Tilray, Canopy, and The Canadian Marijuana Gold Rush

Posted: September 3, 2018 Filed under: business, drugs Leave a comment

As part of my Year of Business I’ve been reading lots of investing websites. An area of insane hype at the moment is Canadian marijuana stocks.

(The picks and shovels play here might be stock images of marijuana leaves).

Recreational marijuana will be legal in Canada in October, and unlike the United States, where federal regulation of the plant makes doing anything on the national level very difficult, it’s all good up there in Justin Trudeau land.

Once Constellation Brands, makers of Corona beer, made a $4 billion deal with Canopy Growth (traded on the New York Stock Exchange as CGC) it was off to the races.

I did not invest in Canopy Growth because a quick image search of CEO Bruce Linton did not inspire confidence.

An interesting aspect of Canada’s marijuana rules are that the packaging has to adhere to very strict regulation, with very little advertising. This, it seems to me, presents kind of a Zen marketing challenge. How will one brand distinguish itself from another?

Blessedly I have kind of a Peter Lynch advantage here. From watching lots of Trailer Park Boys, I know that “BC Hydro” and marijuana from British Columbia is highly prized by the Canadian consumer. Even a low information Canadian marijuana consumer might know to ask for weed from British Columbia.

Blessedly I have kind of a Peter Lynch advantage here. From watching lots of Trailer Park Boys, I know that “BC Hydro” and marijuana from British Columbia is highly prized by the Canadian consumer. Even a low information Canadian marijuana consumer might know to ask for weed from British Columbia.

Tilray, traded on the NASDAQ as TLRY, is a respected marijuana grower based in Naniamo, British Columbia. Here is their respectable looking management team.

A few more observations:

- It is worth remembering our Charlie Munger here. Here he is talking in 2014 about why Berkshire Hathaway, the original textile company, was doomed:

The other rare example, of course, is Berkshire Hathaway. Berkshire started with three failing companies: a textile business in New England that was totally doomed because textiles are congealed electricity and the power rates were way higher in New England than they were down in TVA country in Georgia. A totally doomed, certain-to-fail business.

In a way, marijuana itself is congealed electricity. I’m told power rates are cheapest in Ontario, where Canopy is based. And of course Medicine Hat, Alberta, is the sunniest city in Canada.

Echodale Park in Medicine Hat, by Michael Ireland on Wikipedia

- I find it interesting and a testament to the world’s absurdity that if you had eight ounces of marijuana in New York City, the minimum jail sentence is three years, while down the street billions of dollars of shares of marijuana growers are being traded. Maybe Governor Cynthia Nixon will correct that imbalance. (Since I first discussed this on Twitter, Tilray’s stock went up 67%)

- If the President of the USA really cared about us defeating Canada, wouldn’t he work towards legalizing marijuana immediately, so that US companies could compete without Canada getting a jump on us?

- At first I thought legalized marijuana would end up being just like any commodity, like corn or something. But the technical know-how to extract and present CBD or THC as an oil or in something like a Dosist pen might give an advantage to companies with good processes. Note this picture of a laboratory on Tilray’s website:

- It’s my casual observation that a lot of very dumb bros, like guys who are too dumb to be in tech, are in the marijuana business. There’s something great about a field where many of your competitors will be dumb. (There are also many very, very smart people in this field.)

Celebs getting out the vote

Posted: September 2, 2018 Filed under: America Since 1945 Leave a comment

struck by the intro to this one. Celebs have been trying to get young people to vote for a long time.

Charlie Munger Deep Cuts

Posted: September 2, 2018 Filed under: advice, business 1 Comment

In 2011 Warren Buffett and Charlie Munger came to visit The Office to film a video for the Berkshire Hathaway annual meeting. I hadn’t heard of Charlie Munger. From the Internet I learned that he was a brilliant dude in his own right, as well as a guy Warren Buffett trusted, learned from, and considered his closest partner.

At lunchtime, everyone was huddled around the more famous Buffett, while Charlie Munger was sitting by himself. In this way I ended up having lunch with Charlie Munger.

From his Wikipedia page I knew he’d been a meteorologist in World War II, so I asked him about that. His job was hand drawing weather maps to make predictions as the US was sending planes over the Bering Strait to our then-ally the Soviet Union.

Ever since this encounter I’ve read everything I can find by Charlie Munger.

