Purgatories

Posted: March 7, 2026 Filed under: Italy Leave a commentCanto IV of Dante’s Purgatorio. Dante’s trying to describe the mountain of Purgatory:

Vassi in Sanleo e discendesi in Noli,

montasi su Bismantova in cacume

con esso i piè; ma qui convien ch’om voli;

dico con l’ale snelle e con le piume

del gran disio, di retro a quel condotto

che speranza mi dava e facea lume’

Or:

One goes to Sanleo and descends to Noli,

one climbs the summit of Bismantova

with his feet; but here one must fly;I mean with slender wings and the feathers

of great desire, following that guide

who gave me hope and gave me light.

Gerald Davis gives us this as:

San Leo (source)

Noli (source)

Bismantova (source)

I’d like to visit some day. It may have looked bleaker in Dante’s day:

At the time he saw it, Pietra di Bismantova probably looked even more barren than it does today, because of the intensive deforestation that took place in the surrounding area at the time. In recent decades, the area around the rock has been reforested as a result of the abandonment of local agriculture and a different use of forest resources.

Dateline: Hollywood

Posted: March 5, 2026 Filed under: the California Condition Leave a comment

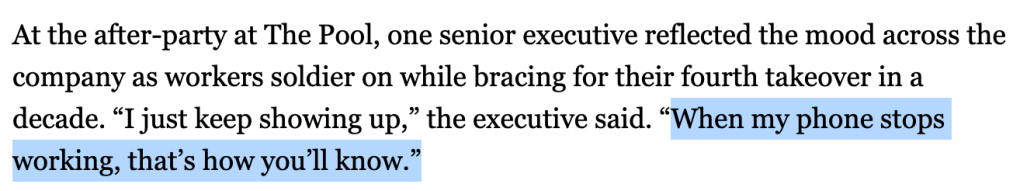

from this Deadline article about the premiere of HBO’s “The Rooster.” The mood here is on edge. But isn’t it ever thus? One of California’s themes is: on the edge.

F2: Fridericus II

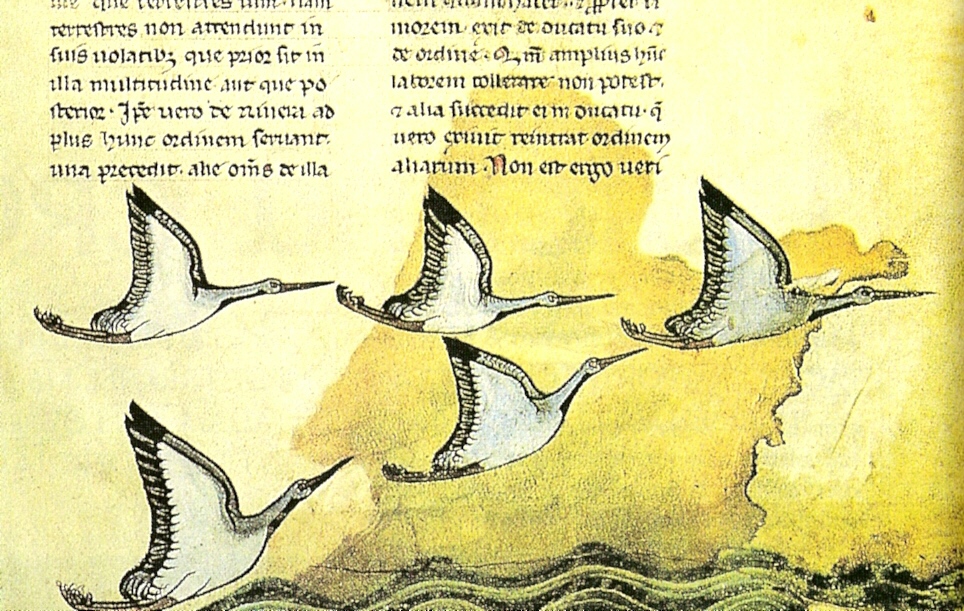

Posted: March 1, 2026 Filed under: hely's history, Italy, Savoy Leave a commentAn important offscreen character in Dante’s Inferno is Fredrick II, the Holy Roman Emperor (to use an anachronistic term).

was he really born in the marketplace?

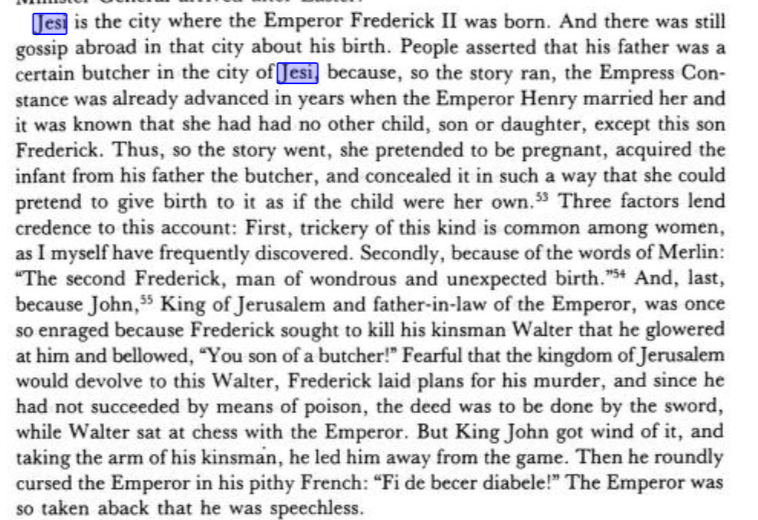

Friderick II (you’ll see why it’s important to spell it that way later) lived from 1194-1250 common era . This was the extent of his domain, in orange and red.

(I got that map from Reddit, you can see that the first commenter is already finding fault, but for our purposes it works).

You can see why Friderick would have conflict with the Pope, who had the lands in white that separated Friderick’s lands from each other. Thus begins (or thus continues) the conflict that tore apart Dante’s Florence, between Guelphs and Ghibellines, supporters of the Pope and supporters of the Emperor, that had such a huge impact on Dante’s life (Dante was Team Pope, but then his own side split into White and Black and he (White) lost and was exiled.)

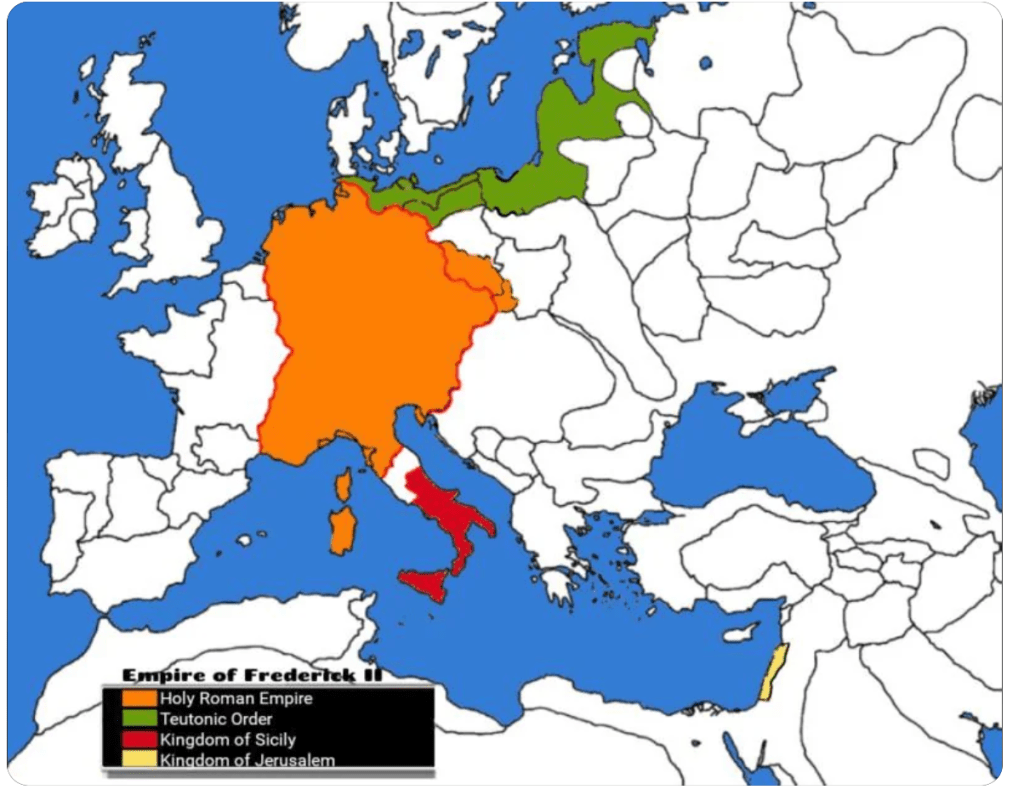

He knew bird:

Frederick II is the author of the first treatise on the subject of falconry, De Arte Venandi cum Avibus (“The Art of Hunting with Birds”)…

For this book, he drew from sources in the Arabic language. Frederick’s pride in his mastery of the art is illustrated by the story that, when he was ordered to become a subject of the Great Khan (Batu) and receive an office at the Khan’s court, he remarked that he would make a good falconer, for he understood birds very well. He maintained up to fifty falconers at a time in his court, and in his letters he requested Arctic gyrfalcons from Lübeck and even from Greenland. …

David Attenborough in “Natural Curiosities” notes that Frederick fully understood the migration of some birds at a time when all sorts of now improbable theories were common.

