled, when he was twelve, into slave territory: The railroad, about the size and character of a modern tram, rambles through unfenced fields and woods, or through village streets, among a haphazard variety of pigs, cows, and Negro babies, who might all have used the cabins for pens and styes, had the southern pig required styes, but who never showed a sign of care. This was the boys impression of what slavery caused and, for him, was all it taught. (E 719)

Yet Adams admires the things that drew him toward the South—the rural simplicity, the courteous code of the owning class, the leisurely pace, the feebleness of open commercial ambition. He quotes the northern churchman William Ellery Channing on the superior manners of the South: “They love money less than we do” (92, emphasis in original).

Washington and others knew that slavery was a burden, economic as well as moral (93), and hoped vaguely that something could someday bring it to an end; but the state (and every other southern state) was quick to resent and resist any outside pressure to change the whole infrastructure of southern life. The southern leaders who ratified the Constitution, over a stout resistance, were “influenced by pure patriotism as far as any political influence could be called pure,” but the popular majority was still hostile to the Union, and certainly remained hostile to the exercise of its powers (96). It was this restive majority that Jefferson and Madison could count on in their appeal to resist the federal government in 1798, when Virginia moved further toward secession than Massachusetts would in 1804 (97-98). Washington’s massive influence was constantly needed to keep his state in line with the Union.

As president Thomas Jefferson found himself trapped in situations where he kept having to expand federal power, which was against his whole philosophy. He was trapped as his ideology confronted reality and immediate problems. He was always trying to avoid war, not because he thought we would lose, but because he thought we might win, and the federal government would expand.

Tom Wolfe would’ve done wonders on Jefferson’s shabby chic:

For them, the shabbiness demonstrated that Jefferson was, improbably, just a plain man of the people. Louisa rightly considered him an aristocrat pretending to be a democrat, noting that he presided in plain clothes over a gourmet’s meal tended by liveried servants, all to the standards, as she said, of a European court. She was wrong to think Jefferson’s attire affected. Or, better, it was not a private affectation but one of his class. He was not hiding his aristocratic style but exhibiting it. The aristocrat is often negligent of appearances, to show he is above relying on them. It is the nervous middle-class striver who is anxious about his dignity. The country gentleman, from Squire Weston to Lord Emsworth, often putters about in old clothes, proving that he has nothing to prove. The Virginia style was apparent in John Randolph, who went onto the floor of the House in muddied riding clothes, high boots on his thin stork legs.

…

Even George III in England liked to call himself a farmer, as Carlos IV in Spain called himself a worker: Don Carlos was a kind of Spanish George … the gunsmiths, joiners, turners, and cabinet-makers went with him from Madrid to Aranjuez, and from Aranjuez to La Granja. Among them he was at his ease; taking off his coat and rolling his shirt-sleeves up to the shoulder, he worked at a dozen different trades within the hour, in manner and speech as simple and easy as the workmen themselves. (232) That was an aristocrat’s style, not a genuine workman’s.

…

Jefferson himself had dressed like a court dandy in Europe, as we know from the first portrait of him, by Mather Brown, in which he wears a wig and frilly lace in the highest French fashion.

…

No law of the United States or treaty stipulation forbade Jefferson to receive Merry in heelless slippers, or for that matter in bare feet, if he thought proper to do so. Yet Virginia gentlemen did not intentionally mortify their guests; and perhaps Madison would have done better to relieve the President of such a suspicion by notifying Merry beforehand that he would not be expected to wear full dress. In that case the British minister might have complimented Jefferson by himself appearing in slippers without heels.

Wills points out that diplomatic protocol, while it can seem silly, is really important. It’s a language to avoid conflict:

Without a symbolic language to reward favors, or to warn of possible trouble, diplomacy would fumble in the dark. The ranking of states by the degree of honor afforded their representatives is itself a continual way of feeling out the attitudes of the other country, where ambiguity can lead to dangerous misunderstandings.

