Restaurants and Railroads: Chili’s Triple Dip Boom

Posted: February 20, 2025 Filed under: America Since 1945, beverages, business, food 1 Comment

Once I’m cast off from show business perhaps I’ll start a newsletter called Restaurants and Railroads. This will analyze those two types of businesses, specifically publicly traded companies. Hedge funds as well as passionate hobbyists will subscribe. They’ll invite me to their conferences, to which I’ll travel in style, by rail when possible. I’ll sample the various restaurants as I go, Tijuana Flats for example, and Pizza Inn which I’ve never tried. In a world of niche media I wonder if I could make that work.

You might not think restaurants and railroads are a natural combination. Fred Harvey might disagree, but I’ll concede they’re very different businesses. The railroads have no new competition, no one is building a new railroad. Only a handful of companies control all the track. Two railroads serve the port of LA: one is BSNF, owned by Berkshire Hathaway, and one is Union Pacific. A duopoly.

The restaurants on the other hand are in frantic, constant competition. They must capture taste and vibe. Tastes change, vibes shift. Plus your customer could always just make a sandwich. How restaurants stay profitable? How do they maintain quality, especially at scale?

These two differing business categories are the two I’m excited to read about when I get an issue of ValueLine. Consumer Staples, Metals & Mining, etc, these lose our interest. But take a look at a personality like Kent Taylor’s or a real railroader like Hunter Harrison (or Casey Jones) and the mind comes to life, it’s hard to get bored.

In the publicly traded restaurant space, a big story this year has been Chili’s:

Chili’s may have just pulled off one of the greatest comebacks in restaurant history.

Same-store sales at the bar and grill chain surged more than 31% from October to December, marking its best quarter since the period just after COVID and accelerating a streak of double-digit same-store sales increases that began last April.

The growth once again was driven by a mix of social media buzz, value-based advertising and a renewed focus on restaurant operations and atmosphere that seemed to snowball as the year progressed.

Just to put this into context, these numbers are comparable to when Popeye’s went off with their spicy chicken sandwich. CEO Kevin Hochman points to TikTok:

About halfway through last year, its Triple Dipper appetizer platter, a staple on the chain’s menu for years, went viral on TikTok, where young customers showed off their “cheese pulls” with the Triple Dipper’s fried mozzarella sticks. …

“What’s happening is that young people are coming in after they’ve seen us on TikTok, and they’re like, ‘Wow, this experience is really good,’ and it becomes a part of the rotation,” Hochman told analysts during an earnings call Wednesday. “I think that’s why you’ve seen the longevity in the results and the acceleration, not just kind of a boom-splat that you typically would see without the operational investments that we’ve made in the business.”

Kevin Hochman seems like a brand guy: while at P&G he worked on Old Spice. $EAT stock has indeed thrived:

On an episode of A Deeper Dive, a quick service restaurant business podcast, the host and guest discussed Chili’s phenomenal success, and possible reasons for it. The fast food competitive price with the sit down experience came up, as did the mix and match. But in the end they agreed people just kinda like it.

It does seem like Chili’s is doing something right:

Coca-Cola

Posted: September 12, 2022 Filed under: beverages Leave a commentEven the Coca-Cola Company regards as out of the ordinary—though it is rather fond of the old girl—a wrinkled Indian woman in a remote Mexican province who told an inquiring explorer in 1954 that she had never heard of the United States but had heard of Coke. (There are fifty-one plants in Mexico that bottle it.) Two years after that, a Coca-Cola man pushed a hundred and fifty miles into the jungles outside Lima, Peru, in search of a really primitive Indian to whom, for publicity purposes, he could introduce Coca-Cola. Deep in the bush, he flushed a likely-looking woman, and, through an interpreter, explained his errand, whereupon the woman reached into a sack she was carrying, plucked forth a bottle of Coke, and offered him a swig.