Now here’s something interesting:

In the language deprivation experiment, young infants were supposedly raised without human interaction in an attempt to determine if there was a natural language that they might demonstrate once their voices matured. It is claimed he was seeking to discover what language would have been imparted unto Adam and Eve by God. Salimbene alleged that Frederick bade “foster-mothers and nurses to suckle and bathe and wash the children, but in no ways to prattle or speak with them; for he would have learnt whether they would speak the Hebrew language (which had been the first), or Greek, or Latin, or Arabic, or perchance the tongue of their parents of whom they had been born. But he laboured in vain, for the children could not live without clappings of the hands, and gestures, and gladness of countenance, and blandishments”.

Our source for that is the Cronica of Salimbene di Adam:

(source)

More experiments reported:

As for his appearance?

A Damascene chronicler, Sibt ibn al-Jawzi, left a physical description of Frederick based on the testimony of those who had seen the emperor in person in Jerusalem: “The Emperor was covered with red hair, was bald and myopic. Had he been a slave, he would not have fetched 200 dirhams at market.”

It’s very possible we would put this guy today into one of several categories ranging from oddball to neuroatypical. Some clues are he did weird experiments, looked weird, and had a guy’s finger cut off for spelling his name wrong.

Lansing and English, two British historians, argue that medieval Palermo has been overlooked in favour of Paris and London:

One effect of this approach has been to privilege historical winners, [and] aspects of medieval Europe that became important in later centuries, above all the nation state…. Arguably the liveliest cultural innovation in the 13th century was Mediterranean, centered on Frederick II’s polyglot court and administration in Palermo…. Sicily and the Italian South in later centuries suffered a long slide into overtaxed poverty and marginality. Textbook narratives therefore focus not on medieval Palermo, with its Muslim and Jewish bureaucracies and Arabic-speaking monarch, but on the historical winners, Paris and London.

Dante preferred Friderick’s successor, Henry VII.

“well he would say that, wouldn’t he”

Posted: February 28, 2026 Filed under: America Since 1945 Leave a comment

I misremembered the famous phrase of Mandy Rice-Davies.

The UK is so odd:

In 1980, with Shirley Flack, Rice-Davies wrote her autobiography, Mandy…Subsequently, journalist Libby Purves, who had met Rice-Davies when Mandy was published, invited her to join a female re-creation on the River Thames of Jerome K. Jerome’s comic novel Three Men in a Boat.

This expedition was commissioned by Alan Coren for the magazine Punch, the other members of the party being cartoonist Merrily Harpur and a toy Alsatian to represent Montmorency, the dog in the original story. Purves recounted how she “immediately spotted that this Rice-Davies was a woman to go up the Amazon with” and, among other things, that “only Mandy’s foxy charm saved us from being evicted from a lock for being drunk on pink Champagne.”

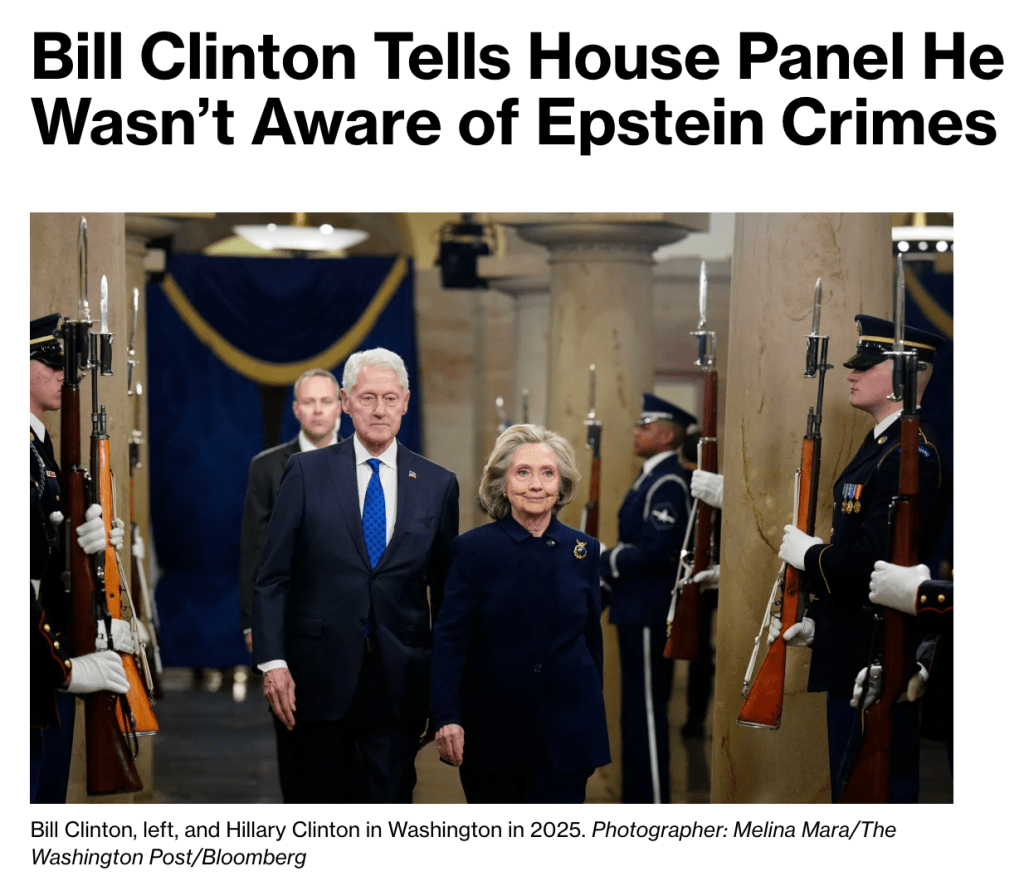

Nothing new

Posted: February 27, 2026 Filed under: America Since 1945 Leave a commentThe idea that AI is gonna give us all too much free time doesn’t worry me. From McCullough’s Truman:

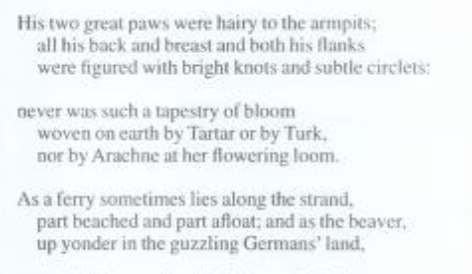

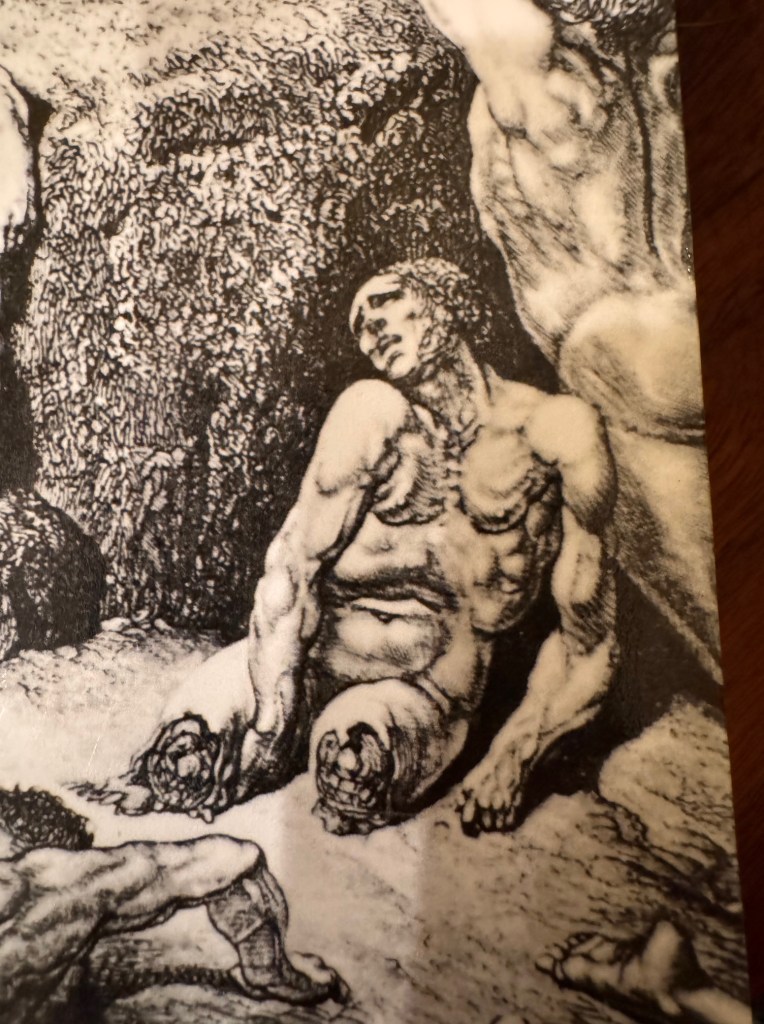

first time I lol’d at Dante’s Inferno

Posted: February 25, 2026 Filed under: Italy Leave a commentCanto 17:

that’s from Gerald Davis translation. John Ciardi gives us:

Mandelbaum:

if we just put “Tedeschi lurchi” in Google translate it gives us “German slugs.”

Cheers to Tom B., age fourteen or something, describing the Inferno as “self insertion fan fiction.” It is!

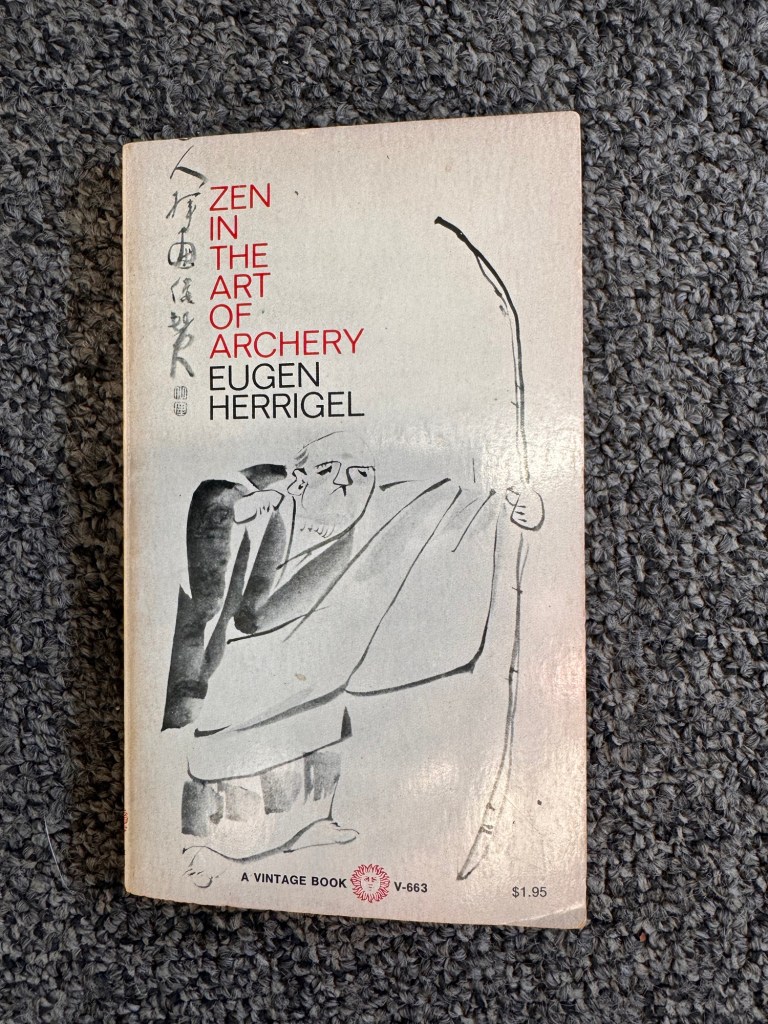

My two year old daughter saw this guy on the cover of John Sinclair’s translation

and said

he’s sad. he misses his mommy.

correct, this is from Canto 28, the Schismatics, who are cut apart as they cut families apart.

Restaurants and Railroads: hospice brands

Posted: February 14, 2026 Filed under: business, railroads and restaurants Leave a comment

Sad. From ValueLine.

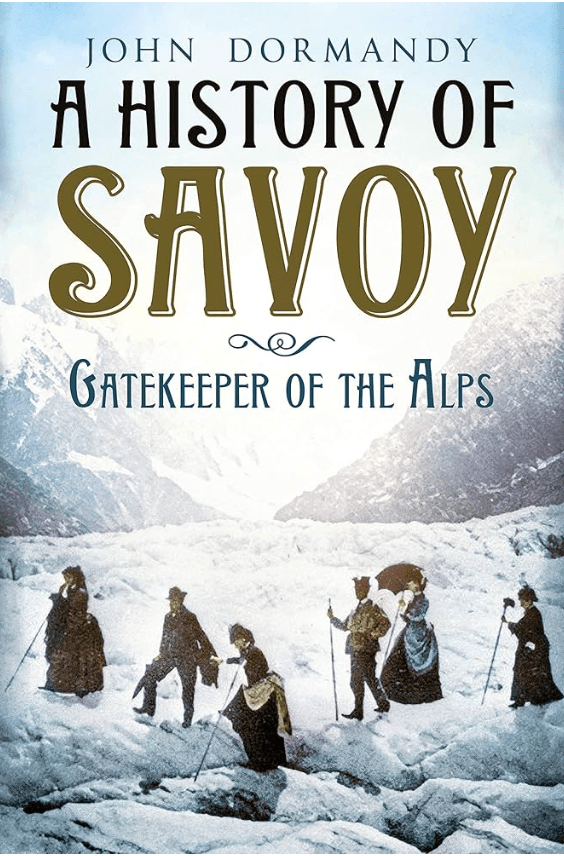

John Dormandy’s Savoy

Posted: February 7, 2026 Filed under: Savoy Leave a commentSavoy was a small state – a principality, a dukedom, a kingdom – that covered parts of what’s now northwest Italy, Switzerland, and southeastern France. The borders were always shifting. For a time Savoy was its own country. The ruling family ended up as kings of Italy, until that ended shortly after World War Two. I’m interested in Savoy because I’ve twice been lucky to travel to the animation festival at Annecy, France, historically part of Savoy.

I judged this book by its cover, thought it might be kinda slop, and ignored it even though I have a strong interest in the history of Savoy. But after burning through most English language Savoy specific content, I bought and started reading it, and it’s fantastic! John Dormandy is a great, conversational, witty writer. He makes a great case for the importance of Savoy as a topic. Blessed with some clever rulers it managed to survive a long time while many other small states like Burgundy were swallowed up. Just an excerpt:

In 1858, Emperor Louis Napoleon III and Count Benzo Cavour, prime minister of King Victor Emmanuel, met secretly in the small spa town of Plombières in the Vosges mountains to hatch a plot. The two men, equally devious, agreed to provoke an attack by Austria on the Kingdom of Sardinia that included Savoy; the French would then promptly come to the aid of poor Sardinia, and together they would expel the Austrians from northern Italy. Following that happy outcome, Sardinia would acquire all of northern Italy and in recompense for his help, Napoleon III would be allowed to annexe Savoy to France. That was exactly what happened, except that by the mid-nineteenth century, Europe, particularly Victorian England, was beginning to baulk at countries being traded as commodities, especially if the recipient of the gift was France under a second Napoleon. Cavour and Napoleon, ever resourceful, organised a ‘free’ plebiscite in Savoy in which 99 per cent of the population voted for annexation to France.

