JAB Holdings

Posted: February 8, 2018 Filed under: America Since 1945, business Leave a comment

and soon:

and

and

are all controlled by JAB Holdings.

Owned by Germany’s Reimann family, 95% of JAB Holding belongs to four of the late Albert Reimann Jr.’s nine adopted children. They are descendants of chemist Ludwig Reimann, who, in 1828, joined with Johann Adam Benckiser (founder of the namesake chemical company).

Allegedly, the heirs take an oath never to discuss their business publicly?

Thought this was interesting

Posted: December 22, 2017 Filed under: business, China Leave a commentEver heard of Shijiazhuang? Well it has ten million people.

Here’s an essay by Puzhong Yao, who tells of his journey from there to Goldman Sachs, and his love for Costco:

It seemed like whatever I wished would simply come true. But inside, I feared that one day these glories would pass. After all, not long ago, I was at the bottom of my class in China. And if I could not even catch up with my classmates in a city few people have even heard of, how am I now qualified to go to Cambridge University or Goldman? Have I gotten smarter? Or is it just that British people are stupider than the Chinese?

With these mixed thoughts, I began working as a trader at Goldman in 2007.

(ht Tyler Cowen)

One class was about strategy. It focused on how corporate mottos and logos could inspire employees. Many of the students had worked for nonprofits or health care or tech companies, all of which had mottos about changing the world, saving lives, saving the planet, etc. The professor seemed to like these mottos. I told him that at Goldman our motto was “be long-term greedy.” The professor couldn’t understand this motto or why it was inspiring. I explained to him that everyone else in the market was short-term greedy and, as a result, we took all their money. Since traders like money, this was inspiring.

Gun Stocks

Posted: October 3, 2017 Filed under: business 1 Comment

I don’t know why I care about this. I guess because I’m interested in what moves stock prices, narratives invented around stock prices, and how things get reported?

This effect seems to me to be exaggerated.

Motley Fool notes:

The market for firearms is highly fragmented, with many names — Glock, Colt, Beretta — privately owned, located abroad, or both. This can making investing in guns tricky. One of the easiest ways for an investor to gain exposure to this market, though, is through buying shares of industry leader American Outdoor Brands.

American Outdoor Brands is a nicer name than “Smith & Wesson”

Yesterday they were up 3.21%.

I asked a financial friend if he thought that was significant:

3%? Not very

The other big gun stock is Sturm, Ruger – RGR.

Yesterday they were up 3.48%. Today they’re up another 1.78%.

Is that meaningful? Maybe? A tiny bit?

Soaring?

There is an initial burst in stock price immediately when trading opened, but that was mostly corrected by the end of the day.

Why do we tell ourselves this story?

I guess because it’s shocking these companies aren’t at all harmed when their product or a competitor’s products are used to shoot hundreds of people.

We tell this story because it’s twisted and we like twisted stories.

Even the Norwegian Sovereign Wealth Fund owns a buncha gun stock:

Fascinated by: Ray Dalio

Posted: September 10, 2017 Filed under: America Since 1945, business, comedy Leave a comment

Ray Dalio, billionaire founder of Bridgewater Associates, one of the world’s largest hedge funds.

That’s a 30 minute video he made about how the economy works, nbd.

A brilliant person with an atypical mind who lays out their worldview in a kind of manifesto can pretty much always get my attention.

Three of his Dalio’s beliefs:

- “algorithmic decision-making is coming at you fast”

- evolution is good

- to achieve success you must face and accept harsh realities

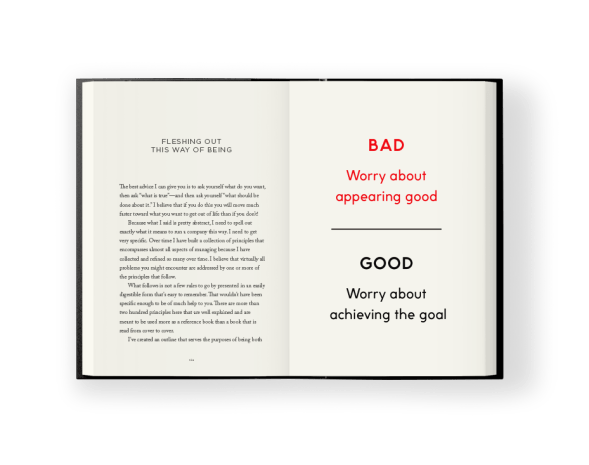

You can read his Principles online. Soon they are coming out in book form, I’ve pre-ordered. Here’s a sample, from the Principles website, which is www.principles.com:

A lot to think about in Ray Dalio’s Principles.

BUT: let’s limit our discussion today to one moment in his TED Talk above. We’re going to talk about a joke and the audience reaction to it.

You’ll have to watch about one minute of the talk. Start at 14:30.

Dalio is describing a complex system where everyone in his company rates each other and is radically transparent with each other. Everyone can rate each other, in different areas. Even a lowly employee can rate Ray, creating charts like this:

At 14:46 he says that because of this, at Bridgewater there is no politics.

Which: Ray Dalio is 100x smarter than me, but I’ll bet ten dollars there are indeed politics at Bridgewater Associates, probably insane, high-order, wildly weird politics.

Anyway.

At 15:13 Ray Dalio makes a joke. This being his TED talk, no doubt a joke he had practiced. Radical transparency, he says, doesn’t apply to everything.

You don’t have to tell somebody their bald spot is growing or their baby’s ugly.

People laugh a little bit. Dalio continues.

I’m talking about the important things.

People laugh a LOT.

Dalio seems even thrown by how much the audience laughs at the second part, not the intended punchline.

Why?

The audience laughs because Dalio is missing the point.

Dalio inadvertently reveals he doesn’t know what the important things are to most people.

What are “the important things?” Making sound investment decisions? Tweaking the algorithm properly? Workplace communication?

Whatever, yes, in theory.

But really? No. To most humans whether your bald spot is growing and whether your baby is ugly are the important things. It would hurt way worse to be told either of those than that you’re ineffectively communicating in the meeting. That pain is a measure of importance.