This is a good place to start.

In my hunt for Munger deep cuts, came across this speech he gave in October 1998 at the Santa Monica Miramar Hotel to a group of institutional investors. Stunningly blunt and direct advice on how to invest:

In the United States, a person or institution with almost all wealth invested, long term, in just three fine domestic corporations is securely rich. And why should such an owner care if at any time most other investors are faring somewhat better or worse. And particularly so when he rationally believes, like Berkshire, that his long-term results will be superior by reason of his lower costs, required emphasis on long-term effects, and concentration in his most preferred choices.

I go even further. I think it can be a rational choice, in some situations, for a family or a foundation to remain 90% concentrated in one equity. Indeed, I hope the Mungers follow roughly this course. And I note that the Woodruff foundations have, so far, proven extremely wise to retain an approximately 90% concentration in the founder’s Coca-Cola stock. It would be interesting to calculate just how all American foundations would have fared if they had never sold a share of founder’s stock. Very many, I think, would now be much better off. But, you may say, the diversifiers simply took out insurance against a catastrophe that didn’t occur. And I reply: there are worse things than some foundation’s losing relative clout in the world, and rich institutions, like rich individuals, should do a lot of self insurance if they want to maximize long-term results.

If only stupid Harvard had listened!

More:

My controversial argument is an additional consideration weighing against the complex, high-cost investment modalities becoming ever more popular at foundations. Even if, contrary to my suspicions, such modalities should turn out to work pretty well, most of the money-making activity would contain profoundly antisocial effects. This would be so because the activity would exacerbate the current, harmful trend in which ever more of the nation’s ethical young brainpower is attracted into lucrative money-management and its attendant modern frictions, as distinguished from work providing much more value to others. Money management does not create the right examples. Early Charlie Munger is a horrible career model for the young, because not enough was delivered to civilization in return for what was wrested from capitalism. And other similar career models are even worse.

More Munger deep cuts from the 2017 Shareholders Meeting of Daily Journal Co., (I found here on the wonderful Mine Safety Disclosures website but it’s in a couple places). Daily Journal Co is a business that, as I understand it, exists on the fact that companies have to publish legal notices somewhere, and this company more or less has a monopoly on the business.

Munger gets real:

the Mungers have three stocks: we have a block of Berkshire, we have a block of Costco, we have a block of Li Lu’s Fund, and the rest is dribs and drabs. So am I comfortable? Am I securely rich? You’re damn right I am.

Could other people be just as comfortable as I who didn’t have a vast portfolio with a lot of names in it, many of whom neither they nor their advisors understand? Of course they’d be better off if they did what I did. And are three stocks enough? What are the chances that Costco’s going to fail? What are the chances that Berkshire Hathaway’s going to fail? What are the chances that Li Lu’s portfolio in China is going to fail? The chances that any one of those things happening is almost zero, the chances that all three of them are going to fail.

That’s one of the good ideas I had when I was young. When I started investing my little piddly savings as a lawyer, I tried to figure out how much diversification I would need if I had a 10 percentage advantage every year over stocks generally. I just worked it out. I didn’t have any formula. I just worked it out with my high school algebra, and I realized that if I was going to be there for 30 or 40 years, I’d be about 99% sure that it would be just fine if I never owned more than three stocks and my average holding period is three or four years.

Once I had done that with my little pencil, I just…I never for a moment believed this balderdash they teach about. Why diversification? Diversification is a rule for those who don’t know anything. Warren calls them “know-nothing investors”. If you’re a know-nothing investor, of course you’re going to own the average. But if you’re not a know-nothing —if you’re actually capable of figuring out something that will work better—you’re just hurting yourselves looking for 50 when three will suffice. Hell, one will suffice if you do it right. One. If you have one cinch, what else do you need in life?

Li Lu is himself a super interesting character.

A student leader in the Tiananmen Square protests, escapes China (with the help of Western intelligence?) ends up penniless at Columbia, hears about a lecture by Warren Buffett and misunderstands that this has something to do with a “buffet” and becomes of the most successful investors in the world?