James Monroe, in Europe trying to smooth things over:

Adams sees a sadly comic side to Monroe’s travail, rejected in court after court, like a silent-movie actor who opens a series of doors and gets a pie in the face every time:

When Jefferson ended up with the Louisiana Purchase he was actually trying to buy Florida (or “the Floridas” as they might’ve been called at the time). Spain, France, who was in control was shifting with the Napoleonic Wars. Adams’ book seems to call attention to the fact that history is really a lot of unintended consequences. A guy as smart as Thomas Jefferson was constantly surprised by unpredictable twists of fate.

Garry Wills is now in an assisted living facility, apparently (I wanted to send him a fan letter). I went to see if he had anything to say on Trump, and yes, he did.

Coventry Carol

Posted: December 15, 2025 Filed under: Christmas Leave a commentIf you think that song is called “Loo Lay,” you are not a true Christmashead.

The carol was traditionally performed in Coventry in England as part of a mystery play called The Pageant of the Shearmen and Tailors.

A leather mask thought to be a surviving example of those worn by some performers in the Coventry Plays is held in the collections of the Herbert Art Gallery and Museum.

(Thanks Wikipedia user Geni)

Although the Coventry mystery play cycle was traditionally performed in summer, the lullaby has, in modern times, been regarded as a Christmas carol. It was brought to a wider audience after being featured in the BBC’s Empire Broadcast at Christmas 1940, shortly after the Bombing of Coventry in World War II, when the broadcast concluded with the singing of the carol in the bombed-out ruins of the Cathedral.

Here’s a recording (apparently) of that broadcast.

(source)

Christmas at its best is a little spooky.

Correction

Posted: December 15, 2025 Filed under: Uncategorized Leave a commentI strive for a high editorial standard here at Helytimes. I’m the writer, editor and publisher, and the occasional typo will slip through, but all factual information should be correct.

In a recent post, Todd Graves/ Raising Cane’s and Staying Craveable, I fell beneath that standard, incorrectly claiming that the Box Combo is the largest combo offered at Raising Cane’s. The largest combo (outside of the tailgate platters) is of course the Caniac.

This was a careless error, I just didn’t study the menu enough. The post has been corrected. Thank you.

NFL

Posted: December 14, 2025 Filed under: sports 1 Comment

I’m with Rob: just a fan of the whole league.

JASON: Is any sport ever going to come close to NFL? No, it’s not. And here’s why. No other sport plays this many games at one time. At the NFL one o’clock time slot and the four o’clock time slot, you know you’re going to get so much action in the span of eight hours. It’s the greatest. That’s why everybody looks forward to it every single week. It’s all at the same time. I’m sitting in the stadium, and I’m trying to watch the game, and I’m also on my app watching YouTube TV, other games. I’m checking the scores on ESPN. I’m like, Dude, being a fan, you don’t know this yet because you’re still playing. Being a fan is fucking incredible. You can watch so much shit.

Travis: I’ve been a fan first. You’re acting like, I haven’t been a fan of this my entire fucking life.

Jason: You’re going to find out. You’re going to be seeing it a lot more when you’re fucking at the game at one o’clock and all this shit’s happening across the league and you’re fucking- That was at your fucking one o’clock games. All right, whatever. But you don’t appreciate it the same way until you’re done. You’re still so focused into the Chiefs. I still love the Eagles, but now I’m looking at more of everything happening across the league. One o’clock on Sunday is like, fucking, let’s go, baby. God damn, that’s a fun time to watch a football.

Travis: Power me up, man.

Doesn’t baseball play many games at the same time? No matter. The Kelce brothers, on their podcast, praising the NFL product. Their 1pm in 10am on the West Coast.

To this casual fan? The NFL is a fantastic product. Every catch is impressive. Every tackle. Every time a player stands up after getting drilled into the ground by 300 lbs of pure muscle. It’s compelling.

I only know it as TV, and it’s good TV. This NYT piece captures the effort, skill, money, thought and energy that goes into storytelling the NFL’s marquee Sunday Night Football broadcast.

Take away the NFL and broadcast television would be dead.

CBS said a record 57.2 million viewers tuned in for the Thanksgiving Day NFL match between the Dallas Cowboys and the Kansas City Chiefs, demonstrating again the sport’s popularity with US audiences.

from Bloomberg.