The audience is expressing laughter / disbelief at the fact Dalio assumes workplace discussion is more important than stuff like whether your baby is ugly.

Perhaps Ray Dalio doesn’t get it because he’s trained himself not to feel that kind of sensitivity. That’s one of the points of Principles, to train your mind to get that nonsense out of the way. It’s served him very well as an investor.

But it’s a little robotic, and a little detached, and a little inhuman.

If I worked for Dalio, I suspect I’d rate him low in the category of “empathy / compassion / understanding for what matters to people / sensitivity.”

But then, are those categories even in the algorithm?

Oh btw James Comey used to work for Ray Dalio, and also Dalio recently recommended allocating 5-10% of assets to gold.

speaking of

algorithm

source: Wiki user Fulvio Spada

looked it up at Online Etymology, my new fave site.

algorithm (n.)

1690s, “Arabic system of computation,” from French algorithme, refashioned (under mistaken connection with Greek arithmos “number”) from Old French algorisme “the Arabic numeral system” (13c.), from Medieval Latin algorismus, a mangled transliteration of Arabic al-Khwarizmi “native of Khwarazm” (modern Khiva in Uzbekistan), surname of the mathematician whose works introduced sophisticated mathematics to the West (see algebra). The earlier form in Middle English was algorism (early 13c.), from Old French. Meaning broadened to any method of computation; from mid-20c. especially with reference to computing.

The man from Khwarizmi.

Wiki:

Few details of al-Khwārizmī’s life are known with certainty.

He worked in Baghdad as a scholar at the House of Wisdom established by Caliph al-Ma’mūn, where he studied the sciences and mathematics, which included the translation of Greek and Sanskrit scientific manuscripts.

Warren Buffett

Posted: March 4, 2017 Filed under: America Since 1945, business, writing Leave a comment

New Berkshire Hathaway letter is out. Free insight and humor for capitalism’s cheery uncle, a great read every year, even if I understand at most 1/12 of it.

Sunny American optimism:

The infectious, enthusiastic amateur style of writing reminds me of Bill James:

Some of the companies Berkshire owns:

9.3% of your Coke is Berkshire’s.

An unlikely hero:

Jack Bogle founded Vanguard, and created a simple, low cost index fund for everyday investors.

found that at JL Collins impressive website.

Buffett tells you, in simple terms, how to get rich:

Why people don’t do that:

On the other hand here’s the S&P 500 chart since 1980:

Doesn’t look like a washtubs moment to me.

Over at marketplace.org, Allan Sloan points out some of the things Buffett leaves out:

Allan Sloan: Two things are missing. One was how wonderful the management of Wells Fargo was, which he wrote the previous year. The second thing is he lavished praise on this company called 3G, what’s known as a private equity company, from Brazil, which manages a company called Kraft Heinz, which is Berkshire Hathaway’s biggest investment. And what it does is it goes around, it buys companies — now with the help of a lot of financing from Berkshire Hathaway — it fires zillions of people, the profits go up, and then after a while, it goes out and buys another company and does the same thing.

Buffett makes me think of Andrew Carnegie, a zillionaire of a hundred years ago who also had some kind of public conscience. If some percentage billionaires weren’t also lovable characters like Buffett, would capitalism collapse? Does his dad humor, like Carnegie’s library building, plug a dyke that holds back revolution?

At the Berkshire Hathaway shareholders conference, you can challenge table tennis champ Ariel Hsing:

Buffett

Posted: February 3, 2017 Filed under: advice, America Since 1945, business, politics, presidents Leave a comment

Warren Buffett’s advice always sounds simple, which isn’t the same as easy to follow.

Loved the doc about him on HBO. The first scene is him advising high school kids to take care of their minds and bodies. The second scene is him in the drive-through line at McDonald’s.

Perspective worth hearing

Posted: December 18, 2016 Filed under: America Since 1945, business Leave a comment

saw this letter to the editor of the Financial Times on somebody’s Twitter.

Inside the La Croix wars: FIZZ vs Glaucus Research

Posted: September 30, 2016 Filed under: beverages, business, Uncategorized 2 Comments

We have the best correspondents here at Helytimes. Anonymous Soda Lover tips us off to the story of FIZZ vs Glaucus Research.

FIZZ is the stock ticker symbol of National Beverage Company, which makes La Croix, the popular sparkling water, Joe Mande enemy, and indispensable hydration agent at Hollywood writers’ rooms:

Myself, I prefer the Perrier slim can, because it is thin and tall like me:

Plus a smaller amount of fluid to become hot in your hand.

But one way or another: Hollywood and indeed America and the world is full of addicts and compulsives who have to consume something constantly. The beer-like but zero-cal zero sugar La Croix fills that hole. Thus, there is an endless market for La Croix.

And indeed, look at National Beverage’s stock price over the last two years:

I cut out what happened this week, when this news came out:

Shares of National Beverage plunged as much as 15 percent on Wednesday after Glaucus Research revealed a short position in the company.

The short selling firm valued the parent company of LaCroix sparkling water at $16.15 per share, more than 65 percent below the stock’s Tuesday closing price of $46.48.

Glaucus’ note alleges that National Beverage “manipulates its reported earnings” as its “reported financial performance is inexplicable.”

Later on Wednesday, National Beverage issued a statement calling the report “false and defamatory.” The stock recovered its losses and ended the day down 8 percent.

“We believe that this ‘report’ was intended to severely manipulate our stock price downward in support of short sellers, whose short position has dramatically increased over recent weeks,” the company said.

First of all, “Glaucus”? Their name comes from the glaucus. Not the ancient Greek sea god:

But the freakish pelagic gastropod, also known as the blue sea slug:

From Glaucus Research’s website:

Glaucus Research, based in Newport Beach, CA, has a rep for bringing the hammer down on fraudulent mid and small-cap Chinese companies. But this week, they dropped a report on FIZZ.

Glaucus alleges all manner of mischief by FIZZ CEO Nick Caporella. At Helytimes we really believe that the first step in evaluating a company is seeing a picture of the CEO. Unfortunately, we can’t find a confirmed pick of Mr. Caporella.