More from Munger on a range of topics:

on Lee Kuan Yew and the history of Singapore:

Lee Kuan Yew may have been the best nation builder that ever lived. He took over a malarial swamp with no assets, no natural resources, nothing, surrounded by a bunch of Muslims who hated him, hated him. In fact, he was being spat out by the Muslim country. They didn’t want a bunch of damn Chinese in their country. That’s how Singapore was formed as a country—the Muslims spat it out. And so here he is, no assets, no money, no nothing. People were dying of malaria, lots of corruption—and he creates in a very short time, by historical standards, modern Singapore. It was a huge, huge, huge success. It was such a success, there is no other precedent in the history of the world that is any stronger.

Now China’s more important because there are more Chinese, but you can give Lee Kuan

Yew a lot of the credit for creating modern China because a lot of those pragmatic communist leaders—they saw a bunch of Chinese that were rich when they were poor and they said, “to hell with this”. Remember the old communist said, “I don’t care whether the cat is black or white, I care whether he catches mice”. He wanted some of the success that Singapore got and he copied the playbook. So I think the communist leadership that copied Lee Kuan Yew was right. I think Lee Kuan Yew was right. And of course, I have two busts of somebody else in my house. One is Benjamin Franklin, and the other is Lee Kuan Yew. So, that’s what I think of him.

on real estate:

MUNGER: Real estate?

Q: Yeah, real estate.

MUNGER: The trouble with real estate is that everybody else understands it and the people who you are dealing with and the competing with, they specialized in a little 12 blocks in a little industry. They know more about the industry than you do. And you got a lot of bullshitters and liars and brokers. So it’s not that easy. It’s not a bit easy.

Your trouble is if it’s easy—all these people, a whole bunch of ethnics that love real estate,. You know, Asians, Hasidic Jews, Indians from India, they all love real estate; they’re smart people and they know everybody and they know the tricks. And the thing is you don’t even see the good offers in real estate. They show the big investors and dealers. It’s not an easy game to play from a beginners point of view; whereas with stocks, you’re equal with everybody if you’re smart. In real estate, you don’t even see the opportunities when you’re a young person starting out. They go to others. The stock market’s always open, except venture capital. Sequoia sees the good stuff. You can open an office—Joe Shmo Venture Capitalist—startups come to me. You’d starve to death.

You’ve gotta figure out what your competitive position is in what you’re choosing. Real estate has a lot of difficulties. And those Patels from India that buy all the motels, they know more about motels than you do. They live in a god damn motel. They pay no income taxes. They don’t pay much in worker’s compensation and every dime they get, they fix up the thing to buy another motel. Do you want to compete with the Patels? Not I.

on Sumner Redstone:

Well, I never knew Sumner Redstone but I followed him because he was a little ahead of me in Law School, but Sumner Redstone is a very peculiar man. Almost nobody has ever liked him. He’s a very hard-driven, tough tomato, and basically almost nobody has ever liked him, including his wives and his children. And he’s just gone through life. There’s an old saying, “Screw them all except six and save those for pallbearers.” And that is the way Sumner Redstone went through life. And I think he was in to the pallbearers because he lived so long. So I’ve used Sumner Redstone all my life as an example of what not to do.

He started with some money, and he’s very shrewd and hard-driven. You know he saved his life by hanging while the fire was up in his hands. He’s a very determined, high IQ maniac, but nobody likes him and nobody ever did. And though he paid for sex in his old age, cheated him, you know always had one right after another.

That’s not a life you want to admire. I used Sumner Redstone all my life as an example of what I don’t want to be. But for sheer talent, drive and shrewdness, you would hardly find anybody stronger than Sumner. He didn’t care if people liked him. I don’t care if 95% of you don’t like me, but I really need the other 5%. Sumner just…

on the movie business:

And the movie business I don’t like either because it’s been a bad business-—crooked labor unions, crazy agents, crazy screaming lawyers, idiosyncratic stars taking cocaine-—it’s just not my field. I just don’t want to be in it.

on copying other investors:

Q: On the topic of cloning, do you really believe that Mohnish said that if investors look at the 13Fs of super investors, that they can beat the market by picking their spots? And we’ll add spinoffs.

MUNGER: It’s a very plausible idea and I’d encourage one young man to look at it, so I can hardly say that it has no merit. Of course it’s useful if I were you people to look at what other—what you regard as great—investors are doing for ideas. The trouble with it is that if you’d pick people as late in the game as Berkshire Hathaway, you’re buying our limitations caused by size. You really need to do it from some guy that’s operating in smaller places and finding places with more advantage. And of course, it’s hard to identify the people in the small game, but it’s not an idea that won’t work.

