S

Posted: March 11, 2024 Filed under: business Leave a commentIn the book’s preface, Smil writes that most growth processes—“of organisms, artifacts, or complex systems”—can be plotted on a so-called S-shaped, or sigmoid, growth curve, meaning that the rate of change increases slowly at first, then increases rapidly, then levels off. An error that humans make with similarly predictable regularity is to assume that the nearly vertical middle segment of an S-shaped curve can continue at that angle indefinitely (the price of Dutch tulips in the seventeenth century, the price of bitcoin in the twenty-first). One of his conclusions is that the steady, unceasing economic expansion that economists and politicians dream of is not sustainable, and that the relentless pursuit of growth is environmentally disastrous. Smil has often said that he doesn’t make forecasts—“a pathetically and inexorably ever-failing endeavor on any level,” he told me—but predictions of a kind are implicit in much of his work. In “Growth” ’s coda, he writes, “Continuous material growth, based on ever greater extraction of the Earth’s inorganic and organic resources and on increased degradation of the biosphere’s finite stocks and services, is impossible”—a principle that, in various forms, animates almost all his work, beginning with his undergraduate thesis.

from The New Yorker’s profile of Vaclav Smil. I got much value from his book on natural gas, still working on How The World Really Works.

Slow lanes

Posted: January 30, 2024 Filed under: business Leave a commentEd Catmull, when president of Pixar, the animation studio, built good friction into the process of developing films such as Toy Story. “The goal isn’t efficiency, it is to make something good, or even great,” he explained to Sutton and Rao about the way his team worked through multiple versions of the original idea, improving it as the movie developed. Colette Cloosterman-van Eerd of Jumbo, a Dutch grocery store chain, saw the need to offset the drive for more efficiency with good friction. She instituted “slow lanes” that would allow checkout staff to chat to shoppers, particularly senior citizens who valued social interaction more than speed.

from a piece on Stanford BS professors Huggy Rao and Bob Sutton in Financial Times.

I also loved this idea for a column:

goddamn lunatic

Posted: December 2, 2023 Filed under: America Since 1945, business 2 CommentsOne last bit of Mungeriana, from the CNBC final interview:

BECKY QUICK: What kind of things would you recognize that they– that they were doing wrong?

CHARLIE MUNGER: Oh. They had some crazy idea. For instance, my Latin teacher was maladjusted, but one who was a devoted follower of Sigmund Freud. And I recognized that Sigmund Freud was –when I first read him when I was in high school. And, of course, it was an odd little boy whose Latin teacher is teaching him Freud. But that was – she was peculiar and so was I. And, of course, when I read – I bought the complete writings of Sigmund Freud from the area library. It was one big book. And I went through it very laboriously. And I realized he was a goddamn lunatic. And so I decided I wasn’t gonna learn that from my Latin teacher. I had some very unusual teachers. The best teacher I had in my life was Lon Fuller. Well, he was the best contracts teacher in any law school. And contracts is the best subject in every law school, at least I think it is. Because it integrates so beautifully with the new doctrine of an economics that came along with Adam Smith and all those people.

I had Dall-E generate some images of boy Charlie Munger reading the complete works of Sigmund Freud:

Horrifying.

Charlie Munger, weatherman.

Posted: November 28, 2023 Filed under: America Since 1945, business, California Leave a comment

“Like Warren, I had a considerable passion to get rich,” Munger told Roger Lowenstein for Buffett: The Making of an American Capitalist, published in 1995. “Not because I wanted Ferraris — I wanted independence. I desperately wanted it. I thought it was undignified to have to send invoices to other people.”

from Bloomberg.

Munger never stopped preaching old-fashioned virtues. Two of his favorite words were assiduity and equanimity.

He liked the first, he said in a speech in 2007, because “it means sit down on your ass until you do it.” He often said that the key to investing success was doing nothing for years, even decades, waiting to buy with “aggression” when bargains finally materialized.

He liked the second because it reflected his philosophy of investing and of life. Every investor, Munger said frequently, should be able to react with equanimity to a 50% loss in the stock market every few decades.

The Financial Times has the best obituary, noting stuff others miss like Munger’s role in funding abortion rights, here’s a link that will work for the first three lucky readers.

Munger on horse race betting, from his most famous (or second most famous?) speech:

How do you get to be one of those who is a winner—in a relative sense—instead of a loser? Here again, look at the pari-mutuel system. I had dinner last night by absolute accident with the president of Santa Anita. He says that there are two or three betters who have a credit arrangement with them, now that they have off-track betting, who are actually beating the house. They’re sending money out net after the full handle—a lot of it to Las Vegas, by the way—to people who are actually winning slightly, net, after paying the full handle. They’re that shrewd about something with as much unpredictability as horse racing. And the one thing that all those winning betters in the whole history of people who’ve beaten the pari-mutuel system have is quite simple. They bet very seldom. It’s not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it—who look and sift the world for a mispriced bet—that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple. That is a very simple concept. And to me it’s obviously right—based on experience not only from the pari-mutuel system, but everywhere else.”

