Husbands and wives

Posted: April 29, 2025 Filed under: family Leave a commentTwo illustrations from PD Eastman.

Can’t run baseball

Posted: April 21, 2025 Filed under: baseball Leave a comment

found in this book at a beach rental house.

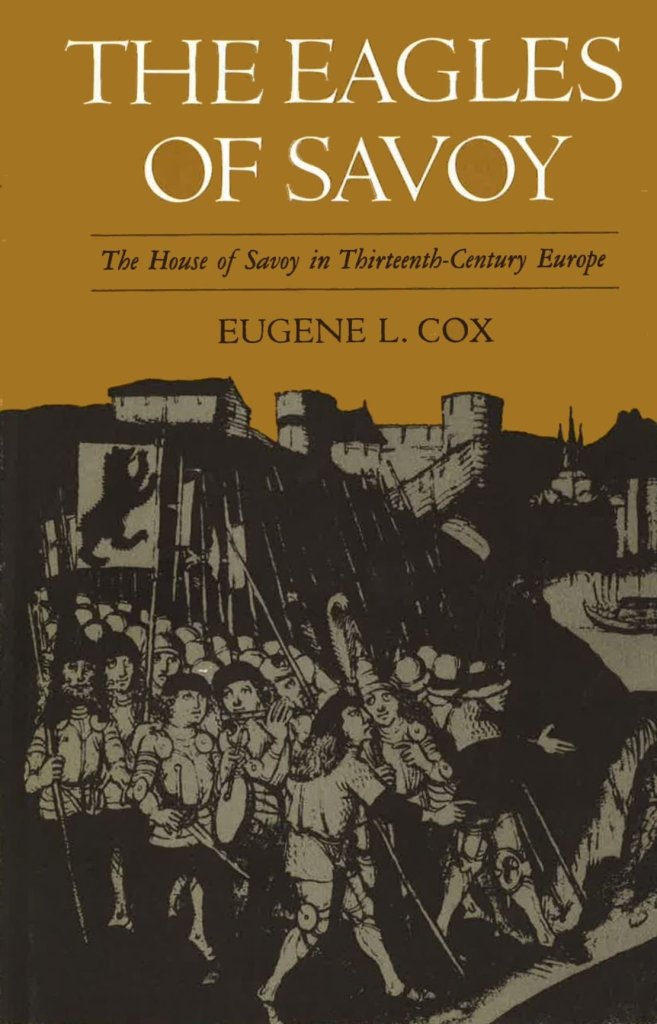

The House of Savoy

Posted: April 19, 2025 Filed under: France Leave a comment

I expect to be at the Annecy Animation Festival in Annecy, France this year, a great treat. If you’ll be there, hmu. As prep I’m reading about the history of that region, known as Savoy.

The land we call Savoie had a curious destiny: a land of empire in the Middle Ages, but divided from the outset between the call of the Rhône valley and that of the Po valley. Over the centuries, it was the cradle of a dynasty of French language and culture, but the fortunes of its history made it the mother of Italian unity, fighting at different times against the Dauphiné, against the Valais, against the Calvinist Geneva, against the Milan, and succeeding despite these incessant wars, It was for a long time a bone of contention between France and the Holy Roman Empire, then between France and Spain, and finally between France and Austria, and is now a link between the two friendly countries that occupy both sides of the Alps.

— André Chamson, Archives de l’ancien duché de Savoie (source.) From the same article:

Pre-Christian Alpine traditions date from this period (Austria, Switzerland, Savoy, Northern Italy, Slovenia), whose characters – Krampus, Berchta (Perchten), wild man – are part of an endangered, folklorized cultural heritage, on the verge of extinction due to the disappearance of traditional ways of life that have been preserved for longer in the Alps.

Bercha/Perchta

Humbert Whitehands was called that because his hands were as white as snow. Or because he was honest in his dealings, his hands were white. Or it’s a misunderstanding, it came from white walls, an easy confusion in sloppy Latin.

Charles Previté-Orton was a scholar of the early house of Savoy:

And he weighs in on what we can know from the years around 1000, and our sources:

He does seem to have put in the work. You can read his Early History of the House of Savoy online if you so choose.