I looked up John Dormandy, and sadly, he’s died. He wrote this book as a retirement project. He led a remarkable life. Here’s an edited version of an obituary I found here:

John Dormandy was born on 3 May 1937 in Budapest. He was the son of Paul Szeben, a pea grower who was accustomed to exporting his crop to the UK, and his wife Clara, who was an author and dramatist. He had a sister, Daisy, and his elder brother, Thomas, was to become a consultant chemical pathologist, renowned for his research on the actions of free radicals. The family were Jewish and went into hiding in 1944 when the Nazis invaded Hungary. After several months sheltering in a convent, they escaped to Geneva. In 1948 they made their way to London, where they settled and changed their surname to that of a village in Hungary which was 150 miles east of Budapest, where they had a country estate. John was educated in Hungary, Geneva and Paris before enrolling at London University to study medicine and graduating MB, BS in 1961. Apart from a spell as a registrar at the Royal Free, he was to spend most of his career at St George’s Hospital, progressing from lecturer in applied physiology to senior lecturer in surgery and, eventually, professor of vascular surgery.

He was famous for his pioneering work investigating the diagnosis and treatment of peripheral artery diseases. A colleague referred to him as an unusual surgeon since he was keen to conserve affected limbs rather than to correct [the problem] immediately with a knife. Written with three co-authors, his book Clinical haemorheology (Springer, 1987) remains a standard work in the field. In the early 1990’s he was the first to advocate the use of specialist nurses to manage clinics for patients with chronic vascular disease and eventually this led to a nationwide network. He saw the benefits of multidisciplinary information sharing and was a leading figure in setting up the Trans-Atlantic Consensus for the management of peripheral artery disease (TASC) which published uniform guidelines in 2000. It was due to his personal involvement that so many vascular societies across Europe and North America collaborated in the research and adopted the recommendation. The author of five medical books and over 200 research papers, he continued to write and appear as an expert witness after his retirement in 2001.

In the 1980’s, as his fame grew, he was called upon to deal with some high profile patients. Flown to Baghdad, he operated on the varicose veins of Saddam Hussein’s mother, to be rewarded with a gold watch which was later stolen. In 1983 he went to Libya where he is thought to have treated either Colonel Gaddafi himself or one of his advisors. John was said to be extremely angry that the large bill for this was never paid due to the row over the siege of the Libyan Embassy the following year.

Due to his multicultural upbringing he was fluent in several languages. He was a popular and gregarious host, enjoying fine wines and good food often followed by a cigar. It was said that when he had to implement a no smoking policy as clinical director of St Georges he put a sign on his office door reading You are now leaving the premises of St George’s Hospital. A keen downhill skier, he also enjoyed playing golf and tennis and travelled at hair-raising speed round town on his beloved scooter. Other interests were art, architecture, theatre, opera and travelling – in retirement he published a book on his favourite part of France A history of Savoy: gatekeeper of the Alps (Fonthill, 2018).

His wife, Klara, predeceased him in December 2018 and he died suddenly in Paris on 26 April 2019. He was survived by his children Alexis and Xenia and stepchildren Gaby and Alex. His brother Thomas predeceased him in 2013.

What a guy! I feel like he’s a pal.

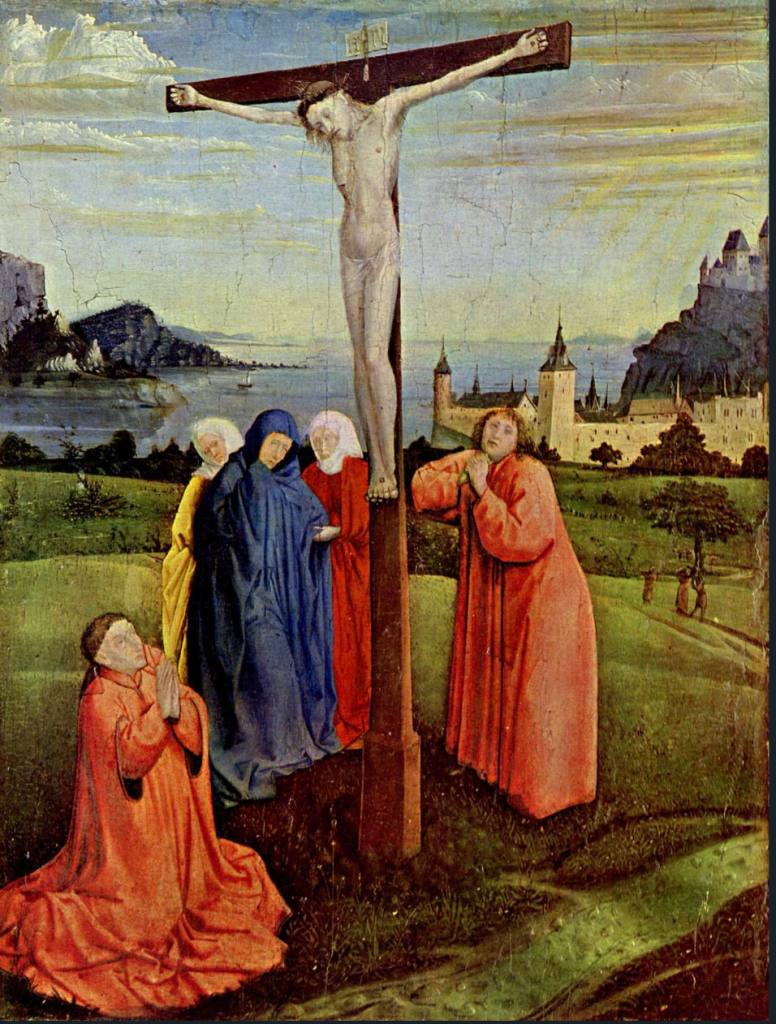

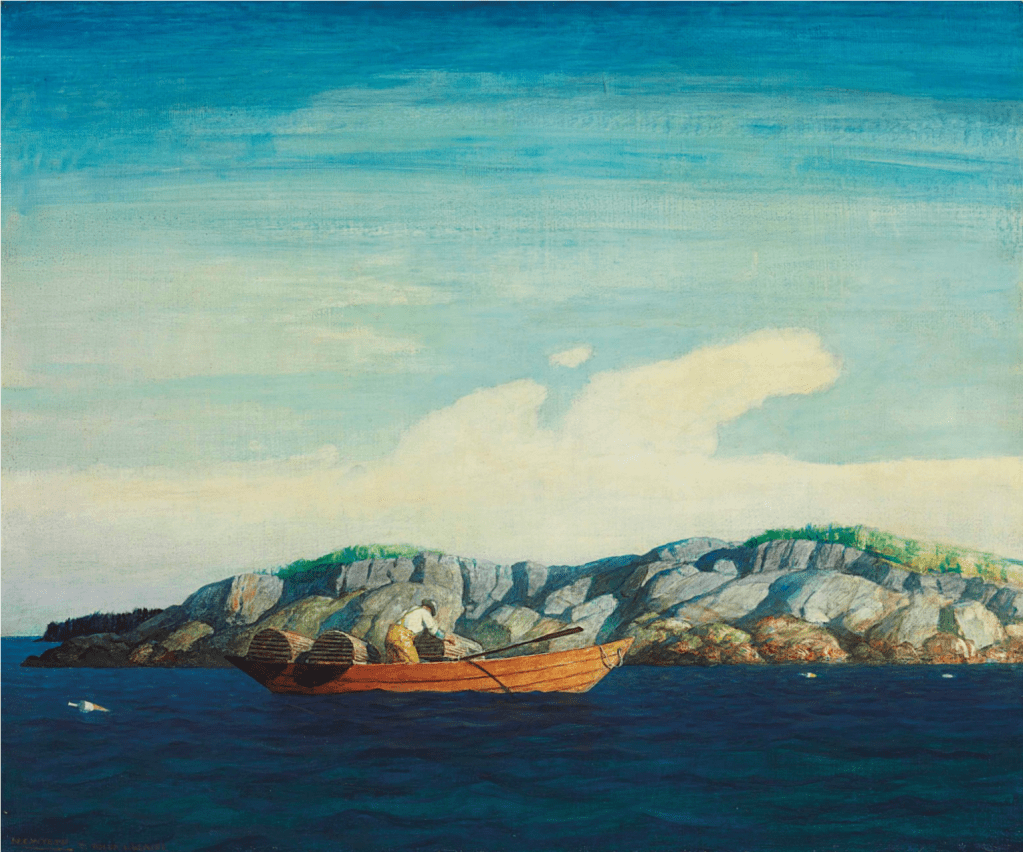

Dormandy thinks Konrad Witz’s Crucifixion depicts Annecy:

It does look like it. He also thinks Witz’s Miraculous Draught of Fishes depicts Lake Geneva, with Mont Blanc in the background, and that very much looks like it!:

Bamberger

Posted: February 6, 2026 Filed under: business Leave a commentfrom a WSJ obituary of J. David Bamberger, conservationist and shareholder in Church’s Chicken.