One day Warren Buffett and Charlie Munger visited the set of The Office to film a comedy video for the Berkshire Hathaway annual meeting. Everyone swarmed around Buffett but nobody really knew Munger. When the lunch break came I had the opportunity to take my plate and sit right down across from him.

From reading his Wikipedia page that morning I’d learned that Charlie Munger had been a weatherman during World War II, so I asked him about that. “It was kind of a humdrum job,” he said, modest. “A lot of people had humdrum jobs in the war.” His job was hand-drawing weather maps to predict the best times to fly planes across the Bering Strait to our Soviet allies in such a way that the engines wouldn’t ice up and kill the pilots. It seems like that might teach you something about probability and decision-making under uncertainty.

We talked about Clifton’s Cafeteria in downtown LA. He expressed admiration for that institution.

In 1931, Clinton leased a “distressed” cafeteria location at 618 South Olive Street in Los Angeles and founded what his customers referred to as “The Cafeteria of the Golden Rule”. Patrons were obliged to pay only what they felt was fair, according to a neon sign that flashed “PAY WHAT YOU WISH.” The cafeteria, at the western terminus of U.S. Route 66, was notable for serving people of all races, and was included in The Negro Motorist Green Book.

The conversation itself wasn’t that profound, but it launched me on a project of learning about more about Munger and his thinking that’s really changed my life.

“You don’t have a lot of envy.

You don’t have a lot of resentment.

You don’t overspend your income.

You stay cheerful in spite of your troubles.

(this from a guy whose first child died of leukemia).

You deal with reliable people.

And you do what you’re supposed to do.

And all these simple rules work so well to make your life better. And they’re so trite.”

His prescription is logical, he says.

“Staying cheerful” is “a wise thing to do,” Munger told Quick, adding that in order to do so, you have to let go of negative feelings.

“And can you be cheerful when you’re absolutely mired in deep hatred and resentment? Of course you can’t. So why would you take it on?” Munger said.

from 2019. (Struck by a resemblance to the mantra Liam Clancy gave Bob Dylan: “no fear, no meanness, no envy.”) He was committed to being rational, and he was witty, he expressed a lot of wisdom in a fast and punchy way. You could listen to him talk for a long time and not get bored. (And he could talk for a long time too.)

On getting the first $100,000, the hard part:

Munger holding forth in February, 2022 with a rare stock pick:

But I would argue that if I was investing money for some sovereign wealth fund or some pension fund with a 30,40, 50-year time horizon I buy Costco at the current price.

Here’s Costco vs. S&P 500 over that timeline:

(although my guy was talking 30-50 years.)

Posting about Munger has led to some interesting real life connections. The Mungerheads search out every scrap on the man. They’re interesting people to talk to, and you usually learn something

pic from the Daily Journal Co. website.

In appreciation of Munger’s life and wisdom, here are references to the man over the years at Helytimes:

Munger Speaks, 2019. On stagnation, and some life advice.

Munger and Lee Kuan Yew. There was a Confucian streak in Munger, maybe a little anti-democratic.

Buffett Bits, and Munger, from the 2020 annual meeting.

Munger and Buffett highlights from the 2021 annual meeting.

Charlie Munger Deep Cuts, my most thorough look at the guy and his wisdom (some funny ones, too, see what he says about Al Gore.

Ominous Remark from Charlie Munger, 2018.

“I’ve mellowed because I consider it counterproductive to hate as much as both parties now hate, and I have disciplined myself,” Munger said. “I now regard all politicians higher than I used to. I did that as a matter of self-preservation.” He said that he had re-read “The Decline and Fall of the Roman Empire,” and it made him “feel a lot better about the current political scene. We’re way ahead of the Romans at the end.”

That’s a pretty low bar, I pointed out.

“It’s very helpful — I suggest you try it,” Munger replied. “Politicians are never so bad that you don’t live to want them back. There will come a time when the people who hate Trump will wish that he was back

Free Samples, from 2023, a look at a commonality in Buffett-Munger businesses.

I’m All Right on That One, a few quotes from the bros of Omaha, 2023:

CHARLIE MUNGER: I used to come to the Berkshire annual meetings on coach from Los Angeles. And it was full of rich stockholders. And they would clap when I came into the coach section. I really liked that. (LAUGHTER) (APPLAUSE)

How the Chevalier de Méré met Blaise Pascal, a look at the origins of probability theory.

Obviously, you’ve got to be able to handle numbers and quantities—basic arithmetic. And the great useful model, after compound interest, is the elementary math of permutations and combinations. And that was taught in my day in the sophomore year in high school. I suppose by now in great private schools, it’s probably down to the eighth grade or so.