It seems we can agree that Humbert I was granted the lands that became Savoy for his loyalty to Holy Roman Emperor Conrad II. There followed various Amadeuses and Humberts, until we get to Thomas, the Eagle of Savoy.

In 1195, Thomas ambushed the party of Count William I of Geneva, which was escorting the count’s daughter, Margaret of Geneva, to France for her intended wedding to King Philip II of France. Thomas carried off Margaret and married her himself.

So says Wikipedia. But Eugene L. Cox, who published a couple of books about the House of Savoy, isn’t so sure:

How much truth there is in this story we shall probably never know, except that Thomas did marry Guillaume’s daughter and in due course found himself faced with the very serious problem of providing suitably for his numerous offspring.

(Side note but if you’re at Wellesley College why not see if you can get the Eugene L. Cox Fellowship? $10,000 to go poke around some castles or something.)

Thomas’s children were married off and scattered into various religious and secular posts (the distinction not being very clear at the time) all over Europe. As a result, the family had wide influence. Cox:

the Savoyards did play a remarkable variety of roles on the international scene, sometimes as adventurers and sometimes as members of a kind of one-family “United Nations” working to assist in the pacification of international conflicts. Thanks partly to the labors of their father and, more literally, to the labors of their sister Béatrice, the countess of Provence whose four daughters all became European queens, the uncles from the Alps could by their presence alone convert a diplomatic conference into a family reunion, a fact which may have contributed to the settlement of some of the more emotional issues in which they were involved. As friends and ambassadors of kings and popes, as men with homes in many lands and connections that stretched from Scotland and Flanders to Sicily and Rome, the Savoyards furnish a very unusual illustration of medieval “universalism,” yet they were not men without a country. No matter how far afield their enterprises may have taken them, all of the eagles kept an eye on the Alpine homeland. Whenever they could, they contributed to the advancement of family interests in Savoy, and all but one returned to the Alps to end his days.

One of Thomas’s granddaughters, Eleanor of Provence, married the king of England. So many of her family came with her that an area of London became known as Savoy, thus the Savoy Hotel, which gave its name to a Harlem ballroom, and thus Stompin at the Savoy.

Eventually after Thomas there was the Green Count, Amadeus VI:

(source)

and then the Red Count, Amadeus VII, and then Amadeus VIII, the Peaceful, who was elevated to duke status.

He became a pope, or an anti-pope, depending on who you ask.

Léon Menabrea sums up the period with these words: “Little by little, the petty feudatories faded away; a star grew and blazed in the middle of the feudal firmament: the star of the House of Savoy“.

(source)

At this time the Annecy region was not part of Savoy, it was run by the Counts of Geneva. Robert of Geneva, one of the last counts, was elected the first of the French antipopes at Avignon. When he died, sonless, the title Count of Geneva went to Humbert VII, who then died, and the title went to Odo, who sold the region to Amadeus VIII for 45,000 gold florins. Why did Odo need florins so bad? I don’t know. French Wikipedia doesn’t elaborate. Odo wasn’t really expecting to become count of Geneva. How much was 45,000 gold florins? Let’s ask Perplexity AI:

The Florentine gold florin in the late 14th and early 15th centuries was a high-value coin used mainly for large transactions, not everyday purchases. Its value in modern terms is hard to pin down exactly, but estimates based on gold content, purchasing power, and historical wages offer some perspective:

- The gold content (about 3.5 grams) would be worth roughly $187 USD today based on current gold prices

- In terms of purchasing power, a florin could buy about 1/12 of a metric ton of wheat in the 1330s, which would equate to about $28–$30 USD in modern wheat prices1.

- In the 15th century, annual salaries for skilled professionals in Florence ranged from 14 to 100 florins, and a city residence might cost 200 florins, with elite palaces valued at 3,500 florins.

- The florin was worth between 65 and 140 soldi (a silver coin) during this period, and was used for major transactions, dowries, and international trade rather than daily expenses

In summary, a single gold florin represented a significant sum—roughly equivalent to several hundred modern US dollars, or more, depending on the comparison method

Not a bad deal. Call it 45 million dollars, and you get a bustling town with canals and a flowing river and big lake and a lot of nice land.

The trade didn’t include the city of Geneva, which was ruled by the bishops of Geneva.