He learned, for example, to place new locations in middle-class neighborhoods, but right on the border of lower-income ones; the real estate was cheaper, and you doubled your clientele. “Black people would come over to the white neighborhood to buy chicken. But if you put a store in a predominantly black neighborhood, white people wouldn’t come over and buy there,” Bamberger lamented in LeBlanc’s book.

There’s a Church’s Chicken in the Inland Empire on the way back from Joshua Tree, it’s not quality. But Bamberger retired in 1988. More:

In addition to his restoration of the land now known as “Selah, Bamberger Ranch Preserve,” Bamberger was instrumental in the preservation of nearby Bracken Cave in the early 1990s, home to more than 15 million Mexican free-tailed bats—a colony believed to be the largest concentration of nonhuman mammals on the planet. Bamberger gained the trust of the family that owned the cave and brokered a sale to the nonprofit Bat Conservation International, then paid to build a trail system and other infrastructure to make the site accessible to visitors.

Suddenly enchanted by bats, Bamberger next hired biologists and geologists to hunt for a spot at Selah where he could establish a bat population of his own. They couldn’t find a single suitable site.

“Most people would have said, ‘Oh well, that’s too bad. I guess we’re not going to have a big bat colony here,’ ” explained April Sansom, executive director of Selah, Bamberger Ranch Preserve. “But not J. David. What he said was, ‘Oh, guess we better try to build one.’ ”

Construction of a system of underground caves was completed in 1997—a mammoth project which Bamberger conceded was “eccentric” even for him, and which was mocked locally as “Bamberger’s Folly.” It took several years, and some iterative modifications to the structure, but wild bats eventually moved in and established a colony there. The population is now half-a-million strong.

More NFL, and Klosterman on books

Posted: February 4, 2026 Filed under: sports Leave a commentChuck Klosterman was on Bill Simmons podcast, talking about his new book about football:

When that book Abundance came out last year, okay, now that seems like a book I would read, right? I never did read it, although I completely informed about it because I heard it on podcast nine different times. Sometimes I think that the way things work now is you write a non-fiction book and maybe 150,000 people read it, but most people experience it through this, through these ancillary moments of people discussing the book. I understand that there are people listening to this podcast who I think would be prime people to buy this, and they probably won’t. They’ll be like, I just I don’t buy books anymore. It’s really hard to sell books to men, particularly. So if you want to talk about specifics of the book, that’s fine. I don’t mind.

At first what Klosterman had to say was similar to our own recent post about the popularity of the NFL. But then Klosterman kept going, and showed why he’s one of the world’s best take-havers:

One thing that’s often mentioned, particularly by people who don’t like football, is a very famous Wall Street Journal article from 2011, where these guys studied these pro football games and they were like, Do you know in a three-hour telecast of an NFL game, there’s 11 minutes of action? You’re sitting there for three hours and there’s 11 minutes of action. Now, if somebody was inventing football right now for the first time, there was no way that would get through the pitch meeting. If they said this is a three-hour sport and there’s actually about 11 minutes of action, people would say, That’s insane. No one’s going to sit through that. Nobody wants that. That’s a huge flaw. But it’s not a flaw. As it turns out, 11 minutes is the perfect amount. Because these things you’re talking about, they happen in between play. Phase. Football has this accidental upside, which is super intense, hyper-action in this small window of time, maybe seven seconds. And then there’s This time when you can think about what you saw, what you will see next, what was the meaning of that? Maybe the analyst will describe what we actually saw in a way that we couldn’t comprehend.

Or maybe I’ll hate the analyst and think he’s an idiot. Sure. Either way, I win.

Or you can think about something else. You can talk to somebody about something that’s not involved with the actual football game, or you can talk about the football game. This experience, which seems like it should be a mistake. It should be a mistake that’s something that lasts that long has that little amount of action. This That is one of these things that… It’s one of the many counterintuitive things about football, in that the TV experience is great despite the fact that it would never get through a focus group. The fact that somebody said, The main view you will have in a football game, most of the time, will not show you all the players. You will not be able to see the free safeties. When the quarterback drops back and throws the ball, you will have a moment where you will have no idea if the guy is open or covered. These things that seem like they should be problems actually create this internal psychological tension that makes this experience so enriching. I really believe that football, the reason that it is the best thing television has ever been built with, is because even a bad football game is weirdly watchable in a way that isn’t true about other things.

Barry Diller on Rick Rubin’s Tetragrammaton podcast

Posted: February 3, 2026 Filed under: Uncategorized Leave a comment

Freud on major/minor decisions

Posted: February 2, 2026 Filed under: advice 1 CommentAlmost 100 years ago in Vienna, Theodor Reik asked Sigmund Freud for advice about choosing a career. Freud replied: “When making a decision of minor importance, I have always found it advantageous to consider all the pros and cons. In vital matters, however, such as the choice of a mate or profession, the decision should come from the unconscious, from somewhere within ourselves.”

that quote has stuck with me, perhaps I first read it in this Feb. 2006 letter to the editor of the NYT.

Machine Learning Learning

Posted: January 31, 2026 Filed under: America Since 1945 1 CommentA sense that the frontier is moving very very fast on what we crudely call “AI.” (A rare point of agreement with President Trump*. “artificial intelligence” is a bad name, I don’t like using it and look for alternatives.)

It reminds us of the explosive growth of Internet, it moved fast. Many of the fast movers thrived. I started college in 1999. That was the first time I had consistent Internet access that didn’t rely on a school lab or an AOL free trial with a 3.5 disk mailed to us. Some of the first bloggers – Andrew Sullivan, Matt Yglesisas – established themselves and stayed there. A sense of if you’re not keeping up you’re falling behind motivated me.

Maybe we should “run at it” as Bill Gurley advises. This stuff isn’t going away, we can mock it, complain about it, or try to figure out what it can do.

The only coding I’ve ever done was in BASIC, or making a text football game on my TI-83 during Statistics class. That was quite satisfying, but limited. During the pandemic, I asked a friend who’s sharp at coding – we’ll call him CC, Coding Chum – what “learn to code” would look like. He suggested we work on a specific project. I suggested a name generator that would scrape Wikipedia, gather real names, and randomly pair first and last names. CC gave me a series of Zoom tutorials where we worked on this in Python. My takeaway was that “learning to code” for me would take several years and I’d never be professional grade at it. I lacked the aptitude and motivation.

Along comes “vibe coding.” This is where you type, in words, what you want to happen, and a machine intelligence does the coding for you. I decided to try this using Claude Code.

The main points of friction for me were interacting with the Terminal on my Mac. I don’t even know how to enter command lines or anything on my computer. But Claude (regular, I’m paying for the $20 a month level) walked me through that, often with me sending it screenshots of error messages.

Once we got through that, and installed what I needed for Claude Code, we got to work. The Wikipedia project proved too daunting for Claude Code. So, we reduced the scale. What’s a pool of names?

How about everyone who ever played Major League Baseball? Famously one of the most recorded and compiled activities, surely there would be databases. I didn’t even tell Claude Code what databases to use, but it went to work, gathered the names of all the twenty something thousand people who ever played Major League Baseball and create a name generator that would pair random first and last names.

This took some coaching and debugging that took less than an hour. Here’s the result. It favors unique first names: common names like “Mike” are in there only once, so they come up the same number of times as say Kenshin or Alvis. But, it works. All told this took less than an hour.

The result I shared with CC, who within a few minutes created a revised version, you can select for 1920s names, limit by eras, etc. People who are good at coding will still be better at coding.

Yet for me, a person not good at coding, I could now do in minutes what once seemed like it would take a year’s worth of training and then much hacking away to accomplish.

The limits of Machine Learning are still funny. That was me asking Claude to find obscure works of microhistory published by academic presses. Despite me sending it up here, it did a pretty good job.

As Ben Affleck points out, as a writer it will generate at best average material, and average writing is, as writing, worthless. But that’s now. Who knows what’s coming? As information gatherer, as a research assistant, Machine Learning tools are already tremendous.

When I finished my vibe coding an excitement was paired with a small sadness. The only limit to what I could accomplish is my imagination. And… I couldn’t really think of much else.