It appears that Nick Caporella personally owns 74% of FIZZ.

We do find this on FIZZ’s website:

Caporella’s letters have been weird before:

This non-English might make more sense when you remember FIZZ also makes Faygo, drink of choice of the Insane Clown Posse:

Now listen. It’s not often that we at Helytimes recommend reading a 56 page report on the finances of a company, but this one is worth a look. For example, have a look at Caporella’s letters to prospective National Beverage Co. buyer Asahi, in which he refers to himself as Nick-San.

Or what about this business about his “little jewel box”?:

FIZZ has hit back hard. They counterattack at the website ReadTheTrueFacts.com.

Glaucus Research is straight-up about the fact that they are short La Croix and thus benefit if the stock goes way down. From Wiki’s page about the glaucus atlanticus:

The Glaucus atlanticus is able to swallow the venomous nematocysts from siphonophores such as the Portuguese man o’ war, and store them in the extremities of its finger-like cerata.Picking up the animal can result in a painful sting, with symptoms similar to those caused by the Portuguese man o’ war.

You can find the latest on FIZZ here. As of this writing, price is $43.32. Glaucus values it at $16.15.

We’ll be watching this battle with interest, with a refreshing Perrier slim can, made by good ol’ Nestlé, in our hand.

Nestle

Posted: May 19, 2016 Filed under: business, the California Condition, water Leave a comment

In the Swabian dialect, “Nestle” is a small bird’s nest.

So says the Wiki for Henri Nestle. I was reading about Nestle because I was trying to learn who owns the spring sources for the major bottled waters in the United States.

Here are our popular waters, by sales in billions of $$:

Dasani and Aquafina are literally just purified municipal tap water with salt added:

Dasani uses tap water from local municipal water supplies, filters it using the process of reverse osmosis, and adds trace amounts of minerals, including magnesium sulfate (Epsom salt), potassium chloride and table salt (sodium chloride).

Nestle Pure Life as I understand it comes from springs in Canada:

Nestlé’s Aberfoyle Springs plant currently bottles two different waters: the on-site Aberfoyle spring water, and spring water tankered in from Cedar Valley Spring in Erin, Ontario. In addition, spring water is botted on-site in Hope, British Columbia. In the United States, Nestlé Pure Life is a purified (filtered) water.

Next is Poland Spring, owned by Nestle. Vitaminwater I don’t care about.

and:

Fiji water is owned by David Brooks’ buddies:

How about local SoCal water sources, like Arrowhead?:

Nestle again!

Here’s an interesting one: Crystal Geyser, the source of which is up on the 395, in bleak country near the Owens Lake, source of LA tap water:

The owner there is:

We had to check in with Anonymous Investor on that one:

I never heard of Otsuka before, but just browsed through their 2015 annual report.

Lots of interesting stuff here. Most of their business (67%) is pharmaceuticals. And the lion’s share of that came from Abilify. When Abilify went generic in 2015, their earnings dropped off a cliff, although they still managed to stay profitable.Crystal Geyser is a tiny sliver of their business. It’s part of their “consumer products” segment. An honor it shares with “Bon Curry,” a line of instant curries–

http://www.amazon.com/Bon-Curry-Gold-180g-pieces/dp/B00BXW9SAM

–and a Gatorade knockoff called “Match”.

http://www.amazon.com/Otsuka-Foods-MATCH-1-5LPETX8-pieces/dp/B010S5VRNK

All together, the consumer products division comprises only 2.8% of the company’s total sales.

So if you buy the stock, what you are getting is mostly the drug business.

Anyway. If you wish to own fresh springs, the way to do it seems to be to buy Nestle stock, as Joshua Kennon enthusiastically advises. Nestle also owns Perrier, whose slim cans I’m getting into.

You should never buy a stock though without looking at a picture of the company’s CEO. What do we think of Paul Bulcke?

On August 30, 2012, Bulcke claimed that water is not a human right and should be privatized. He was quoted as saying “”If something isn’t given a value, people tend to waste it. Water is our most useful resource, but those using it often don’t even cover the costs of its infrastructure. Fresh water is being massively overused at nature’s expense, but it seems only a global crisis will make us realise the importance of the issue. What is environmentally unsustainable today will become socially unsustainable in the future,

(hmm, that quote is sourced on wiki to this article:

but I don’t see it).

File this under our ongoing interest in “sources.”

New Berkshire Hathaway annual letter

Posted: February 27, 2016 Filed under: America Since 1945, business Leave a comment

New Berkshire Hathaway annual letter is out. I love to read this thing every year. If Warren Buffett weren’t busy running a 362 billion dollar company he would be a very talented business writer.

He’s funny, compelling, a calm and sunny optimist, and thoughtful about dimensions beyond the monetary, one of the great American characters alive. Here are some highlights if you are too busy to read:

Some common sense social policy:

About rail cars:

A brief history of auto insurance in the United States:

Advice:

A non-apology for GEICO advertising:

Discussion of the realities of economic change on people’s lives:

Here is the scariest part, a warning about cyber, biological, nuclear or chemical attack on the USA:

Damn I hope I have the time to make it to the annual meeting:

If I make it to Omaha I would like to challenge Ariel Hsing at table tennis:

How to pronounce Broad

Posted: February 25, 2016 Filed under: books, business, the California Condition Leave a comment

If you are on Instagram in LA you have seen probably six hundred pictures of The Broad art museum downtown.

How did Broad get so rich? “Moving money around,” was my guess. Part right: he started a homebuilding company, KB Home, and then when that was up and going he started another company, SunAmerica, for retirement savings / mutual funds. Learning this from the man’s book:

which also gives a final answer on how to pronounce the name:

To summarize: everybody has to say it weird because he didn’t like getting teased as a boy.

(photos of the Broad yanked right off LA Curbed)

Should you buy Twitter? Plus: Advice to Jack Dorsey

Posted: February 14, 2016 Filed under: America Since 1945, business 1 Comment

I’ve noticed that writing about investing is very popular on the Internet so I’m gonna try it.