It’s very simple algebra. It was all worked out in the course of about one year between Pascal and Fermat. They worked it out casually in a series of letters.

More.

You know what? I wish they’d build the giant near-windowless dorm he proposed for UC Santa Barbara.

the purpose of the beehive

Posted: June 10, 2023 Filed under: business Leave a commentCOWEN: What do you think is the central insight you have about how to build that, that is otherwise under-emphasized?

GODIN: I think that Frederick Taylor’s demise is long overdue, that the purpose of a beehive is not to maximize the amount of honey we produce. The honey is a by-product of a successful beehive. That what we have is the chance to get what we want by connecting with people who have a choice about where they work, who choose to enroll with us, to avoid the false proxies of “You look like me” or “You sound like me” or “I want to have lunch with you” when we hire people, and instead dance with the people from whatever background that are going to make our project better.

When you lay it out that simply, people go, “Well, of course.” Then they go back to work in some place that demeans them and undermines them and asks them to phone it in. It just breaks my heart to see that gap.

Seth Godin talking to Tyler Cowen.

50 Cent on water

Posted: June 9, 2023 Filed under: business, water Leave a commentJust looking at things and not understanding why they’re the way they are sparked interest and ideas. I may walk down the grocery aisle, see a gallon of spring water for $2.69, and then I walk farther down, and there’s a gallon of spring water for 59 cents. And I’m like, So I wouldn’t know whether that was Poland Spring if it was in two different glasses. Yo. I want to sell water. This was before I knew Vitamin Water existed. But I knew I could charge $1.50 extra per piece and it wouldn’t even matter. I could get in the middle of that, come in at a dollar and change, and see what happens.

from this Vulture interview.

Free samples

Posted: May 22, 2023 Filed under: America Since 1945, business 1 CommentI was in See’s Candy the other day, as I am on many a weekend, and it dawned on me that two of the classic Buffett/Munger businesses, Costco and See’s Candy, are places that offer delicious free samples.

Go to a Costco and you’ll likely get a tasty snack or two, go to See’s and you’ll get whatever the day’s sample is (yesterday it was salted dark chocolate caramel).

Buffett and Munger are all about urging people to be rational, and managing their own emotions (“I can’t recall any time in the history of Berkshire that we made an emotional decision”) but a huge part of their success and what makes them interesting is their awareness that some businesses are sort of magical. They’ve got a grip on customers that’s beyond rational, that exists in the worlds of love and nostalgia and strong emotion. Buffett raving about the iphone, for instance:

If you’re an Apple user and somebody offers you $10,000, with the the only proviso [that] they’ll take away your iPhone and you’ll never be able to buy another, you’re not going to take it

If they tell you [that] if you buy another Ford motor car, they’ll give you $10,000 not to do that, [you’ll] take the $10,000 and buy a Chevy instead.

I mean, it’s a wonderful business. We can’t develop a business like that, and so we own a lot of it. And our ownership goes up over time.

Or See’s:

People had “taken a box on Valentine’s Day to some girl and she had kissed him … See’s Candies means getting kissed,” he told business-school students at the University of Florida in 1998. “If we can get that in the minds of people, we can raise prices.”

“If you give a box of See’s chocolates to your girlfriend on a first date and she kisses you … we own you,” the investor said in “Becoming Warren Buffett,” an HBO documentary.

(That U Florida interview is one of my favorite Buffett texts, you can see not just the sunny old grandpa but the rapacious capitalist).

There is an accounting term that attempts to quantify some of this, goodwill, but this quality is not measurable in any exact way. In Munger’s famous talk on The Psychology of Human Misjudgment, he talks about how he didn’t learn about any of this at Caltech or Harvard Law School. Being rational is wise, even a moral duty as Munger often says, but you’ll miss out on human decisionmaking if you don’t look for and acknowledge the power of essentially magical forces at work.

The gap between rationality and the way people actually behave due to romantic attachments, sentimentality, brand loyalty, etc is a source of humor, as well as an opportunity for price increases. Buffett and Munger seem to see both.

One example I can think of where free samples didn’t work: the teriyaki place at the mall. Did you have these? At the mall food court the kid at the teriyaki place would often have a plate of free samples. Yet the one time I tried a full plate it was kind of repulsive. I didn’t finish. Too sweet or something, or just not good at scale.

Coke has no taste memory. You can drink one of these at 9 o’clock, 11 o’clock, 3 o’clock in the afternoon, 5 o’clock. The one at 5 o’clock will taste just as good to you as the one you drank early in the morning. You can’t do that with cream soda, root beer, orange, grape, you name it. All of those things accumulate on you. Most foods and beverages accumulate on you — you get sick of them after a while. There is no taste memory to cola.