In Peter Wilson’s history of the Holy Roman Empire, of which Savoy was a part, he mentions the following:

The rapid development of cartography from the fifteenth century made a profound impact by providing a ready image of territorially defined political power. Maps now showed political boundaries as well as natural features and towns. The members of the House of Savoy celebrated its elevation to ducal rank in 1416 with a huge cake in the shape of their territory.

Would’ve loved to have a slice of that.

Eventually, during the French Revolution, revolutionary troops took Annecy back, but the House of Savoy was going strong. You can follow the line of the House through battles, marriages, regents, half-brothers, etc to Victor Amadeus II, who, as a result of some complicated negotiations after the War of the Spanish Succession, ended up as King of Sicily. From this lofty job he was demoted to King of Sardinia.

In a set of trades and turnarounds, the actual land of Savoy ended up officially as part of France, while the House of Savoy, led by Victor Emmanuel II, became the royal family of the newly united Italy.

The story of what happened thereafter is entertainingly told in Robert Katz’s book The Fall of the House of Savoy, which is full of mistresses and cunning ministers and morganatic marriages.

One of these books where even the footnotes are good:

From this turbulence the House of Savoy ended up on top, and they survived World War One, but it was not to last.

Victor Emanuel III messed it up:

He remained silent on the domestic political abuses of Fascist Italy

sadly relevant to our time. Mussolini took over, and we all know how that ended. VEIII ended up in exile in Egypt. Umberto II, his son, spent years in exile in Portugal. He died in Geneva.

Umberto’s son Vittorio Emanuel led a seedy life, including shooting a 19 year old kid in a strange yacht incident, and going to jail on charges of organizing prostitutes for casino patrons. Here he is in happier times, watching the launch of Apollo 11:

source. His son was on Italian Dancing With the Stars, and granddaughter, Vittoria, is of course an influencer.

Thus, the house of Savoy.

I look forward to returning to this lovely part of the world!

You can beat a race, but you can’t beat the races

Posted: April 18, 2025 Filed under: business Leave a comment

Alex Morris has published a compilation of Buffett and Munger remarks at annual meetings. This allowed me to add to my file of times the two have talked about horse race betting and the lessons to be learned there.

Munger’s quote, in his Worldly Wisdom speech, is the bluntest of all:

How do you get to be one of those who is a winner—in a relative sense—instead of a loser? Here again, look at the pari-mutuel system. I had dinner last night by absolute accident with the president of Santa Anita. He says that there are two or three betters who have a credit arrangement with them, now that they have off-track betting, who are actually beating the house. They’re sending money out net after the full handle—a lot of it to Las Vegas, by the way—to people who are actually winning slightly, net, after paying the full handle. They’re that shrewd about something with as much unpredictability as horse racing. And the one thing that all those winning betters in the whole history of people who’ve beaten the pari-mutuel system have is quite simple. They bet very seldom. It’s not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it—who look and sift the world for a mispriced bet—that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple. That is a very simple concept. And to me it’s obviously right—based on experience not only from the pari-mutuel system, but everywhere else.”

I noted professional horseplayer Inside The Pylons saying something related on his Bet With The Best podcast appearance:

Like you have no chance doing stuff like that long term. So you only bet the races where you think are good betting races.

But when you look at nine to nine or 10 races, Santa Anita, I mean, jeez, even if you’re sharp, I mean, if you bet more than three races a day, you’re a sicko I mean, there’s just so many bad races.

This theme recurs in the Morris compilation:

2003 MEETING (02:36:36) *

WB: “The beauty of the investment game, what really makes it great, is that you don’t have to be right on everything. You don’t have to be right on 20%, 10%, or even 5% of the companies in the world. You only have to get one good idea every year or two. I used to be very interested in horse handicapping, and the old story was you could beat a race but you can’t beat the races … If somebody gave me all five hundred stocks in the S&P and I had to make some prediction about how they would behave relative to the market over the next couple years, I don’t know how I would do. But maybe I could find one where I’m 90% sure I’m right. It’s an enormous advantage in stocks: You only have to be right on a very, very few things as long as you never make big mistakes.”