There can be exceedingly few North Americans who are unacquainted with Coca-Cola, which a Swedish sociologist has said bears the same nourishing relationship to the body of Homo americanus that television does to his soul. One such ignoramus came to light ten years ago, when the Army quizzed six hundred and fifty recruits stationed at Fort Knox, Kentucky. Two hundred and twenty-nine of them had never heard of Louisville, twenty miles away; eighty-five had never been to the dentist; and twenty-one had never tasted cow’s milk. A single soldier had never drunk a Coke. All in all it was a set of findings far more encouraging to the Coca-Cola Company than to the Department of Defense.

In contrast to that innocent rookie, some of his fellow-citizens drink Coca-Cola at a staggering clip. “You can drink Coke every day all day long and you don’t get tired of it,” a member of the company’s indefatigable market-research staff has said. “Fifteen minutes after you’ve finished a Coke, you’re a new customer again, and that’s where we’ve got you.” One of the most faithful customers on record is an Alabama woman who on her ninety-seventh birthday attributed her durability to her habit of consuming a Coca-Cola at exactly ten o’clock every morning since the stuff first came on the market, in 1886. Possibly the outstanding Coke drinker of all time is a used-car salesman in Memphis who revealed in 1954, when he was sixty-five, that for fifty years he had been averaging twenty-five bottles daily, and that on some days he had hit fifty. He added, inevitably, that he had attended the funerals of half a dozen doctors who had called his pace killing.

from a 1959 New Yorker article, “The Universal Drink,” by E. J. Kahn Jr., bolds mine. (I was looking up every New Yorker article that mentions Memphis – not many!)

Recently scoured up a Reddit thread on the topic of how much cocaine you’d need to add to modern day Coca-Cola to recreate the original. The conclusion was you’d need to add tons, and it wouldn’t have much effect anyway: a modern caffeinated Coke gets you way more amped than the old coca version.

Dublin Dr. Pepper

Posted: January 25, 2022 Filed under: beverages, Texas Leave a commentThe town is the former home of the world’s oldest Dr Pepper bottling plant (see Dublin Dr Pepper). The plant was for many years the only U.S. source for Dr Pepper made with real cane sugar (from Texas-based Imperial Sugar), instead of less expensive high fructose corn syrup. Contractual requirements limited the plant’s distribution range to a 40-mile (64 km) radius of Dublin, an area encompassing Stephenville, Tolar, Comanche and Hico.

Was looking up some of the towns where various pro bull riding stars are from: Jesse Petri hails from Dublin, TX. My goodness I’d like to try that Dublin Dr. Pepper.

from the Dallas Morning News, March 31, 2017:

Ask for a Dr Pepper, and the response was routine and coy: “We don’t have a knock-off Dr Pepper, but you ought to try our Dublin Original. It’s really good, and I know you’ll love it.”

Kloster said it was a conscious marketing decision to offer customers who loved Dr Pepper a nostalgic product that looked and tasted similar. Even the bottle was packaged with stripes from a retro Dr Pepper color scheme and a “DDP” on the label.

“It got out of hand. We got out there and we pushed the envelope,” Kloster said. “The Dublin Original black cherry was pushing the envelope and was in violation of the agreement.”

boldface mine.

Dr. Pepper Snapple Group has since been consumed by Keurig Dr Pepper. I don’t expect any sense could be talked into the people who think shooting hot water through plastic is a good method of making coffee, but if I can find the time perhaps I’ll reach out to the JAB Group.

What if it turned out life expectancy in Stephenville, Tolar, Comanche and Hico had been 135 years + back in the sugar age?

Inside the La Croix wars: FIZZ vs Glaucus Research

Posted: September 30, 2016 Filed under: beverages, business, Uncategorized 2 Comments

We have the best correspondents here at Helytimes. Anonymous Soda Lover tips us off to the story of FIZZ vs Glaucus Research.

FIZZ is the stock ticker symbol of National Beverage Company, which makes La Croix, the popular sparkling water, Joe Mande enemy, and indispensable hydration agent at Hollywood writers’ rooms:

Myself, I prefer the Perrier slim can, because it is thin and tall like me:

Plus a smaller amount of fluid to become hot in your hand.