If I were you people, of course I would do that. I would want to know exactly what the shrewd people were doing and I would look at every one of them, of course. That would be a no-brainer for me.

on Li Lu:

I got to tell you a story about Li Lu that you will like. Now General Electric was famous for always negotiating down to the wire and just before they were at close, they’ll add one final twist. And, of course, it always worked, the other guy was all invested, so everybody feels robbed and cheated and mad, but they get their way in that last final twist.

So, Li Lu made a couple of venture investments and he made this one with this guy. The guy made us a lot of money in a previous deal and we’re now going in with him again on another—a very high-grade guy and smart and so forth.

Now we come to the General Electric moment. Li Lu said, “I have to make one change in this investment.” It sounds just like General Electric just about to close. I didn’t tell Li Lu to do it; he did it himself. He said, “You know, this is a small amount of money to us and you got your whole net worth in it. I cannot sign this thing if you won’t let me put in a clause saying if it all goes to hell we’ll give you your money back.” That was the change he wanted. Now, you can imagine how likely we were to see the next venture capital investment. Nobody has to tell Li Lu to do that stuff. Some of these people, it’s in their gene power. It’s just such a smart thing to do. It looks generous and it is generous, but there’s huge self-interest in it.

on Al Gore:

Oh, I got another story for you that you’ll like.

Yeah get that thing (peanut brittle out of here or I’ll eat it all).

Al Gore has come into you fella’s business. Al Gore, he has made $300 or $400 million in your business and he is not very smart. He smoked a lot of pot. He coasted through Harvard with a Gentlemen’s C. But he had one obsessive idea that global warming was a terrible thing and he understandably predicted the world for it. So his idea when he went into investment counseling is he was not going to put any CO2 in the air. So he found some partner to go into investment counseling with and he says, “we are not going to have any CO2”. But this partner is a value investor. And a good one.

So what they did was Gore hired his staff to find people who didn’t put CO2 in the air. And of course, that put him into services-—Microsoft and all these service companies that were just ideally located. And this value investor picked the best service companies. So all of a sudden the clients are making hundreds of millions of dollars and they’re paying part of it to Al Gore, and now Al Gore has hundreds of millions of dollars in your profession. And he’s an idiot. It’s an interesting story and a true one.

Warren Buffetts, real and fake

Posted: September 1, 2018 Filed under: business, heroes Leave a comment

These dudes started a fake Warren Buffett account on a bet, and within a few days it was retweeted by Peggy Noonan, Kanye, etc.

Impressed with how generic and bland the advice was.

The worship of Buffett as an oracle is not just a US phenomenon. If anything it may be stronger in Asia. In Korea in 2007, I saw subway vending machines selling biographies of Warren Buffett. In this video, being interviewed by a Chinese magazine, you can see Warren Buffett’s partner, Charlie Munger, attempt to explain why he thinks he and Buffett are so popular in China. He suggests that it’s because much of their advice is very Confucian:

Actual Warren Buffett’s advice is free and very available. You can read all of Berkshire Hathaway’s letters to shareholders, which are funny and interesting at times (the better you are at skimming the boring parts, the more enjoyment you will get out of them). You can see everything he invests in — he legally has to tell you!

Investing is simple, but not easy

is a quote often attributed to Buffett, though I myself cannot find the original source for it.

Buffett himself was asked about the fake account on CNBC:

QUICK: BUT THERE WAS A FAKE TWITTER ACCOUNT, A FAKE WARREN BUFFETT TWITTER ACCOUNT THAT WENT FROM 20,000 FOLLOWERS TO 200,000 FOLLOWERS IN 24 HOURS BY TWEETING OUT ALL KINDS OF PITHY SORT OF SOUND ADVICE, THINGS THAT FOLKSY SAYINGS THAT SOUNDED LIKE IT COULD HAVE COME FROM YOU. WHY DON’T YOU TWEET MORE OFTEN?

BUFFETT: WELL I JUST DON’T SEE A REASON TO. I PUT OUT AN ANNUAL REPORT, AND I DO NOT HAVE A DAILY VIEW ON ALL KINDS OF THINGS. AND, AND MAYBE I’VE GOT A GUY IN THIS COPYCAT OR IMITATOR, MAYBE HE’S PUTTING OUT BETTER STUFF THAN I WOULD. SO IF HE PUTS OUT GOOD ADVICE, I’LL TAKE CREDIT FOR IT.