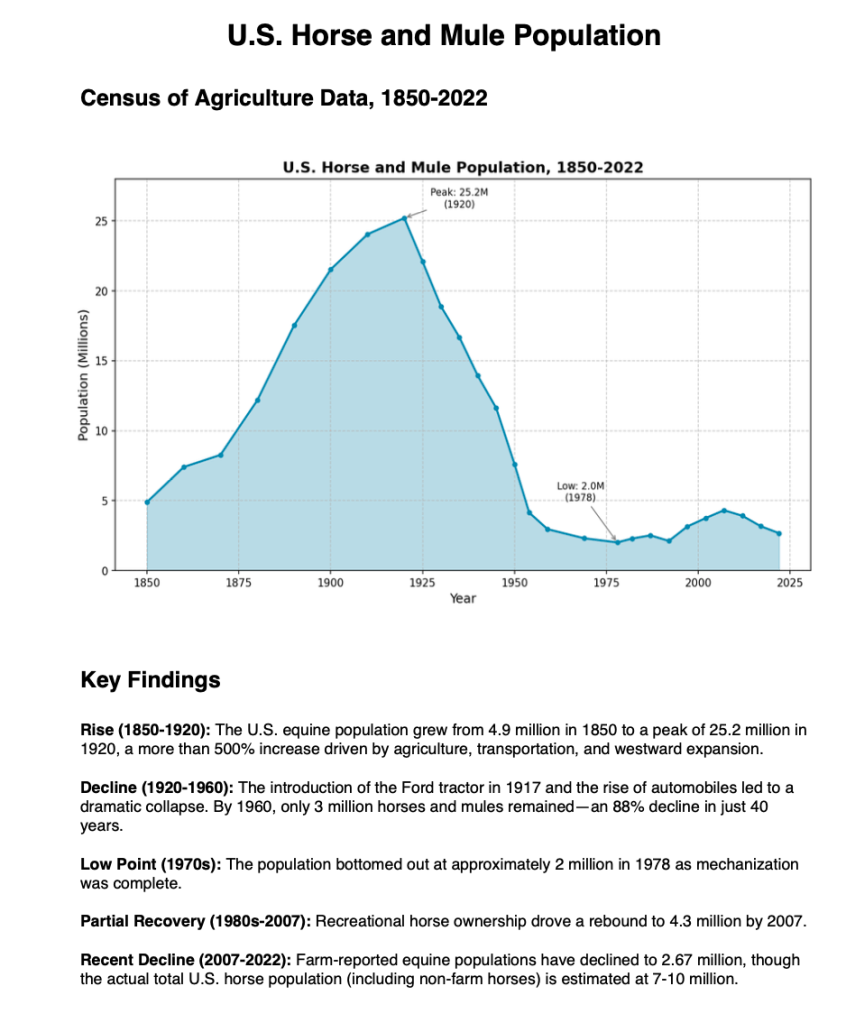

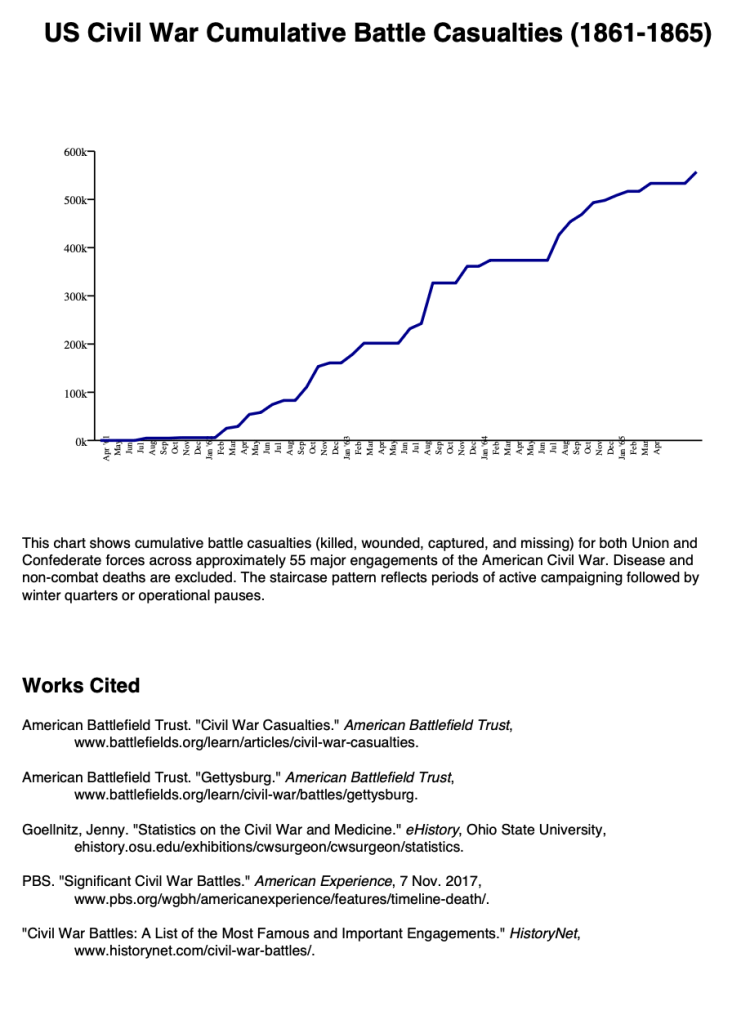

Someone on X suggested a powerful use is data visualization. I went to work. Here’s an example:

I asked Claude to go through Census data and create a chart of US horse and mule populations. I asked it to cite sources in MLA format:

Here’s another:

This chart doesn’t show us much that’s new, such a chart may have even existed. These just happened to be some personal botherations I looked into. Work that would’ve taken an afternoon is done in seconds.

Extrapolate from here: what happens when we start putting this on archives, untranslated literatures? Historians have made careers on stuff like, for example, showing correlations between Salem land ownership and witchcraft allegations. If you start putting machines on archives, what connections will it find?

The hard part might be getting physical documents into the machines (which was a challenge for the witchcraft guys):

Published in 1978 in three volumes, The Salem Witchcraft Papers: Verbatim Transcripts of the Legal Documents of the Salem Witchcraft Outbreak of 1692 included transcriptions of the legal papers that had been done by a WPA team headed by Archie N. Frost in 1938, which had only been available to scholars in typescript form on deposit with the Essex Institute and with the Essex County Clerk of the Courts.

My belief is that the humanities will be slow to realize the effects these tools could have on their disciplines. By tomorrow you could have a silicon-based assistant who’s read everything extant in Latin and Greek. Or the entirety of the California Digital Newspaper Collection, or the Texas Slavery Project, or the Congressional Record. Here on my desk is a copy of Heart Of Europe: A History Of The Holy Roman Empire. Every paragraph seems to have something like “The Prussian King held only 4.5 percent of the agricultural land, with nobles owning and directly managing 11 per cent, and cities and foundations a further 4.5 percent.” Crunching that data might’ve been some historian’s summer. What kind of analysis will your computer assistant be able to do?

This assistant can read every language and find any pattern, and be trained to look for anything.

The job may scale up from doing the work to managing and steering the incredible power of the automated work-doers. We’ll all become managers. We’ll still have to figure out what to ask, of course.

It’s funny, I’m reminded of Shelby Foote:

I’ve never had anything resembling a secretary or a research assistant. I don’t want those. Each time I type, it gives me another shot at it, another look at it. As for research, I can’t begin to tell you the things I discovered while I was looking for something else. A research assistant couldn’t have done that. Not being a trained historian, I had botherations that led to good things. For instance, I didn’t take careful notes while reading. Then I’d get to something and I’d say, By golly, there’s something John Rawlins said at that time that’s real important. Where did I see it? Then I would remember that it was in a book with a red cover, close to the middle of the book, on the right-hand side and one third from the top of the page. So I’d spend an hour combing through all my red-bound books. I’d find it eventually, but I’d also find a great many other things in the course of the search.

There’s a lot to that. On the other hand, I remembered something like that quote, but I couldn’t remember where I found it. I thought maybe Shelby Foote? I told my troubles to two machine learned machines. Perplexity AI was stumped but Claude found it in seconds.

The future is hard to predict but we’re sitting on a volcano.

* still feels insane to type those words

Sandwich history

Posted: January 28, 2026 Filed under: food Leave a comment

Picked up some beef stew with a piece of bread, and wondered if you really need two slices. Was the first sandwich more like this, a kind of Anglo taco?