This post is about Twitter (TWTR). At the moment: the stock is priced at 15.88, I don’t own it.

Twitter is one of my favorite products in the world. If I’m being real, I probably spend minimum an hour a day looking at Twitter.

Lots of people hate it — my Great Debates colleague Dan Medina, for instance, claims to find it unusable. Yet there he is:

and he’s fascinated by it.

How can you not be? Here are entertainers, comedians, athletes, famous people of all kinds, plus millions of strong-opinioned randos, bots, sex bots, ordinary citizens, kids, organizations, Vine people, all gabbing away at some fantastically weird party / school assembly gone mad.

On the one hand maybe Twitter is a negative in my life, because I read fewer books. On the other hand, while I’ve been putting off reading William Gibson’s books, I’ve been enjoying his Twitter feed:

Little Esther tells me Twitter is for losers, but her feed is hilarious:

Twitter is a fiendishly perfect invention for distracting comedians because so many of them

- Crave instant feedback/laughs

- Are desperate for connection

- Are bored

- Are traveling / waiting around for something

- Are video game addicts

If anything, the biggest problem I have a user of Twitter is how much stuff there is I want to look at, and how to sift it out from all the garbage.

I’ve solved that problem more or less to my satisfaction by making private lists. The second biggest problem might be the jarring combos of information:

but maybe that’s a feature, not a bug.

For all this entertainment, hours and hours of it, Twitter charges me…

NOTHING?! Zero dollars?

That is ridiculous.

I mean, I guess sometimes I have to look at ads. But I gotta tell ya, these ads don’t tend to get in the way. Often they are wack enough to be part of the fun:

(What? The Embassy of Poland wants to brag to me, specifically, about its military expenditures?)

What kind of wonderful company is this, that gives me entertainment, information and amusement for free?!

Should I get in on?

When a product becomes a part of your life, you have to ask yourself if maybe you should go ahead and own part of the company by buying shares in it.

SHOULD YOU INVEST IN TWITTER (TWTR)?

What I know about investing is cobbled together from skimming and half-reading investment books, blogs and articles (and Twitter) plus mistakes plus talking to people.

First, big believer in the Peter Lynch method.

Peter Lynch of Fidelity Investments.(Story/Paulson)

Peter Lynch was a wealthy Bostonian of my youth who got his start caddying for the president of Fidelity Investments, became an intern there, and rose up to manage Fidelity’s Magellan fund:

From 1977 until 1990, the Magellan fund averaged a 29.2% return and as of 2003 had the best 20-year return of any mutual fund ever.

and also wrote some bestselling investment guides:

which I haven’t read. But which Wikipedia helpfully summarizes:

His most famous investment principle is simply, “Invest in what you know,” popularizing the economic concept of “local knowledge“. Since most people tend to become expert in certain fields, applying this basic “invest in what you know” principle helps individual investors find good undervalued stocks.

Lynch uses this principle as a starting point for investors. He has also often said that the individual investor is more capable of making money from stocks than a fund manager, because they are able to spot good investments in their day-to-day lives before Wall Street. Throughout his two classic investment primers, he has outlined many of the investments he found when not in his office – he found them when he was out with his family, driving around or making a purchase at the mall. Lynch believes the individual investor is able to do this, too.

OK, great.

I would say I’m not an expert but I’m pretty serious about:

- comedy

Twitter is a great way to get comedy in quick, easy form. Every comedian I know is on Twitter.

- written entertainment

Not every writer is on Twitter but a lot of them are, and there’s neat writing on Twitter every day.

- news/information/infotainment.

from this I’ve had my biggest insight of all: journalists are obsessed with Twitter. They give better, faster, more interesting news directly to their Twitter feeds.

Plus, the news makers and influencers are themselves talking directly to the Twitter user:

and

That’s how I identified Twitter as a possible opportunity. Now let’s run it through a rigorous Lynchian checklist.

Do you use it yourself?

Yes, so much so that I have to impose rules on myself that I then break.

Do people you know use it?

Oh God they’re obsessed.

Does it seem like a good product?

Well, I dunno. For instance I have no idea how or if they make money.

That brings us to the next level.

Buffet analysis.

Everybody knows billionaire investor and Omaha cheapskate Warren Buffett, he is one of the great American characters.

You might also know his partner and former WWII Army Air Corps meteorologist Charlie Munger:

A good intro to some of Munger’s ideas can be found here on the blog of Tren Griffin, who rounds up a lot of wisdom.

Buffett and Munger’s insights are many and not easy to summarize, but a crudely simplified version in three quotes might be:

1:

Buy into a company because you want to own it, not because you want the stock to go up.

2:

I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.

(that quote I can’t 100% track down to the source but it appears legit).

and 3:

Never invest in a business you cannot understand.

Buffett is a value investor. He asks, is the business valuable? For instance, a railroad.

Only a few companies control all the railroad track in North America:

and they’re not building more. People continue to ship things on railroad. Warren Buffett decided that he understood railroads I guess, because he bought one.

Presumably before he did that, though, he ran BNSF through the third level of investment analysis, which is the level of numbers.

This is the level that is so boring. You almost can’t believe it.

Try, for instance, to read the wikipedia page on valuation (finance) and if your eyeballs don’t turn to mush maybe investment banking is for you.

For me, I can only handle the very basics. There’s P/E (price of the stock to earnings), for instance. Should be simple enough:

Theoretically, a stock’s P/E tells us how much investors are willing to pay per dollar of earnings. For this reason it’s also called the “multiple” of a stock. In other words, a P/E ratio of 20 suggests that investors in the stock are willing to pay $20 for every $1 of earnings that the company generates. However, this is a far too simplistic way of viewing the P/E because it fails to take into account the company’s growth prospects.

So says investopedia. Ugh, everything is always far too simplistic with these guys.

Let’s take it down to basics.

Hmmmmmm.

OK, I can do this.

EBITDA is earnings before interest, taxes, depreciation, and amortization. A measure, right, of how much money the company is making.

Twitter’s is negative two hundred and eight million dollars.

Coca-Cola, by comparison, is $124 million.

Amazon’s is $7.8 billion.