QUICK: WE HAVE SEEN SOME CEOs WHO LIKE TO TWEET VERY FREQUENTLY, INCLUDING ELON MUSK.

BUFFETT: YES.

QUICK: HE’S CERTAINLY SOMEBODY WHO TWEETED A LOT. WHAT DO YOU THINK ABOUT PEOPLE WHO TWEET A LOT?

BUFFETT: I DON’T THINK IT’S HELPED HIM A LOT. NO, I THINK IT’S — WELL, IT’D BE PARTICULARLY DANGEROUS TO START COMMENTING ON BERKSHIRE DAILY, WHICH I NEVER WOULD DO. I WON’T DO IT WITH YOU. BUT I THINK THERE’S OTHER THINGS IN LIFE I WANT TO DO THAN TWEET. I MEAN, I’M NOT THAT DESPERATE FOR SOMEBODY TO HEAR MY OPINION ON THIS.

This aspect of Buffett is much celebrated:

It’s sometimes forgotten or overlooked that he also owns a $7.9 million house in Laguna Beach.

Though in fairness he bought it in 1971 for $150,000.

worry they’re not anxious enough

Posted: August 30, 2018 Filed under: America Since 1945 Leave a comment

from yesterday’s Washington Post

Normal world we’re living in

Posted: August 30, 2018 Filed under: business Leave a comment

from today’s WSJ

The Ten Day MBA

Posted: August 26, 2018 Filed under: business Leave a comment

My New Years’ resolution this year was to learn business. So I finally took off the shelf and read this one, which had been recommended to me years ago by a business school graduate.

Friends, this book is fantastic. Funny and informative and clarifying. Shortly after finishing it, I overheard a loud, obnoxious conversation between two young businessmen at a bar, and I was able to follow all the acronyms and MBA gibberish they spewed at each other, as well as see many flaws in their thinking.

I thought this was a funny part. The chapter on ethics is of course the shortest, and much of it is devoted to a “I’m telling you this so you know not to do it” kind of moral reasoning.

How about Genichi Taguchi, from the chapter on Operations?:

This book is worth the cost just for the summaries of leadership and public speaking books included at the end.

Highest praise to author Steven Silbiger. I don’t know how much business you can learn from a book but this felt like a good start.

Nassim Nicholas Taleb

Posted: August 25, 2018 Filed under: business 1 Comment

Has any writer ever distilled his key ideas into his titles so well?

Great example from this book. Casinos employ all kinds of mathematicians to build sophisticated models of probability to ensure their edge. These probabilities work within the rule-bound world of games, but to imagine life exists within the controlled parameters of a game is what Taleb calls “the ludic fallacy” (from the Latin for game). In real life, crazy things you couldn’t have predicted may happen:

You almost don’t need to read these books, once you grasp the implications of the titles. Our brains have difficulty grasping the implications of probability.

Prepare yourself and live a life that accepts and can absorb risk.

You’d be crazy to armchair psychoanalyze as feisty a Twitter arguer as Nassim Nicholas Taleb, but I did feel like this passage in Fooled By Randomness suggests hints to an origin story for a man obsessed with probability:

I’ve now read all these books and found them entertaining, eccentric, inventive, infectious, and fun. I even liked:

Felt like my brain was getting steady nutrition as well as entertainment from these books.

This commencement address he gave is one of many samples available for free over at Medium.

Darkest Hour

Posted: August 20, 2018 Filed under: film, history Leave a comment

This movie is on HBO this month. I saw the movie in the theater and thought it was pretty good. It really captured the batty, Lewis Carroll eccentricity element of Churchill and the British Parliament.

But one thing that I was wondering about was the title. I remembered a story I’d heard years ago about Churchill visiting Harrow in 1941. The schoolboys sang a new verse to an old song:

When Churchill visited Harrow on October 29 to hear the traditional songs again, he discovered that an additional verse had been added to one of them. It ran:

“Not less we praise in darker days

The leader of our nation,

And Churchill’s name shall win acclaim

From each new generation.

For you have power in danger’s hour

Our freedom to defend, Sir!