So says Buffett, perhaps related to “the teriyaki problem.”

Maybe the free sample method only works with a quality product. Sometimes the samples at Costco are bad. Remember when they used to give a sample at Trader Joe’s? Covid has killed that I guess. It worked on me.

Giving out free samples, in both See’s and Costco’s case, represents a strong investment on serving customers. Giving out free samples is a pain in the butt. A business that has the abundance to consistently deliver is probably confident and well-managed. Is this blog a form of free samples?

I’m all right on that one

Posted: May 11, 2023 Filed under: America Since 1945, business Leave a commentAnd there used to be a politician in Nebraska, and if you asked him some really tough question like, you know, how do you stand on abortion, he would look you right in the eye and he’d say, “I’m all right on that one.” And then he’d move next.

very Warren Buffett joke from Warren Buffett.

You know, Tom Murphy, the first time I met him, said two things to me. He said, “You can always tell someone to go to hell tomorrow.” Well, that was great advice then. And think of what great advice it is when you can sit down at a computer and screw your life up forever by telling somebody to go to hell, or something else, in 30 seconds. And you can’t erase it. …

And then the other general piece of advice, I’ve never known anybody that was basically kind that died without friends. And I’ve known plenty of people with money that have died without friends, including their family. But I’ve never known anybody, and you know, I’ve seen a few people, including Tom Murphy Sr. and maybe Jr., who’s here, (LAUGH) but certainly his dad, I never saw him, I watched him for 50 years, I never saw him do an unkind act.

on fun:

And we had as much fun out of deals that didn’t work in a certain sense as the ones that did work. I mean, if you knew you were going to play golf and you were going to hit a hole in one on every hole, you just hit the ball, and it went in the hole that was 300 yards away, or 400 yards away, nobody would play golf.

I mean, part of the fun of the game is the fact that you hit them to the woods. And sometimes you get them out, and sometimes you don’t.

So, we are in the perfect sort of game. And we both enjoy it. And we have a lot of fun together. And we don’t have to do anything we don’t really believe in doing.

On See’s:

And it has limited magic in sort of the adjacent West. It’s gravitational, almost. And then you get to the East. And incidentally, in the East, people prefer dark chocolate to milk chocolate. In the West, people prefer milk chocolate to dark. In the East, you can sell miniatures, and dark — in the West —

I mean, there’s all kinds of crazy things in the world that consumers do.

Talking about Netjets:

CHARLIE MUNGER: I used to come to the Berkshire annual meetings on coach from Los Angeles. And it was full of rich stockholders. And they would clap when I came into the coach section. I really liked that. (LAUGHTER) (APPLAUSE)

(he doesn’t fly that way anymore)

from this CNBC transcript of the afternoon session of the annual meeting. I couldn’t find a transcript of the morning session.

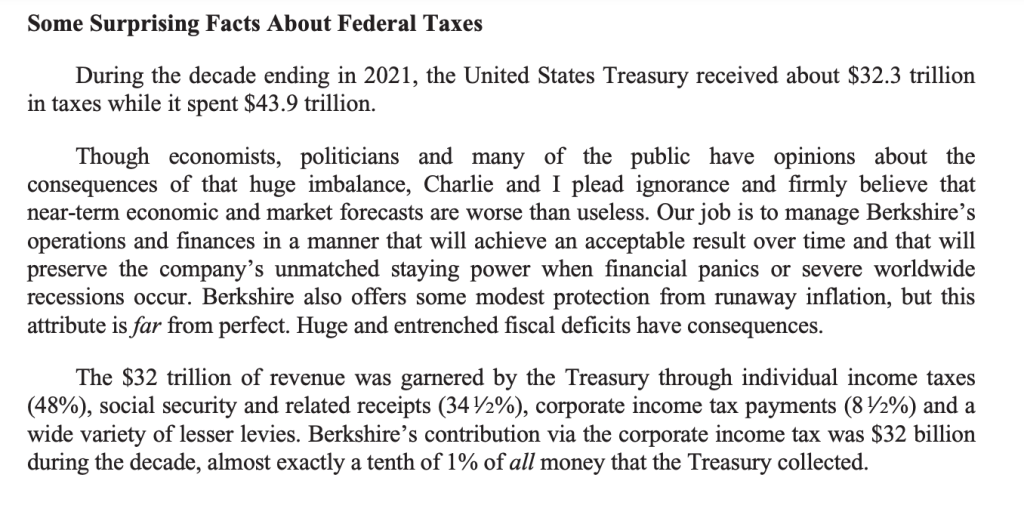

Tax facts from Uncle Warren

Posted: February 25, 2023 Filed under: business Leave a comment

from the Berkshire Hathaway annual letter.

If you prefer Jimmy Buffett, we have that covered too.