Netflix’s is $368.1 million.

Chipotle’s is $908 million.

How about profit margin, that seems simple.

Coca-Cola: 2.7%

Amazon: .56%

Netflix: 1.81%

Chipotle: 10.57%

Twitter: -27.99%

OK, so let us answer the key question:

- How much money is Twitter making?

Negative a lot?

- How is that possible?

Well, I took to the Internet. Here are some things I learned:

- Twitter makes huge amounts of revenue, but not a profit.

From this week’s earnings call, we learned that Twitter’s revenue in the fourth quarter totaled $710 million, up 48 percent year-over-year.

Most of that money ($641 million) comes from ad sales, with the rest ($69 million?) coming I guess from data sales. Although apparently Twitter has somehow screwed up selling that up — last year it made $147 million from data sales before they shut off their data “fire hose.”

I ran all this by my colleague Anonymous Investor. Here’s what he has to say:

Let’s say you owned a pizza shop. In 2015 you sell a million dollars worth of pizza (or said another way, you made a million dollars in revenue). At first glance, that might seem good. But if your food, labor and rent costs add up 1.3 million, you would have ended up losing money for the year. (a $300,000 loss for 2015).

Likewise, Twitter sold 2 billion dollars worth of stuff (mostly advertising sales). But they spent around 2.5 billion dollars doing it. I haven’t dug deep into it, but lots of their costs seem like wasteful spending — such as 778 million on research and development, which seems ridiculous for a company that’s basically not much more than a slightly-advanced message board.

Seems the company could be profitable if google or someone else bought it. They could slash costs and make some profit off that revenue.

- Twitter wastes lots of money.

How much does it cost to run Twitter? I honestly have no idea, but the brilliant thing about the business is that the users are doing the hard work of generating the content. All Twitter should have to do is run the servers and so on, right?

In looking into it, I found that Twitter spends an insane amount of money on research and development. This is from a 2013 Fortune article:

According to its IPO document, in the third quarter of the year, Twitter shelled out nearly $90 million on R&D. That was equal to more than half, 52%, of the company’s revenue in the same period. It is Twitter’s largest cost, nearly 50% more than it spent on marketing. And it’s far more than most of its rivals spend. Facebook, for instance, spent just 14% of its revenue on R&D in the the quarter right before it went public. It has since ramped up that spending to 26%. But Facebook FB 0.10% makes money, unlike Twitter.

Google spends just 15% of revenue on R&D. And Google is working on a self-driving car, high-tech glasses and, maybe, space elevators.

There is no sign that Twitter is working on anything that cool. Twitter actually gives very little detail about what it spends its R&D budget on in the offering documents for its IPO. It says that R&D expenses are to “improve our products and services.” And it doesn’t appear that Twitter is building some kind of high-tech lab or supercomputer. In fact, the bulk of Twitter’s R&D expenses go toward personnel-related expenses. And a good portion of that expense, about a quarter, was the cost of handing out stock options.

Twitter doesn’t say how many employees work in its R&D groups. The company has a total of 2,300 employees. That would be $104,000 per employee if all of its employees were in R&D, which they are not.

That sounds crazy. And it seems like the problem has not been solved. Take a look at this:

Again, I am no expert, the whole point of writing this is to educate myself, but Twitter is spending $800 million dollars on research & development?! WTF? To research and develop what?!

Your job is to bring me this shit as simply as possible:

And you don’t even do a good job of that!

Much of that money, apparently, is stock distribution.

- Twitter’s employee stock distribution system is screwy.

So I learn from this Quora post. I don’t entirely understand this. Neither do the folks at Vox I guess, who proclaim:

At the same time, depending on how you count Twitter employees’ stock options, the company is either still continuing to lose money or only modestly profitable.

That murkiness definitely makes me uneasy.

Is this an accounting anomaly that’s falsely inflating how much money Twitter is spending?

Or is Twitter like giving away too much of itself to its employees?

- Twitter is not gaining users

That seems to be what’s making “Wall Street” so mad, since when they bought into it at its IPO with a valuation of $30 billion dollars they were assuming it would be the next Facebook or whatever. Not happening.

As far as I can tell at least some significant percentage of Twitter users are bots anyway. If some of your users are artificial sex picture machines, and you’re still losing users?

- Twitter has untapped revenue potential?

So says this bullish article:

According to Twitter, there are 500 million people who consume Twitter that don’t actively use Twitter, or have accounts. These people see tweets on websites, mobile apps, in articles, or in Google search among other places. After much debate, and criticism about how Twitter can convert those users to the platform, Dorsey made the decision to begin showing promoted tweets to its logged out userbase of 500 million, rather than wasting money trying to convert those consumers to users.

I don’t really understand this. Does it mean you’re gonna get users back to Twitter? Doubt it. We’ll watch the test case of our colleague Dan Medina, but in my experience people don’t come back to social media apps they left.

- This guy has a terrible idea. Or is it genius?

To let everybody pay to push up their Tweets. Users eat it.

The title of his article is:

How Twitter could be 10X bigger, 100X more profitable, and 1000X more awesome

and I have to say this is a case of what we might call Bro Exaggeration.

- What about the exact opposite?

Twitter pays you if your tweets get 2,500 RTS. Celebrities excluded, can only win a few times, scams will have to be dodged etc., but: essentially Twitter becomes a joke casino where anyone can play. Americans love casinos. Casino owners do not go broke but they sometimes get murdered I guess.

OK so those are the things I know

Can I pass any of Buffett’s tests?

Do I want to own Twitter as a business, not just as a stock?

Not if it costs ten billion dollars, no, which is market cap as of this writing.

If the stock market shut down for five years tomorrow, would Twitter emerge well?

Ehhhhhh…. yes I think so but not worth ten billion dollars or its five year equivalent.

Do you understand the business?

Not really. It is a simple mobile entertainment company where the content is generated for free but somehow it costs TWO billion dollars a year to run it? Where all the ads are like garbage and increasingly young people tell me it is for losers?

I don’t understand that.