ACTIVE MANAGEMENT AND PROFESSIONAL INVESTORS

1997 MEETING (01:21:40)

WB: “Money managers, in aggregate, have underperformed index funds. It’s the nature of the game. They simply cannot overperform, in aggregate. There are too many of them managing too big a portion of the pool. It’s for the same reason that the crowd could not come out here to Ak-Sar-Ben [racetrack] and make money, in aggregate, because there’s a bite taken out of every dollar that was invested in the pari-mutuel machines. People who invest their dollars elsewhere through money managers in aggregate cannot do as well as they could do by themselves in an index fund. They say you can’t get something for nothing. But the truth is money managers, in aggregate, have gotten something for nothing; they’ve gotten a lot for nothing. And the corollary is investors have paid something for nothing. That doesn’t mean people are evil.

FROM POOR INVESTMENTS

1995 MEETING (01:01:17)

WB: “A very important principle in investing is that you don’t have to make it back the way you lost it. In fact, it’s usually a mistake to try and make it back the way that you lost it.”

CM: “That’s the reason so many people are ruined by gambling; they get behind and then they feel they have to get it back the way they lost it. It’s a deep part of human nature. It’s very smart just to lick it by will; little phrases like that are very useful.”

WB: “One of the important things in stocks is that the stock does not know you own it. You have all these feelings about it; you remember what you paid and you remember who told you about it, all these little things. And it doesn’t give a damn, it just sits there. If a stock is at $50 when somebody’s paid $100, they feel terrible. Meanwhile, somebody else who paid $10 feels wonderful. It has no impact whatsoever. As Charlie says, gambling is the classic example. Someone goes out and gets into a mathematically disadvantageous game. They start losing it, and they think they’ve got to make it back, not only the way they lost it, but that night. It’s a great mistake.”

Some other words of interest: On ValueLine:

PATIENCE (WATCHING FOR HISTORIC FINANCIAL DATA)

1995 MEETING (03:54:41)

CM: “I think the one set of numbers that are the best quick guide to measuring one business against another are the Value Line numbers. That stuff on the log scale paper going back fifteen years, that is the best one-shot description of a lot of big businesses that exists. I can’t imagine anybody being in the investment business involving common stocks without that on their shelf.”

WB: “And, if you have in your head how all of that looks in different businesses and industries, then you’ve got a backdrop against which to measure. If you’d never watched a baseball game and never seen a statistic on it, you wouldn’t know whether a .3o0 hitter was a good hitter or not. You have to have some kind of a mosaic there that you’re thinking is implanted against, in effect. And the Value Line figures, if you ripple through that, you’ll have a pretty good idea of what’s happened over time in American business.”

CM: “I would like to have that material going all the way back; they cut it off at fifteen years back. I wish I had that in the office, but I don’t.”

WB: “I saved the old ones. We tend to go back. If I’m buying Coca-Cola, I’ll go back and read the Fortune articles from the 193os on it. I like a lot of historical background on things, just to get it in my head how the business has evolved over time, and what’s been permanent and what hasn’t been permanent, and all of that. I probably do that more for fun than for actual decision-making. We’re trying to buy businesses we want to own forever, and if you’re thinking that way you might as well look back a way and see what it’s been like to own them forever.”

The way you learn about businesses is by absorbing information about them, thinking, deciding what counts and what doesn’t count, relating one thing to another. That’s the job. And you can’t get that by looking at a bunch of little numbers on a chart bobbing up and down or reading market commentary and periodicals or anything of the sort. That just won’t do it. You’ve got to understand the businesses. That’s where it begins and ends.”

SCUTTLEBUTT (ON-THE-GROUND RESEARCH)

1998 MEETING (04:27:09)

WB: “One advantage of allocating capital is that an awful lot of what you do is cumulative in nature, so you get continuing benefits out of things you’ve done earlier. By now, I’m fairly familiar with most of the businesses that might qualify for investment at Berkshire. But when I started out, and for a long time, I used to do a lot of what Phil Fisher described, the scuttlebutt method …

“The general premise of why you’re interested in something should be 80% of it.