Coins

Posted: November 7, 2022 Filed under: business, money Leave a comment

say what you will about Queen Elizabeth she looks good on a coin. I wonder if some of the turbulence in UK markets of late have to do with the fact that Steady Grandma will no longer be on the money, now it is Weird Son.

French coin picked up most likely in Tahiti

The Euro’s kind of ominous, no?

Who runs Bartertown?

Posted: July 18, 2022 Filed under: America Since 1945, business, politics Leave a commentWhen he gets to Bartertown, Max is taken up in the tower to meet Aunty (Tina Turner). She tells him she wants him to kill somebody. Who? Master Blaster.

Master is a little gnome who rides around on the giant Blaster. Aunty explains that the energy to run the lights and electricity of Bartertown comes from the underworld, a horrible factory-like place where pig shit generates methane.

Max goes down to the underworld under the guise of a pig-shit shoveler. While there, he meets Master Blaster, who is determined to show him who really runs Bartertown. Master Blaster turns off the methane to Bartertown. Everything goes dark. Master Blaster calls up to Aunty. His demand to turn the methane back on is that she answer the question: Who run Bartertown? Reluctantly, she answers: Master Blaster. He makes her say it publicly, over the PA system. Who run Bartertown? Master Blaster. Once she’s said this he smiles and turns the methane back on.

That’s all pretty early in the movie, we haven’t even gotten inside the Thunderdome yet. And since the movie is called Mad Max Beyond Thunderdome, we know we’re barely getting started.

Market research

Posted: July 10, 2022 Filed under: business Leave a commentMy data-driven advice for getting rich for someone with good analytical skills and deep experience in a field is to start a market research business. Use your specialized knowledge in the field to write up reports; sell them widely and charge a fortune to your contacts in the field. I have estimated that more than 10 percent of owners of market research businesses are in the top 0.1 percent.

from this NY Times op-ed, “The Rich Are Not Who We Think They Are,” by Seth Stephens-Davidowitz.

Intrigued, I Googled “how to start a market research business” and found:

There are a number of market researchers out there fighting for the same business you are. Consider your own business the firm’s first client. What does your target audience respond most to? Build a marketing strategy around that. Highlight your strengths through the use of existing contacts, networking, and cold calling. Get involved by attending conferences. Offer to speak at a conference or become a committee member.

Bold is mine, that’s brilliant. It does sound like a lot of work though. But, Stephens-Davidowitz tells us:

A study of thousands of millionaires led by researchers at Harvard Business School did find a gain in happiness that kicks in when people’s net worth rises above $8 million. But the effect was small: A net worth of $8 million offers a boost of happiness that is roughly half as large as the happiness boost from being married.

That sounds good?

Mining News

Posted: June 26, 2022 Filed under: business Leave a comment

forget what search or series of searches led to me being hit with these ads. Don’t mind it.

An egg a day

Posted: June 25, 2022 Filed under: business, food Leave a commentJoe Weisenthal Tracey Alloway interview their colleague Tim Culpan about FoxConn and founder Terry Guo.

And so one of the first things Terry Guo did was he said, okay, I want all of my workers to eat well. So every single one of them would get an egg a day, so they could get a bit of protein. That was kind of a bit of a way out idea at the time. This was, just to be clear, this was in the eighties, seventies and eighties, seventies and eighties. And so Terry Guo is not an electronics guy. Most people in the tech industry have a tech background, they have an electronics background, maybe electronic engineering, Terry Guo studied at a maritime college in Northern Taiwan. So he really studied shipping and logistics, and then he moved into plastics. So his kind of opening business was plastic injection molding. And if you think of Taiwan in the seventies and eighties, it was known, as you know, ‘Made in Taiwan,’ cheap plastic toys, Barbie dolls, and everything else was made in Taiwan.

That’s my bold.

Some of the history of the world:

Joe: (13:44)

How did Apple find Foxconn?Tim: (13:48)

Well when Steve Jobs came back, as we all know, the company was in trouble, they, Apple was actually making their computers — like physically making them in California, but over a period of time, many companies, you know, Michael Dell and Hewlett Packard, Compaq, and others were starting to outsource to Asia. And at some point during that period of time, Tim Cook, who was operating officer at the time, he’d not yet become CEO, would’ve discovered Foxconn and realize that, you know, these guys make the components. We should probably get to know them. And they really jumped into bed deeply when the iPod came out in the early 2000s.

Harsh

Posted: June 14, 2022 Filed under: business 1 CommentThis morning, Coinbase CEO Brian Armstrong announced his firm will lay off roughly 18% of staff in a less-than ceremonious manner – via automatic removal of access to the office email server

wow. Cold. Almost Daily Grant’s continues:

On the bright side, the founder will be able to mull those fast-changing circumstances in style. From the Jan. 3 edition of The Wall Street Journal:

Coinbase Chief Executive Officer Brian Armstrong is the buyer of a $133 million Los Angeles estate, according to people familiar with the deal. The transaction, which closed in December, is one of the priciest single-family home sales ever completed in the L.A. area.