I kind of do understand it like the world’s news feed and it’s free. Something like an AP wire that anyone can post on, that (mostly) sorts itself out but has as it’s biggest problem filtering, a problem it has to solve fast or it will be replaced like MySpace by something nimbler and cooler that doesn’t cost two billion dollars to run.

It all comes down to the final piece of the Hely Investment Method: look at a photo of the CEO.

Does he look like he knows what he’s doing? Would you trust this man with your money?

Hrmm. I dunno. How can you tell with these tech guys?

Maybe Jack Dorsey will:

- figure out innovations that draw new users to Twitter without antagonizing the existing users

- find deep new trenches of revenue

- cut operating expenses

and Twitter will be an amazingly valuable company. OR, maybe he will

- appear or come close enough to doing that so the stock price goes way up.

Very possible.

Another possibility is

- they go too far and drive off the users they do have.

Jack Dorsey, knowing he has to do something, uses his neuro-atypical brain to change interfaces in ways that actual humans hate. No new users join, Wall Street freaks out. The company stock plummets. Maybe some giant buys it out of perverse experimentation or nostalgia or valuation of scrap parts at some lower level.

One thing I can almost guarantee:

- Twitter will not grow in new user gain numbers

New people are not lining up to join Twitter. Everyone in the world has had a chance to try it out.

What I would suggest to Jack Dorsey?:

- DON’T DO ANYTHING.

Some huge number of people are insane devotees of your site as is.

Let them keep entertaining and informing themselves with it.

Change nothing. You won’t gain any new users, but you won’t lose any either. In the meantime, you can figure out how to sort out operating expenses and improve advertising.

Wall Street investment banks overvalued the company because they were in a hysteria about tech and had no idea how to value a company that had nothing but enormous user growth, so they overvalued it. Now the user growth has stopped and they are panicking. But it’s fine. Maybe Twitter isn’t worth $10 billion / $15 a share, but it is worth something.

At this price I would suggest do not buy Twitter. Marc Cuban agrees with me, here’s what he said to CNBC on Feb. 11 (funny how their transcripts are in all caps):

WAPNER: THAT LEADS ME TO MY LAST QUESTION. SINCE WERE TALKING TECH AND SO-CALLED FALLING KNIVES, WHEN YOU LOOK AT A TWITTER, WHAT DO YOU SEE IF YOU ARE PART OF AN INVESTMENT GROUP OR IF YOU WERE A CEO OF ANY NUMBER OF TECH COMPANIES OUT THERE, WOULD YOU LOOK AT THIS PROPERTY AS AN ASSET YOU WANTED TO HAVE?

CUBAN: YEAH, YOU KNOW, A LITTLE BIT LOWER I CERTAINLY WOULD. I THINK NOW IT IS AT THE QUESTION POINT WITH THE $10 BILLION MARKET CAP, BUT $6 BILLION MARKET CAP WITH $2 BILLION IN CASH, I WOULD BE A HUGE BUYER OF THE STOCK.

If you believe him, and I guess I do, somebody will buy Twitter soon.

So, there’s some stock price point at which that news will come out, and then the stock will go up some (probably). So if you want to gamble on that exact moment you can make money.

Seems like a sucker’s game to me, but if you love gambling it’s probably fun. Says Anonymous Investor:

Despite the fact that the company can’t make any profit, the stock is still selling for a high price. It’s selling for 5 times its revenue. That’s higher than average. The high valuation means that investors have the belief that in the future some of those revenues can be converted into profit. And other investors might have the belief that twitter could be bought out by another company for a market cap north of 10 billion dollars (or to be more accurate: north of around 8 billion, since Twitter holds about 2 billion in net cash).It’s all a matter of opinion. To me, both assumptions have a pretty high risk of not happening. So in order for me personally to buy Twitter, I’d need to be compensated for that risk with a lower price.

Did you know Jack Dorsey has a whole other company he’s CEO of?

Wait what? You’re telling me he’s working at most half time on fixing Twitter?

Yes he’s also busy being CEO of Square, the credit card payment company that might be hugely profitable or might be about to collapse?

Haha this guy. How does he explain that?

He says it’s easy with his “theme day” system:

The way I found that works for me is I theme my days. On Monday, at both companies, I focus on management and running the company…Tuesday is focused on product. Wednesday is focused on marketing and communications and growth. Thursday is focused on developers and partnerships. Friday is focused on the company and the culture and recruiting. Saturday I take off, I hike. Sunday is reflection, feedback, strategy, and getting ready for the week.

HAHA amazing. This guy.

Steve Albini

Posted: September 14, 2015 Filed under: business, music Leave a commentI have pretty much zero interest in the kind of music Steve Albini plays but whenever I come across an interview or something with him, he always strikes me as remarkably clear-headed about the realities of making money as an artist.

Take this profile in Psychology Today (what?) by Michael Friedman:

“There are kind of two perspectives on business. One of them is that a business exists to make money for the investor class that has a stake in that business. That’s one perspective. So, from a stock-market perspective, from a shareholder perspective, from an investor perspective, that from any publicly held company’s perspective, the company’s reason to exist is to make money for those people,” he explained. “And if you’re not making money, you’re a failing company. If its share price doesn’t go up, then the company’s failing, whether you’re making a profit or not. The idea is that the fundamental reason for that company to be there is to make money.”

Albini contrasts this approach to how he runs his business. “From an entrepreneurial standpoint, from someone like me — someone who builds a business for a reason — the reason my company exists is to make recordings of music. And in so doing, every now and again we’ll turn a profit. But that’s not why we’re in business. We’re not in business so that we can make money. And there’s a pretty strong argument that most businesses that are not part of the public sphere, not part of the investment transaction or equity management or whatever, most businesses operate on that level,” he said.

“Like a bakery opens because a guy wants to make bread. A tavern opens because a guy wants to serve beer to people. That’s why people start businesses. It’s because they want to do something with their time. They want that enterprise to be how they spend their days. But from an academic standpoint or from an analytical standpoint or from the standpoint of publicly held companies and investment class and everything, the reason the company started is meaningless. All they want to know is the share price going up. And for people like me that seems insane.”