But one way or another: Hollywood and indeed America and the world is full of addicts and compulsives who have to consume something constantly. The beer-like but zero-cal zero sugar La Croix fills that hole. Thus, there is an endless market for La Croix.

And indeed, look at National Beverage’s stock price over the last two years:

I cut out what happened this week, when this news came out:

Shares of National Beverage plunged as much as 15 percent on Wednesday after Glaucus Research revealed a short position in the company.

The short selling firm valued the parent company of LaCroix sparkling water at $16.15 per share, more than 65 percent below the stock’s Tuesday closing price of $46.48.

Glaucus’ note alleges that National Beverage “manipulates its reported earnings” as its “reported financial performance is inexplicable.”

Later on Wednesday, National Beverage issued a statement calling the report “false and defamatory.” The stock recovered its losses and ended the day down 8 percent.

“We believe that this ‘report’ was intended to severely manipulate our stock price downward in support of short sellers, whose short position has dramatically increased over recent weeks,” the company said.

First of all, “Glaucus”? Their name comes from the glaucus. Not the ancient Greek sea god:

But the freakish pelagic gastropod, also known as the blue sea slug:

From Glaucus Research’s website:

Glaucus Research, based in Newport Beach, CA, has a rep for bringing the hammer down on fraudulent mid and small-cap Chinese companies. But this week, they dropped a report on FIZZ.

Glaucus alleges all manner of mischief by FIZZ CEO Nick Caporella. At Helytimes we really believe that the first step in evaluating a company is seeing a picture of the CEO. Unfortunately, we can’t find a confirmed pick of Mr. Caporella.

It appears that Nick Caporella personally owns 74% of FIZZ.

We do find this on FIZZ’s website:

Caporella’s letters have been weird before:

This non-English might make more sense when you remember FIZZ also makes Faygo, drink of choice of the Insane Clown Posse:

Now listen. It’s not often that we at Helytimes recommend reading a 56 page report on the finances of a company, but this one is worth a look. For example, have a look at Caporella’s letters to prospective National Beverage Co. buyer Asahi, in which he refers to himself as Nick-San.

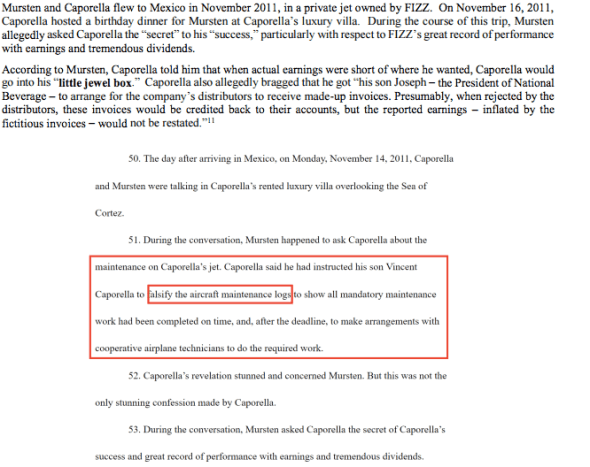

Or what about this business about his “little jewel box”?:

FIZZ has hit back hard. They counterattack at the website ReadTheTrueFacts.com.

Glaucus Research is straight-up about the fact that they are short La Croix and thus benefit if the stock goes way down. From Wiki’s page about the glaucus atlanticus:

The Glaucus atlanticus is able to swallow the venomous nematocysts from siphonophores such as the Portuguese man o’ war, and store them in the extremities of its finger-like cerata.Picking up the animal can result in a painful sting, with symptoms similar to those caused by the Portuguese man o’ war.

You can find the latest on FIZZ here. As of this writing, price is $43.32. Glaucus values it at $16.15.

We’ll be watching this battle with interest, with a refreshing Perrier slim can, made by good ol’ Nestlé, in our hand.