Is it a bad sign that some of the best daily / column comedy writing is coming from the financial world? Matt Levine’s Money Stuff is unstoppable, Joe Weisenthal, Terminal Value…

The price of hay

Posted: June 13, 2022 Filed under: America Since 1945, art history, business Leave a comment

A friend of ours who runs a horse barn told me the price of hay is up $5 a bale, from $27 to $32.

(I know what you’re thinking, that’s a lot for hay, but trust me, these horses are getting primo stuff.)

(painting is Rhode Island Shore by Martin Johnson Heade, at LACMA, not on display last I was there).

The Price of Gas

Posted: June 12, 2022 Filed under: America Since 1945, business, the California Condition Leave a commentIt’s so high! How can people do anything? Yet shouldn’t we want the price of gas to be high, so we don’t cook up the planet quite as fast? Though, won’t the high prices cause estimates and spreadsheets and algorithms across the oil and gas companies to be adjusted? When the calculations are revised, it suddenly makes sense to drill more and deeper and in crazier ways in more chaotic countries? They’ll capitalize new and more projects, dredging up our oil faster than ever.

Is this merely the boom and bust cycle we all must toil under, written many times over in the history of every boomtown and oil craze? From Nantucket to Houston to the Bakken to Bakersfield to Alaska we are told this story. Above LA looms the Getty, named for a man whose father left Minnesota for a boom in Bartlesville, Oklahoma. The son took the lesson and was early in on Saudi Arabia. To get to the Getty from here you’d have to cross Doheny, he of Teapot Dome. But look, you saw the oil wells when you came in from the airport (in a car), and if you looked out the window of your plane as you landed at LAX you saw the diesel tankers and maybe even an oil tanker filling up at the offshore spigot. You get the idea.

Not so long ago I watched the documentary version of The Prize in small chunks, just before bed. Though the content can be bracing it is soothingly narrated by Donald Sutherland, and there is something relaxing about seeing how the pieces fit together. Finding the doc compelling I read Daniel Yergin’s original book, which is full of great characters and strange scenes:

In early March 1983 the oil ministers and their retinues hurriedly convened, ironically in London, the home court of their leading non-OPEC competitor, Great Britain. They met at the Intercontinental Hotel at Hyde Park Corner, for what turned out to be twelve interminable, frustrating days – an experience that would leave some of them with an allergic reaction whenever, in future years, they set foot inside the hotel.

and:

Later in the day, Silva Herzog was glumly eating a hamburger at the Mexican embassy, preparing to leave, when a call came from the United States Treasury saying that the $100 million fee had been rescinded. The Americans could not risk a collapse. Who knew what the effects would be on Monday? And with that, the Mexican Weekend concluded, with the first part of the emergency package now in place.

Some takeaways of value:

- it’s not just the getting of the oil. It’s the refining. Rockefeller controlled the refining, and the shipping, and eventually everything

- one of Rockefeller’s killer qualities: he was a visionary accountant. Can there be such a thing? Yes. Rockefeller.

- The Great War, later World War One, was a gamechange for oil. Railroads had been key in the US Civil War, but in World War One, the tank and the truck, oil powered vehicles, proved to be the crucial transport. Churchill, head of the Admiralty at the time, switched the Royal Navy to oil from coal. At the end of the war, the destruction of the Ottoman Empire left the British and French in control of oil fields in Mesopotamia.

- both on the Eastern Front and in the Pacific in World War Two, oil was the key strategic factor. Really everywhere, but those offer clear examples. Decisions on how to invade the Soviet Union were based on gaining control of oil fields before the German forces ran out of oil. The Japanese navy’s decisions were bounded by limits on oil. The fleet had to be stationed near Singapore. The “Marianas turkey shoot” was a result of decisions made based on saving oil. There was not enough oil not only for active operations, but for pilot training.

How about this?:

When [J. Paul] Getty died in 1976, age eighty-three, the eulogy at his funeral was delivered by the Duke of Bedford. “When I think of Paul,” said the Duke, “I think of money.”

Many people and groups of people have attempted to control oil, but it’s unpredictable. Sometimes the board gets reshuffled: North Sea oil fields, Saudi, Alaska. The North Sea oil fields saved the UK economy. Or did it ruin the UK economy? It saved Margaret Thatcher. You can’t send ships and helicopters to the coast of Argentina if you don’t have oil.

Look how rich Norway is. It doesn’t have to be this way, Norway used to be poor, that’s why Rose on Golden Girls is from St. Olaf.