The modern sandwich is named after Lord Sandwich, but the circumstances of its invention and original use are the subject of debate. A rumour in a contemporaneous travel book by Pierre-Jean Grosley, Tour to London (published 1772), formed the popular myth that bread and meat sustained Lord Sandwich at the gambling table, but Sandwich had many habits, including the Hellfire Club, and any story may be a creation after the fact. Lord Sandwich was a very conversant gambler, the story goes, and he did not take the time to have a meal during his long hours playing at the card table. Consequently, he would ask his servants to bring him slices of meat between two slices of bread, a habit known among his gambling friends. Other people, according to this account, began to order “the same as Sandwich!”, and thus the “sandwich” was born.The sober alternative to this account is provided by Sandwich’s biographer N. A. M. Rodger, who suggests that Sandwich’s commitments to the navy, to politics, and to the arts mean that the first sandwich was more likely to have been consumed at his work desk.

Islands named after Sandwich by Capt. James Cook

Lord Sandwich was a great supporter of Captain James Cook. As First Lord of the Admiralty, Sandwich approved Admiralty funds for the purchase and fit-out of the Resolution, Adventure and Discovery for Cook’s second and third expeditions of exploration in the Pacific Ocean. He also arranged an audience with the King, which was an unusual privilege for a lower ranking officer. In honour of Sandwich, Cook named the Sandwich Islands (Hawaii) after him, as well as the South Sandwich Islands in the Southern Atlantic Ocean and Montague Island in the Gulf of Alaska.

This guy came damn close to having two great things, the sandwich and Hawaii, named after himself.

Previous discussions of Captain Cook.

MONIAC

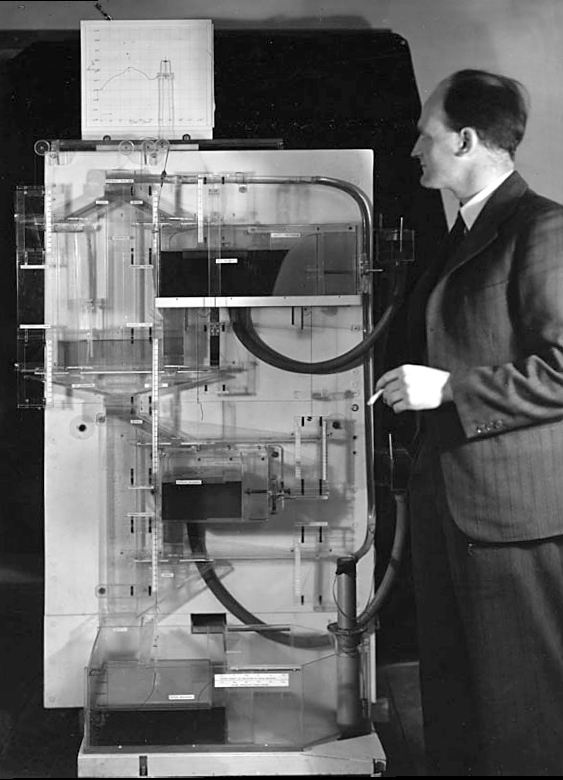

Posted: January 27, 2026 Filed under: money Leave a commentThere’s a visual metaphor for the process [of economists getting lost in models and trying to apply principles to reality] in the form of an amazing device called the Phillips machine, the creation of a remarkable New Zealander called Bill Phillips. After a roundabout route to the world of economics via a spell in a Japanese prisoner-of-war camp, Phillips set up a workshop in a south London garage. There, using recycled Lancaster bomber parts, he botched together a machine that used the flow of water to demonstrate the functioning of the entire British economy. There was a point at which these machines, known as MONIACs—Monetary National Income Analogue Computers—were all the rage: there are about twelve of them (no one knows exactly how many were built) in places as diverse as the central bank of Guatemala, the University of Melbourne, Erasmus University in Rotterdam, and Cambridge, England, which has the only one that works. The Phillips machines/MONIACs were fine-tuned to simulate different economic conditions: the New Zealand one, for instance, was set up to match the specific dynamics of the New Zealand economy.

That’s from How To Speak Money by John Lanchester.

(source)

Lanchester continues:

Phillips was a serious man, who partly on the basis of his machine became a professor of economics at LSE, and he had a serious specific concern in creating the MONIAC, to do with stabilizing demand inside the economy. And yet, it’s hard not to see his machine as a comic allegory of what’s called wrong in the model-making side of economics. It’s inherently comic in the way that a Roz Chast cartoon is inherently comic. The idea that this thing can simulate something as big and complicated as an entire economy—really? And yet, that’s what economic models set out to do all the time. The Federal Reserve and US Treasury are to this day reliant on models of exactly this sort; their models are built out of mathematics rather than out of bomber parts and water, but the underlying principles are the same. Credit flows and monetary supply, inflation rates and external shocks and trade imbalances and fluctuations in demand and tax changes are all modeled in an exactly analogous way.

(source, the cigarette is a great touch)

Phillips:

During this period he learned Chinese from other prisoners, repaired and miniaturised a secret radio, and fashioned a secret water boiler for tea which he hooked into the camp lighting system.[4] Sir Edward ‘Weary’ Dunlop explained that Phillips’ radio maintained camp morale, and that if discovered, Phillips would have faced torture or even death.[7]

Pasadena weather report

Posted: January 26, 2026 Filed under: the California Condition Leave a comment

It could’ve been an early October day in Massachusetts.

You might find it odd to see a Union Civil War monument in southern California, Pasadena wasn’t even founded until 1874. But it was founded by people from Indiana, the experience was probably quite real to them.