You don’t want to be chasing down every idea that way; you should have a strong presumption. You should be like a basketball coach who runs into a seven-footer on the street. You’re interested to start with; now you have to find out if you can keep him in school, if he’s coordinated, and all that sort of thing. That’s the scuttlebutt aspect of it. But as you’re acquiring knowledge about industries in general, and companies specifically, there really isn’t anything like first doing some reading about them, and then getting out and talking to competitors, customers, suppliers, ex-employees, current employees, whatever it may be. You will learn a lot. But it should be the last 10% or 20%. You don’t want to get too impressed by that, because you really want to start with a business where you think the economics are good, where they look like seven-footers, and then you want to go out with a scuttlebutt approach to possibly reject your original hypothesis. Or maybe, if you confirm it, do it even more strongly.

“I did that with American Express back in the 1g6os; essentially the scuttlebutt approach so reinforced my feeling about it that I kept buying more and more as I went along. If you talk to a bunch of people in an industry and you ask them

STOCK SELECTION

1998 MEETING (03:02:34)

WB: “The criteria for selecting a stock is really the criteria for looking at a business. We are looking for a business we can understand. They sell a product that we think we understand, or we understand the nature of the competition and what could go wrong with it over time. And then we try to figure out whether the economics, the earnings power, over the next five, ten, or fifteen years is likely to be good and getting better, or poor and getting worse. Then we try to decide whether we’re getting in with people that we feel comfortable being in with. And then we try to decide what’s an appropriate price for what we’ve seen up to that point in the business.

“What we do is simple, but it is not necessarily easy. The checklist that we go through in our minds is not very complicated. Knowing what you don’t know is important; knowing the future is impossible in many cases, and difficult in others. We’re looking for the ones that are relatively easy. Then you have to find it at a price that’s interesting to you, and that’s very difficult for us now (although there have been periods in the past where it’s been a total cinch).

“That’s what goes through our mind. If you were thinking of buying a gas station, dry cleaner, or convenience store to invest your life savings in and to run as a business, you’d think about the competitive position and what it would look like five to ten years from now, and how you were going to run it, or who was going

Cape Grim Air Archive

Posted: April 11, 2025 Filed under: Australia Leave a comment

Here is Cape Grim, on the northwestern coast of Tasmania, where they collect and test the Earth’s air:

The Cape Grim Baseline Atmospheric Pollution Station (CGBAPS) commenced operation in early 1976, fulfilling an Australian government commitment to participate in the WMO (World Meteorological Organization) recommended network of global background atmospheric stations, focussed on observing the long-term drivers of climate change and ozone depletion, in particular carbon dioxide (CO2), chlorofluorocarbons (CFCs), surface ozone (O3) and aerosols. Cape Grim was chosen as a site representative of the mid-latitudes of the Southern Hemisphere and complimented NOAA’s Southern Hemisphere sites at Cape Matatula, American Samoa (tropical Pacific) and at the South Pole.

(source). They also maintain an archive of Earth air, going back to 1976:

More info here. Maybe for my birthday they’d let me breathe 1979 air. ht to Professor McHugh who’s always sending us wonders.