Obama’s presidency coincided with a huge boom in US oil extraction. Is “coincided” the right word? Was it a coincidence? What’s at work here?

A character worth some study: Marcus Samuel. (Shell, the first oil tanker, Lord Mayor of London).

It was called Shell because his Iraqi Jewish family used to import and sell seashells. (That’s the story, anyway.)

Here’s a solid summary of The Prize.

Recall that Moby-Dick is about the oil business, and Ahab like Daniel Plainview is an oilman.

Tom Murphy

Posted: June 10, 2022 Filed under: business Leave a commentMr. Murphy clearly wanted to grow the size of Capital Cities, but he never lost sight of the fact that growth through acquisition only creates value if it can be accomplished at sensible prices, nicely encapsulated in this quote:

“The goal is not to have the longest train, but to arrive at the station first using the least fuel.”

from this Rational Reflections post.

I am in a game

Posted: April 18, 2022 Filed under: business Leave a comment

the game is very very easy if you have the right lessons in your mind.

Buffett says that to succeed at the game you need an IQ of about 120, but more than that is a hinderance.

Nothing shocking in Warren Buffett’s interview with Charlie Rose if you are a Buffett student. He drinks a Coke. That this interview exists is perhaps the most interesting thing: Charlie Rose is back? In this form? It’s not shot like Charlie’s PBS show.

Could this room be more generic?

Warren:

I think about what the company’s gonna be worth in 10-12 years.

and:

most of them [Berkshire investors] give it away when they get through

What does “get through” mean here? Die?

Buffett mentions pitching some doctors at a place called The Hilltop House in Omaha. Sadly it no longer exists, I find this photo of it on the post “I Wish I Could Have Gone To: Hilltop House” on MyOmahaObsession and I share the sentiment.

Railroader: The Unfiltered Genius and Controversy of Four-Time CEO Hunter Harrison by Howard Green

Posted: March 27, 2022 Filed under: business, Canada, railroads Leave a commentOver his career Hunter Harrison ran four railroads: Illinois Central, Canadian National, Canadian Pacific, and CSX. His gospel was Precision Scheduled Railroading. He’s usually credited with the PSR idea, although we can’t overlook the role of “Pisser Bill” Thompson in formulating the concept. “Pisser Bill” was called that because wherever he was on the railyard, if he had to piss, he would take his dick out and piss all over the place. That’s what railroading was like when Hunter Harrison began his career oiling traincars.

Harrison kept score by one main metric: operating ratio. Operating expenses divided by revenue. He cared about other numbers of course, but only as to how they’d affect operating ratio. You want a lower operating ratio: less dollars spent for every dollar earned.

Harrison focused on the numerator: expenses. He was obsessed with smart use and purchase of assets. One of his sayings was that an unused asset is a liability. When he found unused assets he shed them. On the Illinois Central, which runs from Chicago to New Orleans, there were two parallel tracks. Hunter got rid of one of them. He wanted to save the cost of maintaining it. (Sidings were kept so two trains didn’t run into each other). He knew pricing would take care of itself because the railroad is almost a monopoly. He didn’t care much about customers. He saw some stickers once at a BNSF yard that said “the customer is always right.” He had them torn down. Ignoring customers caused him some problems politically, especially in Canada, but it didn’t stop him from getting the operating ratio down.

Harrison was a fanatic about trainyard efficiency. He rose up as a trainmaster in the Frisco yard in Memphis. Although he never went to college, Harrison had a pure mind for railroad management. When Sue Rathe introduced him to a new world of computerized data at Illinois Central, he immediately understood the potential and how to use it. (Although no one would argue Harrison could not be gruff, Rathe tells us not to miss the gentlemanly side. Harrison encouraged people with potential. His bookshelf was full of memoirs of great coaches, he viewed himself as a coach, he used coaching metaphors.)

As CEO, Harrison got the Illinois Central’s OR down from like 90% to mid 60s. The employees didn’t always like him for it. But they came to respect him. The alternative might’ve been bankruptcy.

What produced results was the approach he would preach for the next two and a half decades – what train velocity does for efficiency, what longer trains mean for efficiency, and on and on. He saw better processes for everything, base hit after base hit.

There’s not much about this point in the book, but I wonder if Harrison had one key world historical insight. Railroading had changed. The Staggers Act of 1980 deregulated railroads. After that there was some nominal oversight but really the railroads could charge whatever they wanted. (The Staggers Act was meant to be anti-inflationary, it was signed by President Carter).

The news that railroads were now, like, businesses hadn’t caught on. Railroads still acted like federal bureaucracies. Everything was inefficient. The labor force was notoriously lazy, naps and “leave earlys” were common, drunkenness not unknown.

That was in the US. Up in Canada mind, CN at this time was still nationalized! In fact not even nationalized, it was a “Crown corporation,” legally speaking it was more or less Queen Elizabeth’s personal plaything.