And then there’s college football! Where every game has meaning. A potential national champion can’t lose a single game without risk. And each broadcast is also a travel show about Gainesville, Tuscaloosa, Knoxville. There’s pageantry and 80,000 excited kids!

On an October Sunday Night Football broadcast (Lions/Chiefs) Chris Collinsworth said something like “well you know the season really starts at Thanksgiving…” was a funny thing to say. Why did I just watch this then? But I had, and I enjoyed it, because it was a tense battle of 70 odd extreme athletes with various skillsets, fighting and performing at the highest levels.

The American public has responded. TV is football:

Around 2015, with the release of the movie Concussion, came the peak of a moral panic about head injuries, CTE and the terrible human costs associated with getting smashed this much. These gladiator games. At least one NFL player was a straight up murderer, did that have anything to do with his banged up head? Maybe that was an unrelated matter (even worse?).

The problem hasn’t gone away. On a recent Thursday Night Football game, you could see Cowboys receiver Ceedee Lamb’s head hit the ground, and then he has an unsettling reaction that could be some kind of brain glitch. It’s distressing to watch.

The league has taken this seriously. The history of football is evolutions to keep it acceptably risky. Here’s a historical essay from Granta that reviews all that (didn’t realize Dwight Eisenhower played football against Jim Thorpe.)

We, the American people, accept some amount of possible lifetime damage to the players. After all, they accept it! They love it! We the people watching vote with our eyeballs. Give us our circus! The danger aspect might be part of why we like it. This is high risk!

Take the dark aspects of football and invert: is it possible this regulated controlled game and ritual might be a healthy release valve for deep, troubling urges in the American spirit? Without football, might all that gladiatorial energy, intensity and violence blow out in much more harmful ways?

Maybe believing that is just a way to rationalize my enjoyment.

I don’t even really have a team. When I was a kid I liked the Patriots so much I got Irving Friar’s autograph at training camp. I still root for the Patties, Drake Maye and Mike Vrabel are fun, but they don’t move my heart. Should I root for the Chargers? I like handsome Justin Herbert, son of Eugene Oregon and former Oregon star, who just won a game with a broken hand after Hart tipped the ball to Jefferson to beat the Eagles. (There was good drama when he was impatient about his postgame interview.)

Who’s playing doesn’t matter that much to me. Like John McCain I’d watch the bedwetters play the thumbsuckers. I like the acoustic quality, the sound of the broadcast, the rhythm of it. The announcers have gotten so good at finding and developing narratives, stories of personalities, characters, stakes.

I was watching UNLV play Boise State the other day in the Mountain West championship. I was struck by the quality of the color commentator, he could really lay out missed coverage, the nature of the plays, who screwed up what, intentions vs. execution. I looked it up and it was RGIII!

I found Bill Belichick’s book, The Art of Winning, to be not urgent to finish. Belichick’s central message of work hard, do your job, just isn’t that interesting to read about. It’s not hard to understand, it just takes discipline to execute every day. There aren’t enough anecdotes. Belichick, we know, can be really interesting on the details of football strategy and the history of the game. We know that he’s probably read every book on football strategy out there (see our review of Halberstam’s book on Belichick, Education of a Coach.) He could’ve made real contribution with a dense book of football knowledge, even if that doesn’t seem likely to be popular as a book on “winning.”

Pete Carroll’s book is fun, like drinking a fountain soda. Invigorating. Maybe I’m just more of a Pete Carroll type.

If Belichick wrote a book about his personal life, that was a true My Heart Laid Bare, I’d be first in line to buy the hardcover.

The job I want in the NFL is owner.

Now why didn’t Chuck Klosterman’s book about football come out in time for Christmas? I guess it’ll be out in time for the Super Bowl?

The Hely-Hutchinsons

Posted: December 13, 2025 Filed under: hely, Ireland Leave a commentEvery year Christmas season rolls around, and everyone asks me if I’m any relation to the composer Victor Hely-Hutchinson, of “The Carol Symphony.”