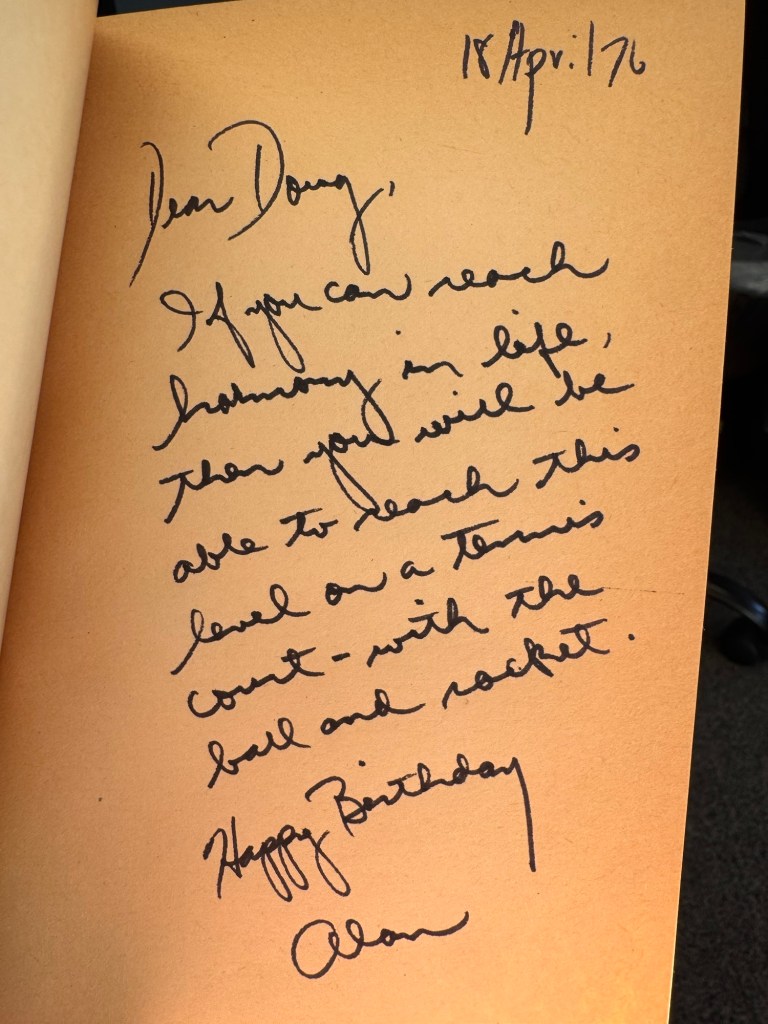

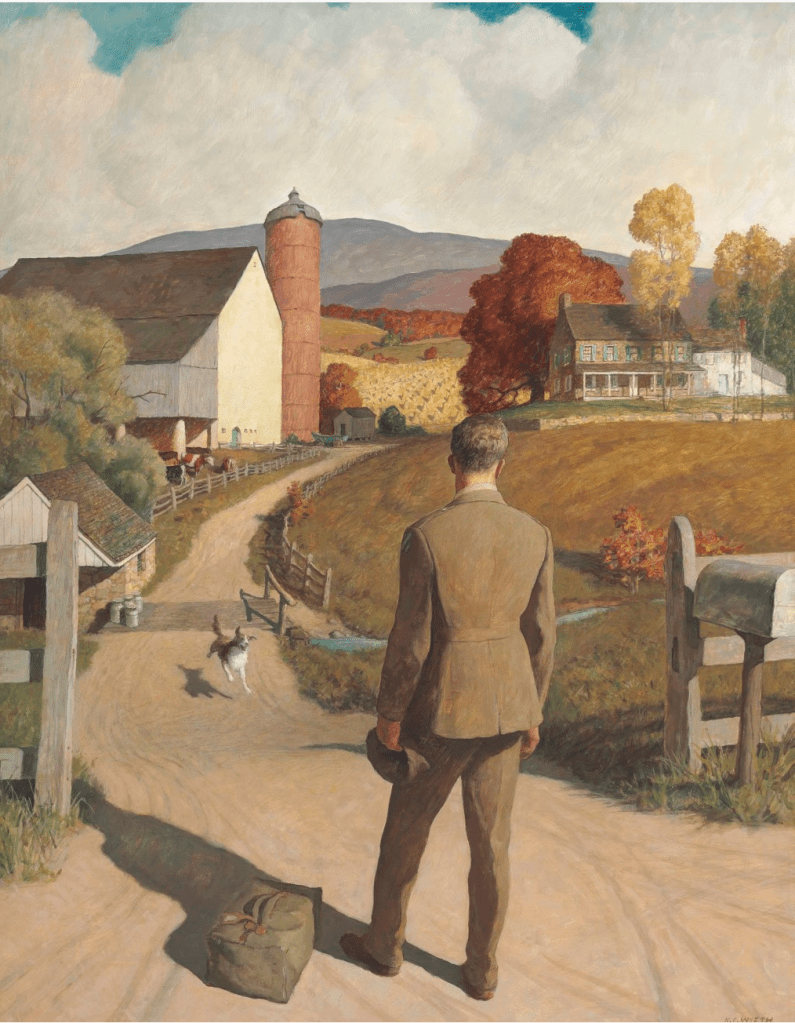

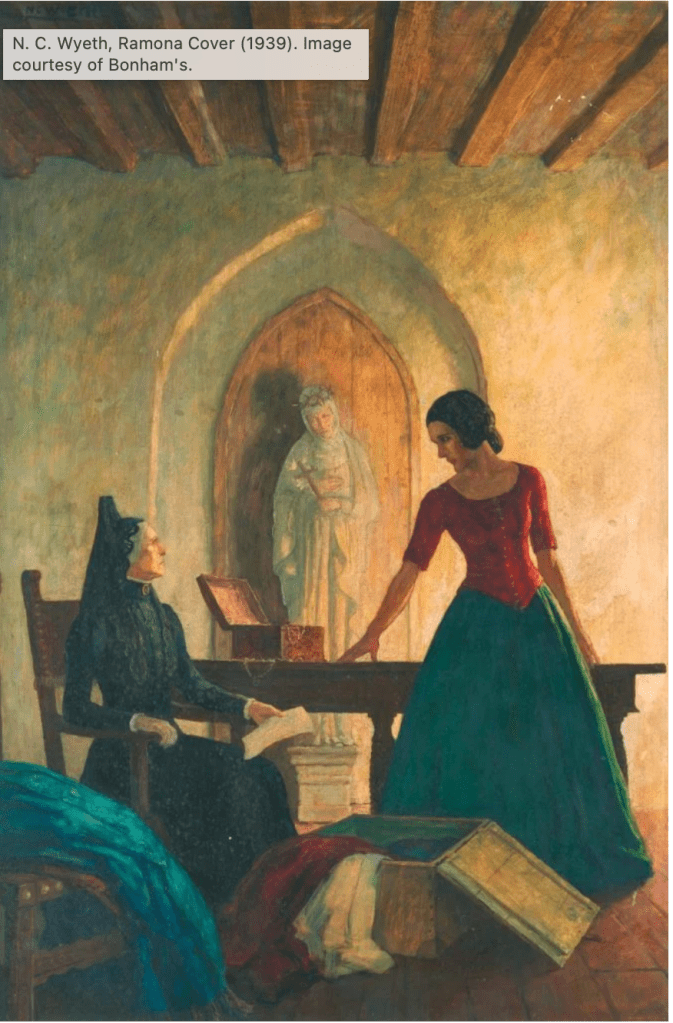

N. C. Wyeth

Posted: January 26, 2026 Filed under: art history 1 CommentSeeing what the son of Needham’s paintings were fetching lately at auction (high six-low seven figures).

more here.

A potential cover of Ramona:

Captain Gronow

Posted: January 21, 2026 Filed under: Clubs Leave a comment

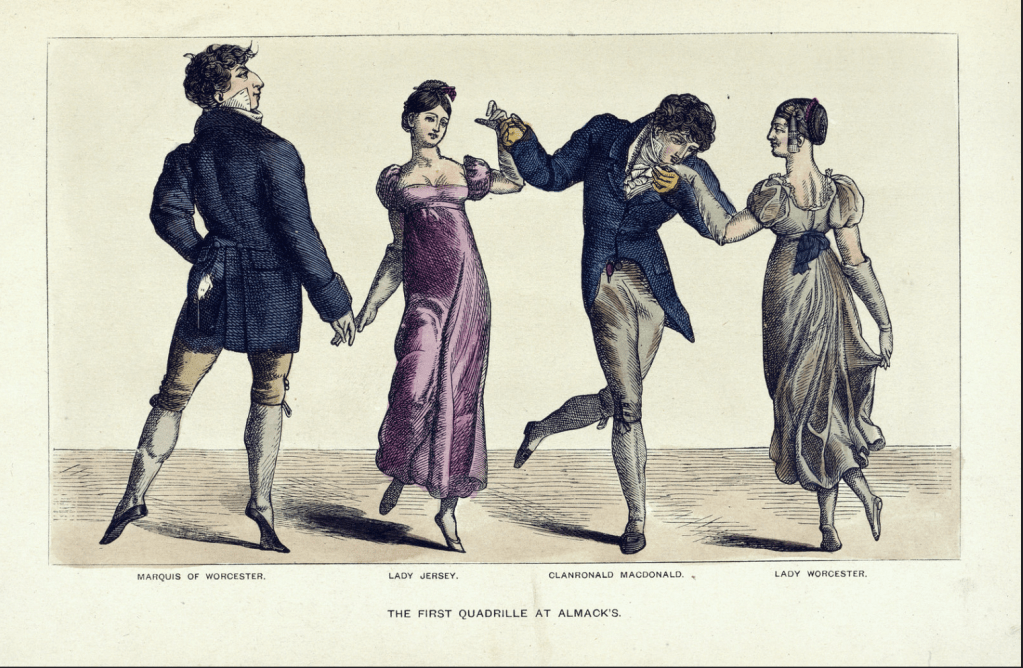

one thing (the TV series Mr. Loverman, the island of Antigua) led to another (William Clark’s Ten Views in the island of Antigua, The British Library’s Flickr page) and I’m looking at this great party from the Reminiscences of Captain Gronow, formerly of the Grenadier Guards and M.P. for Stafford, being Anecdotes of the Camp, the Court, and the Clubs, at the close of the last War with France, related by himself)

He was a remarkably handsome man, always faultlessly dressed, and was very popular in society. His portrait appeared in shop windows with those of Brummell, the Regent, Alvanley, Kangaroo Cook, and other worthies. With the exception of Captain Ross he was the best pistol shot of his day, and in early life took part in several duels. He married first, in 1825, an opera dancer, Antoinine, daughter of Monsieur Didier of Paris. By his second wife, Amelia Louisa Matilda Rouquet (a Breton aristocrat), whom he married in 1858, aged 63, he had four children. According to the Morning Post, he left his widow and infant children “wholly unprovided for” at his death, aged 70 in Paris on 22 November 1865.[1]

Lunch bums

Posted: January 7, 2026 Filed under: Hollywood Leave a comment

He skipped lunches since they interfered with his work and he felt they often made him tired. He was therefore dismissive of actors who ate lunch, believing that “lunch bums” had no energy for work in the afternoons.

Reading about the director Michael Curtiz, who directed 102 movies (does that include shorts?) in Hollywood, including Casablanca, and Elvis in King Creole.

During filming, Presley was always the first one on the set. When he was told what to do, regardless of how unusual or difficult, he said simply, “You’re the boss, Mr. Curtiz.”[86]