Harrison realized (if I understand the book right) that pricing would take care of itself. Don’t even think about it, charge whatever. Focus on cutting costs and moving cars (cars, not trains, a key point). You’d make huge gains in operating ratio. That would get reflected in the stock price, and ultimately in Harrison’s personal compensation. By the time he was done he’d personally made something like $500 million, which he used on estates for show horses in Connecticut and Florida, filling trophy rooms.

It wasn’t just having the insight though. Harrison had the combo of skills to execute. No easy job. There was a lot of what he called mud to scrape away. He was not shy about confrontation. During some lost years as a young man he once woke up in a pool of his own blood after a bar fight. He took that attitude into his railroads.

Activist investor Bill Ackman saw the possibilities. He took a big position in Canadian Pacific and fought to get Harrison appointed CEO. After some board room battling, Ackman succeeded.

When Harrison took over CP in 2012, he went up the offices in Calgary. It was the week of the Calgary Stampede. Hardly anyone was at work.

“It’s Stampede,” said one of the secretaries.

“Who gives a shit it’s Stampede? This company hasn’t made a penny and we’re worried about Stampede, having a few shooters at noon?”

Harrison turned CP around, starting with the mailroom, where he was disgusted to find a box being FedExed to a destination eight miles away. By then he’d run two railroads. He had a playbook. It was almost too easy for him. In eighteen months he brought the OR down from 81% to 65.9%. Two and a half years later, CP’s OR was 59.8%. He had the railroad using 40% fewer locomatives, he’d closed yars, he was increasing velocity and train length without sacrificing safety (although absolutely sacrificing love from the work force, which he reduced by about four thousand).

For this reader, the least engaging part of Railroader: The Unfiltered Genius and Controversy of Four-Time CEO Hunter Harrison by Howard Green came as Harrison was exiting CP to run CSX for a final act of his career. The details about board politics and compensation packages just weren’t as thrilling as turning around a railroad. I can see why Green devoted so much time to this period, however. He’s an anchor on Canada’s Business News Network, and he had access to Harrison during this time. There was some resentment of Harrison’s manner at CP. Harrison himself acknowledged to Green that he’d mistakenly assumed Canada was just like the USA, and Canadians just like Americans, but the business culture there was smaller, closer, and more sensitive, less blunt.

By the time Harrison left CP and went to fix up the “spaghetti-like” CSX*, his health was in rough shape. He took over CSX in March, 2017, and died that December. His ashes were scattered in the Memphis railyard.

Green sums up Harrison’s worldview on page one:

He reshaped an industry by literally making the trains run on time. While Sir Richard Branson advised executives to focus on employees first, customers second, and investors third, Harrison reversed the priorities: investors came first. For him the game was capitalism, pure and simple. You either played it or you didn’t.

Harrison’s legacy lives on. His protege Keith Creel is now CEO at Canadian Pacific. Bill Ackman is taking another bite of that apple. The question is: has Harrison’s Insight is already played out? The operating ratios for all the major railroads now are in the high 50s and 60%s. Some of those numbers include real estate sales. The railroads were given a great deal of land to induce them and help them build, much of it indigenous land, a continued resentment.

Are these railroads just now juicing their numbers by scrapping off their parts? Is that the ultimate end of capitalism, for a corporation to achieve ultimate efficiency and then begin consuming itself, or rather allowing the shareholders to consume it in a cannibalistic ritual?

I should confess/disclose I myself am long CP and UNP and (through Berkshire) BSNF. Good luck building another transcontinental railroad. Canadian Pacific was built in five years. California will take longer than that to go from Bakersfield to Merced, although in fairness we’re not importing 15,000 Chinese laborers nor will the deaths of 600 people be acceptable. Both CP and the UNP were built with the aid of corrupt schemes. Corrupt schemes may still be rampant but they’re less effective, at least in North American railroad building.

Throughout this book are accounts of high stakes dinners and meetings at places like the Mount Royal Club in Montreal or The Breakers in Palm Beach. I know I’m not cut out to be a railroad CEO because I was reading and thinking, sure, sure this is a faceoff over control of the board but: what’s the food like? What’re people eating? I wanted the flavor! One meal that got my attention was a hasty conference at a Chick-Fil-A near Atlanta. That was the kind of food Hunter Harrison liked.

Cheers to Alex Morris, @TSOH_investing on Twitter, I think that’s how I heard about this book. I read it because I wanted to learn a bit about running a railroad, and I did!

* an example of Harrison’s mind: he could look at the map for CSX railroad and see that “stripped down, CSX wasn’t spaghetti; to Harrison it was more or less a square” with the corners being Selkirk, NY near Albany, Willard Ohio (60 miles south of Toledo), Nashville Tennessee, and Waycross, Georgia.