No, I can’t claim it. Perhaps 500 years ago we were all part of some proto Hely clan, who can know. Perplexity AI estimates there are some 60,000-100,000 “Healys” and hundreds/low thousands of “Helys” worldwide.

The Hely-Hutchinsons are their own deal, a semi-distinguished Anglo-Irish family. They start with John Hely:

In 1751 married Christina Nickson:

and took on the name of her rich uncle, Richard Hutchinson.

He added Hutchinson to his surname in consequence of the marriage, which brought him her considerable fortune.

says the 1911 Encylopedia Britannica:

He was a man of brilliant and versatile ability, whom Lord Townshend, the Lord Lieutenant, described as by far the most powerful man in parliament. William Gerard Hamilton said of him that Ireland never bred a more able, nor any country a more honest man. Hely-Hutchinson was, however, an inveterate place-hunter, and there was a point in Lord North’s witticism that if you were to give him the whole of Great Britain and Ireland for an estate, he would ask the Isle of Man for a potato garden.

Hely-Hutchinson ended up becoming provost of Trinity College, Dublin:

For this great academic position Hely-Hutchinson was in no way qualified, and his appointment to it for purely political service to the government was justly criticised with much asperity.

Too bad he didn’t keep his hands on Frescati House.

Mrs. Hely-Hutchinson became the Baroness Donoughmore. Their kids had interesting careers. Richard Hely Hely-Hutchinson commissioned Knocklofty House:

(source)

which has sadly lost its grandeur due to abandonment. Here’s a YouTube. I fear it’s beyond repair.

Richard’s brother, grumpy looking John, was at the Battle of Alexandria

and took command after Abercromby was killed. He never married. The Earlship passed along.

The fourth earl was president of the Board of Trade and makes a brief cameo in Shelby Foote’s Civil War.

The fourth Earl’s second son was Walter, who became governor of the Cape Colony. His wife was May, Lady Hely-Hutchinson:

In 1902, she published the article “Female Emigration to South Africa”, where she bluntly and at length complained about the quality of available domestic servants:

[…] each class has its allotted duties, and the woman who deliberately neglects or ignores the more delicate or involved social duties of her class is quite as blameworthy as the servant who, instead of attending to her duties, spends what she considers her own, but what is really her mistress’s time, in gazing out of a window or reading a ‘penny dreadful.’

They were the parents of the composer.

The winter of 1947 was very long-lasting and to save fuel (which was still rationed), Hely-Hutchinson refused to switch on the radiators in his office. He developed a cold, which became influenza.

(Family trait? maybe we are related.)

Just to finish off the Earls: the fifth earl was this guy:

And the sixth was this big boi:

His son was the 7th Earl, whose most memorable moment came when he was kidnapped by the IRA from Knocklofty House in 1974. Luckily this kidnapping was more comic than tragic. From a 2008 Irish Independent article, “Couple Formed Unlikely Bond with Kidnappers“:

The RTE documentary series, Hostage, reveals how there was a good-humoured clash of cultures during the kidnapping, with Lady Donoughmore sending her compliments to the chef for a fry cooked for them by the head of the gang. On another occasion, their son revealed, one of their guards blurted out the answer to a Gaelic games crossword question.

“My mother was working on a crossword puzzle and one of the questions was, ‘Whose colours are black and amber in Gaelic games?’ There were a couple of people guarding them who were local volunteers and told never to speak to them. My father had gone through about eight counties and the man said, ‘For God’s sake, don’t you know it’s Kilkenny’?”

The 8th Earl was the last of the earls, because the 1999 House of Lords Act reformed things. The 8th Earl’s kids include the painter Nicholas (his gallery) and the publisher Tim, and his grandkids include Alex the London restauranteur.

Thus the Hely-Hutchinsons. Let’s all listen to The Carol Symphony together!

Sidequest: on Christiana Hely-Hutchinson’s wikipedia page, it claims she’s an ancestress of Katharine, Duchess of Kent:

but I can’t follow the connection if there is one. Katharine is the mother of Lady Helen Taylor:

The British press is savage. They’re just calling a Lady “Melons.”