“It’s like defining a marriage by the size of the house it occupies as opposed to defining the marriage by the love between two people and the life they build for themselves and the experience they share as part of the marriage. That’s the difference between the people who don’t get it (that you’re talking about), business people who can’t seem to buy into the greater culture of their business, and entrepreneurs, who started the business because the business itself means a lot to them.

“And there’s literally no way you can turn the second type of businessman into the first type. If somebody is hired to run a company and that company has investors who have expectations, then it is already impossible for that company to mean more to the employees as a concept than a paycheck. Because the value of the company has already been defined by the investor class. Now it is possible for somebody to start as an entrepreneur and then eventually sell off his company into the publicly held market and then he’s transformed from an entrepreneur into that second type of businessman. But it’s literally impossible to go the other way.”

I am a little baffled as to how this guy is, as he says, broke. More:

“Selfishness and greed are among the first things that we are instructed against as children. Like, ‘Don’t be selfish; share with your sister’ or whatever. And I feel like abandoning that principle when it’s money rather than gummy bears involved is fucking ridiculous.”

Albini takes heart that he is not alone: Other artists who have followed in a similar path. He explains: “There’s a Dutch band called The Ex who are an absolute inspiration. They’ve been going for 30 years now. And they originally started as sort of a squatter punk band in the squats in Amsterdam. And they have since built a sustainable, durable career, extraordinary body of work. They’ve been all over the world. They’ve made records with pop musicians and traditional musicians from Ethiopia. They’ve toured every flat spot on the globe. And they’ve all bought homes and raised families and all that sort of stuff — and all of it done in a very natural, very sustainable, very ethical way. They’re not a household name.”

“That’s the difference. If you want to be a household name, you kind of have to participate in the rock-star world of things where you’re either going to be a superstar or you’re going to be nobody. If you just want to play music for the rest of your life, that’s a completely attainable goal,” he said.

“What Happened When Marissa Mayers Tried To Be Steve Jobs”

Posted: December 18, 2014 Filed under: America Since 1945, business, writing Leave a comment

This article, by Nicholas Carlson in the upcoming NY Times magazine, is one of the best business articles I’ve ever read (note: I don’t read that many business articles).

Here’s where the story really begins:

But as Alibaba’s stock soared, Yahoo’s dropped, an indication that the market seemed to concur with Jackson’s analysis: Yahoo’s core business was worth less than zero dollars.

That’s bad. Next sentences:

A week later, Smith published an open letter calling for Yahoo to divest itself of its Alibaba assets, return the money to its shareholders and then merge with AOL. Redundancies could be eliminated, thousands of people could be fired and two former Internet superpowers would be downsized into a single and steady (if uninspiring) entity that sold ads against its collective online properties — news, blogs and Web products like email, maps and weather. “We trust the board and management will do the right thing for shareholders, even if this may mean accepting AOL as the surviving entity,” Smith wrote.

(Note that “could be fired” — non-business readers like me often gotta remind themselves that in business articles it’s often assumed that firing people is positive.)

The article goes on with punchy, succinct, clear explanations the challenges of tech companies, and specifically the challenge Mayers faced, and I don’t envy her:

Previous Yahoo C.E.O.s had underinvested in mobile-app development, plowing money into advertising technology and web tools instead. A couple of days into the job, Mayer was having lunch at URL’s when an employee walked up to her and introduced himself as Tony. “I’m a mobile engineer,” Tony said. “I’m on the mobile team.”

Mayer responded to Tony, “Great, how big is our mobile team?” After some back and forth, Tony replied that there were “maybe 60” engineers. Mayer was dumbfounded. Facebook, for instance, had a couple of thousand people working on mobile. When she queried the engineering management department, it responded that Yahoo had roughly 100. “Like an actual hundred,” Mayer responded, “or like 60 rounded up to 100 to make me feel better?” The department responded that it was more like 60.

But then it starts to unravel:

Mayer subsequently immersed herself in the redesign. Months into her tenure, she was meeting with Sharma’s team regularly in a conference room that started to look more like a design studio: projectors hung from the ceiling, rendering screens displayed on the wall. All around, dozens of foam core boards were pinned with ideas. Mayer would regularly interrogate designers about the minutest details of display and user experience. By early December, one day before Yahoo Mail was set to release, she convened a meeting at Phish Food, a conference room in the executive building of Yahoo’s campus, to talk about the product’s color. For months, the team had settled on blue and gray. If users were going to read emails on their phones all day long, the thinking went, it was best to choose the most subtly contrasting hues. But now, Mayer explained, she wanted to change the colors to various shades of purple, which she believed better suited Yahoo’s brand.

Well, see, purple sucks? More great detail:

During a breakfast with Anna Wintour, the editor in chief of Vogue, Mayer asked if there might be any partnership opportunities between the magazine and Shine, Yahoo’s site for women. According to Mayer’s own telling of the story to top Yahoo executives, Wintour lookedappalled.

I bet she did!

Reuters photo stolen from NY Post article “Anna Wintour Has A Sense Of Humor Over Drag Parody Show” http://pagesix.com/2014/08/12/anna-wintour-has-sense-of-humor-over-drag-parody-show-about-her/

Bad to worse:

Yahoo Tech would sometimes go weeks without running a single ad.

Don’t know much about this, but that sounds terrible.

This delinquency eventually became a problem outside Yahoo. At a major advertising event in the South of France, Mayer sat for an interview with Martin Sorrell, the C.E.O. of WPP, one of the world’s largest agencies. In front of a filled auditorium, Sorrell asked Mayer why she did not return his emails. Sheryl Sandberg, he said, always got back to him. Later, Mayer was scheduled for dinner with executives from the ad agency IPG. The 8:30 p.m. meal was inconvenient for the firm’s C.E.O., Michael Roth, but he shuffled his calendar so he could accommodate it. Mayer didn’t show up until 10.