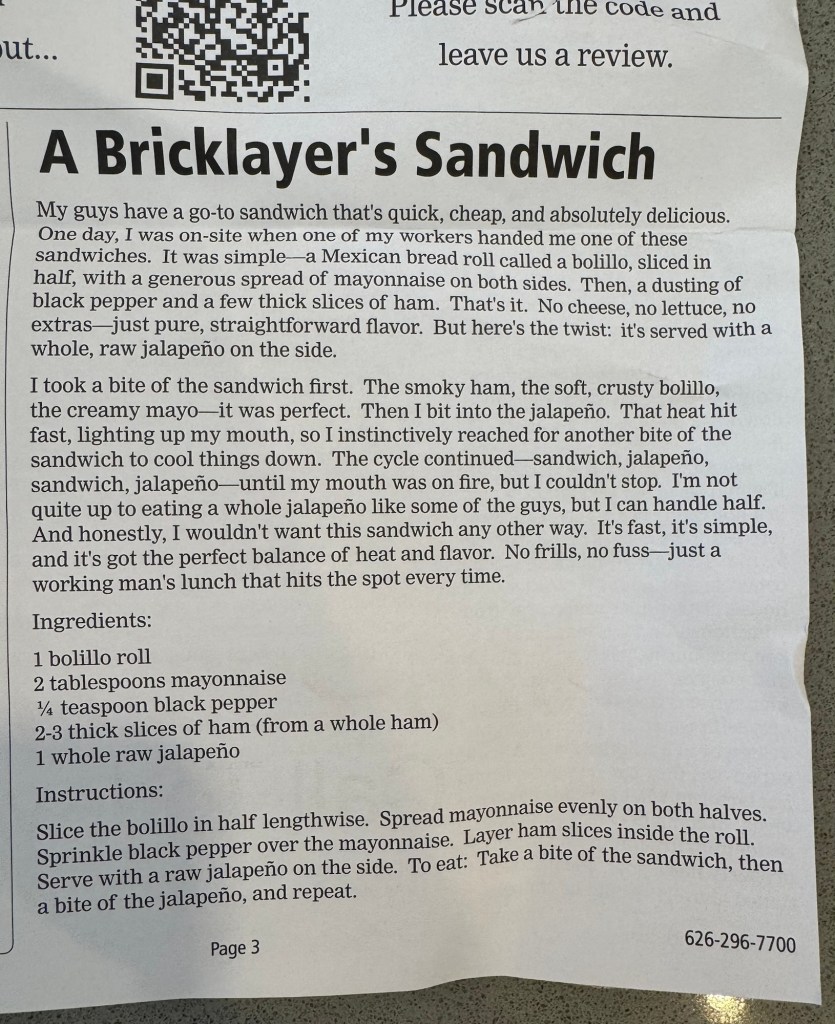

Helytimes Prize for Sandwich Journalism

Posted: April 9, 2025 Filed under: food Leave a comment

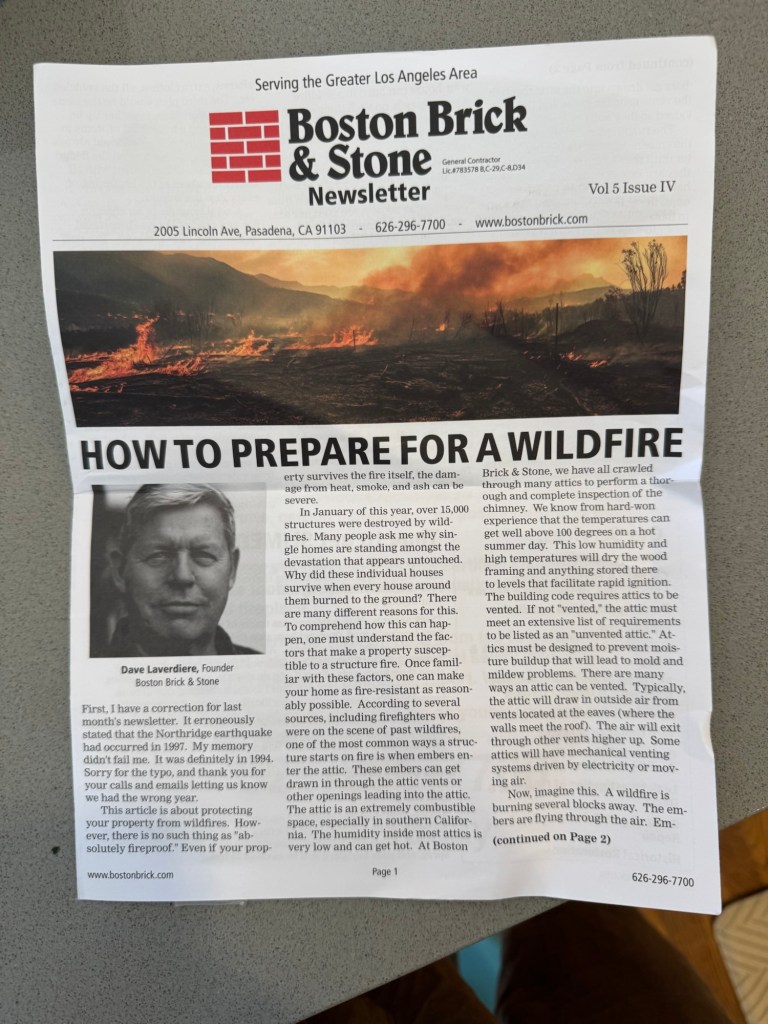

The Boston Brick & Stone newsletter is interesting marketing, and honestly one of my favorite periodicals. I’m awarding it a Helytimes Prize for Sandwich Journalism for this feature, “A Bricklayer’s Sandwich.”

“Buy when there’s blood in the streets”

Posted: April 6, 2025 Filed under: advice, business 3 Comments

On the famous quote sometimes attributed to Nathan Rothschild

His four brothers helped co-ordinate activities across the continent, and the family developed a network of agents, shippers and couriers to transport gold—and information—across Europe. This private intelligence service enabled Nathan to receive in London the news of Wellington’s victory at the Battle of Waterloo a full day ahead of the government’s official messengers.[2] He is famously quoted as saying “Buy when there’s blood in the streets”, though the original quote is believed to have appended “even if the blood is your own”. The quote refers to his contrarian investing strategy that he is well known for adhering to as to buy assets when the financial markets are crashing and panicking investors are selling. The quote has a tremendous impact today on value investing and modern businesspeople and investors alike when buying assets in down markets when investment opportunities arise.[3][4][5]

The first part of this concerning the Battle of Waterloo has already been adequately dealt with. The second part of this seems equally dubious, and I can’t find a good source for it. You can find this “buy when there is blood in the streets” quote in many modern business books, but they hardly count as a reliable source for a biography of Nathan Rothschild. The earliest sources I’ve found so far date from 1907/8 – for example Thomas Gibson’s Market Letters for 1907 contains the following supposed conversation:

“Buy Rentes,” advised Rothschild.

“But the streets of Paris are running with blood.”

“That is why you can buy Rentes so cheap.”

Grateful to Wikipedia editor Franz for getting to the bottom of that quote.

The first time I heard Cass McCombs was in a car in Queensland, Australia. The aux cord wasn’t working properly, so the vocals weren’t coming through, just the instrumentals. For awhile I was like “who is this genius that just plays rhythmic patterns?!” It was cool either way!

People drop this quote every time there’s a stock market downturn. But it sounds like Rothschild was speaking of a time when blood was literally running in the streets.

Based

Posted: April 3, 2025 Filed under: America Since 1945 Leave a comment

from THR’s White Lotus oral history.