Fuck that. Worse:

Mayer’s largest management problem, however, related to the start-up culture she had tried to instill. Early on, she banned working from home. This policy affected only 164 employees, but it was initiated months after she constructed an elaborate nursery in her office suite so that her son, Macallister, and his nanny could accompany her to work each day. Mayer also favored a system of quarterly performance reviews, or Q.P.R.s, that required every Yahoo employee, on every team, be ranked from 1 to 5. The system was meant to encourage hard work and weed out underperformers, but it soon produced the exact opposite. Because only so many 4s and 5s could be allotted, talented people no longer wanted to work together; strategic goals were sacrificed, as employees did not want to change projects and leave themselves open to a lower score.

This got ugly:

During the revamping of Yahoo Mail, for instance, Kathy Savitt, the C.M.O., noted that Vivek Sharma was bothering her. “He just annoys me,” she said during the meeting. “I don’t want to be around him.” Sharma’s rating was reduced. Shortly after Yahoo Mail went live, he departed for Disney. (Savitt disputes this account.)

Then this part is deeply weird:

As concerns with Q.P.R.s escalated, employees asked if an entire F.Y.I. could be devoted to anonymous questions on the topic. One November afternoon, Mayer took the stage at URL’s as hundreds of Yahoo employees packed the cafeteria. Mayer explained that she had sifted through the various questions on the internal network, but she wanted to begin instead with something else. Mayer composed herself and began reading from a book, “Bobbie Had a Nickel,” about a little boy who gets a nickel and considers all the ways he can spend it.

“Bobbie had a nickel all his very own,” Mayer read. “Should he buy some candy or an ice cream cone?”

Mayer paused to show everyone the illustrations of a little boy in red hair and blue shorts choosing between ice cream and candy. “Should he buy a bubble pipe?” she continued. “Or a boat of wood?” At the end of the book, Bobby decides to spend his nickel on a carousel ride. Mayer would later explain that the book symbolized how much she valued her roving experiences thus far at Yahoo. But few in the room seemed to understand the connection.

Strange. But man, what great writing in this article.

Let’s give the last word to Aswath Damodaran:

Aswath Damodaran, a professor at N.Y.U.’s Stern School of Business, has long argued about the danger of companies that try to return to the growth stage of their life cycle. These technology companies, he said, are run by people afflicted with something he calls the Steve Jobs syndrome. “We have created an incentive structure where C.E.O.s want to be stars,” Damodaran explained. “To be a star, you’ve got to be the next Steve Jobs — somebody who has actually grown a company to be a massive, large-market cap company.” But, he went on, “it’s extremely dangerous at companies when you focus on the exception rather than the rule.” He pointed out that “for every Apple, there are a hundred companies that tried to do what Apple did and fell flat on their faces.”

from New York University’s beautifully done website: http://people.stern.nyu.edu/adamodar/

Debt

Posted: May 9, 2012 Filed under: business, Nigeria Leave a commentHelen DeWitt pulls a great thing from this interview with David Graeber, author of Debt: The First 5,000 Years.

David Graeber: An anthropologist who studied people in central Nigeria showed us how we were completely clueless. She doesn’t really speak the language and she gets a house, and immediately women start showing up from the neighborhood and dropping off little baskets of stuff: somebody bringing some okra, somebody bringing some fish. And she doesn’t know what to do so she takes out her little notebook and eventually somebody takes pity on her and starts explaining how things work. The person says, “Well, you know, you give something back to these people. But the key is you have to figure out exactly what it’s worth, and then give them either something slightly more valuable, or slightly less valuable. So if it’s worth twelve shillings, you give them something worth eleven or thirteen, never give twelve. Because if you give twelve, that’s like saying, ‘go to hell, I don’t ever have to see you again.’” So everyone has to be a little bit beholden.

Peter Thiel on pitching

Posted: May 8, 2012 Filed under: advice, business, screenwriting 1 CommentDefinite crossover with movie/TV pitching:

One of the most important things to understand is that, like all people, VCs are different people at different times of day. It helps to pitch as early as possible in the day. This is not a throwaway point. Disregard it at your peril. A study of judges in Israel doing parole hearings showed prisoners had a two-thirds chance of getting parole if their hearing was early in the day. Those odds decreased with time. There was a brief uptick after lunch—presumably because the judges were happily rested. By the end of the day people had virtually no chance of being paroled. Like everyone, VCs make poorer decisions as they get tired. Come afternoon, all they want to do is go home. It does indeed suck to have to wake up early to go pitch. But that is what you must do. Insist that you get on the calendar early.

A related point: It’s also important not to provide too much choice. Contrary to the standard microeconomics literature which extols the virtues of choice, empirical studies show people are actually made unhappy by a lot of choice. Too many choices makes for Costco Syndrome and mental encumbrance. By the end of the day, the VCs have had a lot of choices. So in addition to getting to them early in the day (before they’ve had to make a lot of choices), you should keep your proposition simple. When you make your ask, don’t give them tons of different financing options or packages or other attempts at optimization. That will burden them with a cognitive load that will make them unhappy. Keep it simple.

Whole thing is interesting. HT Tyler Cowen.

Let me tell you some quick facts about William Jardine

Posted: May 5, 2012 Filed under: business, family, from wikipedia, history, Hong Kong Leave a comment

He became a surgeon’s mate on a ship at age 18

His lifelong friend was named Jamsetjee Jejeebhoy

An early business partner was named Hollingworth Magniac

His rival was named Lancelot Dent

He started a business in Hong Kong importing, among other things, opium to China. His partner was James Matheson:

William C. Hunter, a contemporary of Jardine who worked for the American firm Russell & Co., wrote of him, “He was a gentleman of great strength of character and of unbounded generosity.” Hunter’s description of Matheson was, “He was a gentleman of great suavity of manner and the impersonation of benevolence.”

“He was nicknamed by the locals “The Iron-headed Old Rat” after being hit on the head by a club in Guangzhou.”

When the Chinese tried to ban the importation of opium, he gave the foreign secretary a detailed plan on how to attack China, which the British went ahead and did.

His farewell dinner when he left Hong Kong was legendary. FDR’s grandfather was there.

A bachelor, when he died he left his fortune to his nephews and siblings.

Jardine Matheson Group, still run by members of his family, is today – all of this is according to wikipedia – the second-largest employer in Hong Kong.