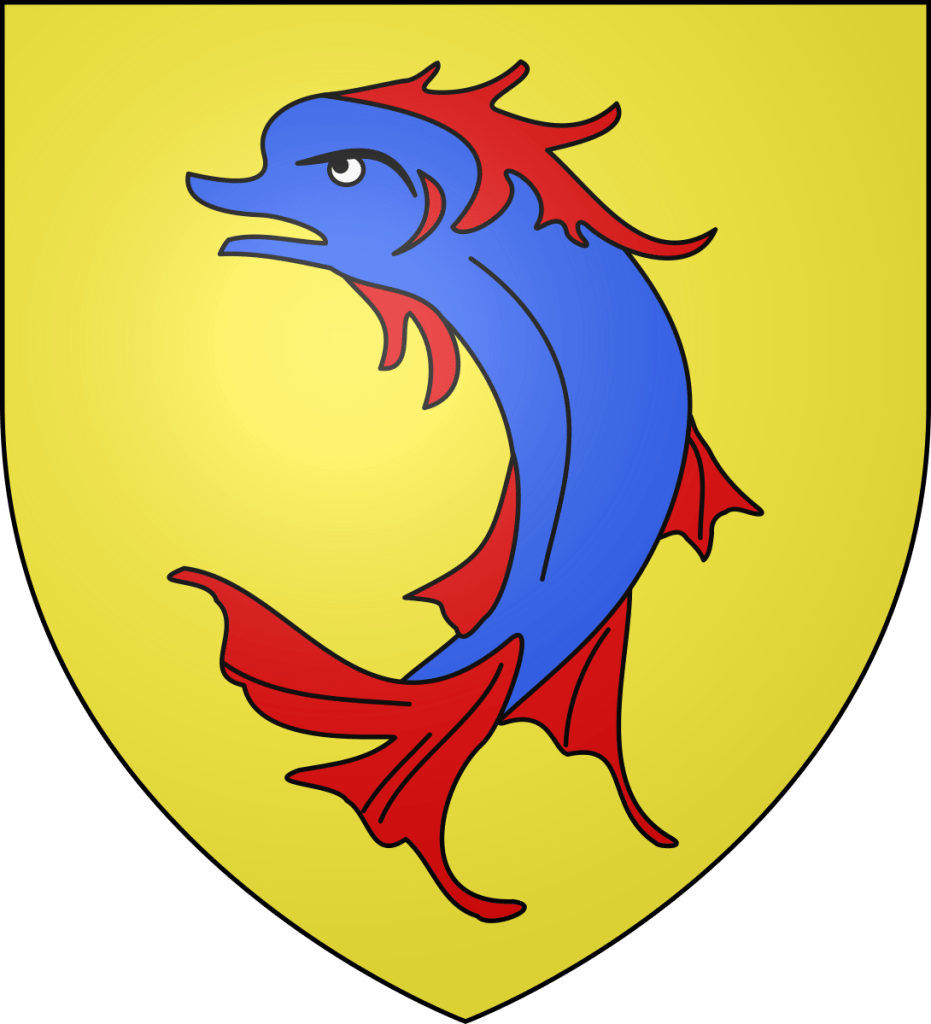

Great coat of arms

Posted: April 3, 2025 Filed under: France Leave a comment

reading about Dauphiné, was wondering why this region of France was called that, and of course it’s because Guigues IV had a dolphin on his coat of arms.

Glimpses of Abraham Lincoln: awaiting election results with Charles Dana

Posted: April 3, 2025 Filed under: presidents, WOR Leave a comment

Charles Dana, former journalist and assistant secretary of war was with Abraham Lincoln as he awaited results of the election of 1864:

All the power and influence of the War Department, then something enormous from the vast expenditure and extensive relations of the war, was employed to secure the re-election of Mr. Lincoln. The political struggle was most intense, and the interest taken in it, both in the White House and in the War Department, was almost painful. After the arduous toil of the canvass, there was naturally a great suspense of feeling until the result of the voting should be ascertained. On November 8th, election day, I went over to the War Department about half past eight o’clock in the evening, and found the President and Mr. Stanton together in the Secretary’s office. General Eckert, who then had charge of the telegraph department of the War Office, was coming in constantly with telegrams containing election returns. Mr. Stanton would read them, and the President would look at them and comment upon them. Presently there came a lull in the returns, and Mr. Lincoln called me to a place by his side.

“Dana,” said he, “have you ever read any of the writings of Petroleum V. Nasby?”

“No, sir,” I said; “I have only looked at some of them, and they seemed to be quite funny.”

“Well,” said he, “let me read you a specimen”;

“let me read you a specimen”;

and, pulling out a thin yellow-covered pamphlet from his breast pocket, he began to read aloud. Mr. Stanton viewed these proceedings with great impatience, as I could see, but Mr. Lincoln paid no attention to that.

He would read a page or a story, pause to consider new election telegram, and then open the book again and go ahead with a new passage. Finally, Mr. Chase came in, and presently somebody else, and then the reading was interrupted.

Mr. Stanton went to the door and beckoned me into the next room. I shall never forget the fire of his indignation at what seemed to him to be mere nonsense.

The idea that when the safety of the republic was thus at issue, when the control of an empire was to be determined by a few figures brought in by the telegraph, the leader, the man most deeply concerned, not merely for himself but for his country, could turn aside to read such balderdash and to laugh at such frivolous jests was, to his mind, repugnant, even damnable. He could not understand, apparently, that it was by the relief which these jests afforded to the strain of mind under which Lincoln had so long been living, and to the natural gloom of a melancholy and desponding temperament-this was Mr. Lincoln’s prevailing characteristic-that the safety and sanity of his intelligence were maintained and preserved.

Petroleum Naseby was a character, a cowardly Copperhead who supported the Confederacy but didn’t want to do anything about it, invented by David Ross Locke.

In his day Locke was up there with Josh Billings and Mark Twain.

Val Kilmer

Posted: April 2, 2025 Filed under: actors 1 CommentCan’t forget him doing his one man show as Mark Twain at the Hollywood Cemetery. Afterwards he stayed on stage while he was taking his elaborate makeup off and asked the audience if they uncomfortable with him saying the n word so much.

The Doors, Tombstone, Heat, Spartan… he wasn’t just pretending, he was in it.

Kilmer briefly considered running for Governor of New Mexico in 2010, but decided against it.

What if?