Though long the fight we know that right

Will triumph in the end, Sir!”

Churchill didn’t care for the word darker. In his speech to the school he said:

You sang here a verse of a School Song: you sang that extra verse written in my honour, which I was very greatly complimented by and which you have repeated today. But there is one word in it I want to alter – I wanted to do so last year, but I did not venture to. It is the line: “Not less we praise in darker days.”

I have obtained the Head Master’s permission to alter darker to sterner. “Not less we praise in sterner days.”

Do not let us speak of darker days: let us speak rather of sterner days. These are not dark days; these are great days – the greatest days our country has ever lived; and we must all thank God that we have been allowed, each of us according to our stations, to play a part in making these days memorable in the history of our race.

Getting all that from the National Churchill Museum.

I believe this Wikipedia page is inaccurate:

“The Darkest Hour” is a phrase coined by British prime minister

Did he coin this phrase?

Winston Churchill to describe the period of World War II between the Fall of France in June 1940 and the Axis invasion of the Soviet Union in June 1941 (totaling 363 days, or 11 months and 28 days), when the British Empire stood alone (or almost alone after the Italian invasion of Greece) against the Axis Powers in Europe.

Perhaps he uses it in his volumes of history, which I don’t have at hand. But that’s not the source Wiki cites. In the cited “Finest Hour” speech, Churchill did use the phrase “darkest hour,” but to refer to what a sad period this was in French history:

The House will have read the historic declaration in which, at the desire of many Frenchmen-and of our own hearts-we have proclaimed our willingness at the darkest hour in French history to conclude a union of common citizenship in this struggle.

I bought screenwriter Anthony McCarten’s book:

on Kindle and did a search. Unless I’m missing something, I can find no other time in the book where Churchill himself is quoted using the phrase “darkest hour.”

So, the movie about Churchill uses for its title a term that Churchill himself specifically asked people not to use.

My question as always: is this interesting?

What is a story? What is narrative?

Posted: August 19, 2018 Filed under: writing, writing advice from other people 1 Comment

“Good story” means something worth telling that the world wants to hear. Finding this is your lonely task. It begins with talent… But the love of a good story, of terrific characters and a world driven by your passion, courage, and creative gifts is still not enough. Your goal must be a good story well told.

says McKee.

What is a story? What makes something a story? It’s a question of personal and professional interest here at Helytimes. The dictionary gives me this for narrative:

a spoken or written account of connected events; a story.

boldface mine.

The human brain is wired to look for patterns and connections. Humans think in stories and seem to prefer a story, even a troubling story, to random or unrelated events. This can trick us as well as bring us wisdom and pleasure.

Nicholas Nassem Taleb discusses this in The Black Swan:

Narrative is a way to compress and store information.

From some investing site or Twitter or something, I came across this paper:

“Cracking the enigma of asset bubbles with narratives,” by Preston Teeter and Jörgen Sandberg in Strategic Organization. You can download a PDF for free.

Teeter and Sandberg suggest that “mathematical deductivist models and tightly controlled, reductionist experiments” only get you so far in understanding asset bubbles. What really drives a bubble is the narrative that infects and influences investors.

Clearly, under such circumstances, individuals are not making rational, cool-headed decisions based upon careful and cautious fundamental analysis, nor are their decisions isolated from the communities in which they live or the institutions that govern their lives. As such, only by incorporating the role of narratives into our research efforts and theoretical constructs will we be able to make substantial progress toward better understanding, predicting, and preventing asset bubbles.

Cool! But, of course, we need a definition of narrative:

But first, in order to develop a more structured view of how bubbles form, we also need a means of identifying the structural features of the narratives that emerge before, during, and after asset bubbles. The most widely used method of evaluating the structural characteristics of a narrative is that based on Formalist theories (see Fiol, 1989; Hartz and Steger, 2010; Pentland, 1999; Propp, 1958). From a structural point of view, a narrative contains three essential elements: a “narrative subject,” which is in search of or destined for a certain object; a “destinator” or source of the subject’s ideology; and a set of “enabling and impeding forces.” As an example of how to operationalize these elements, consider the following excerpt from another Greenspan (1988) speech:

More adequate capital, risk-based capital, and increased securities powers for bank holding companies would provide a solid beginning for our efforts to ensure financial stability. (p. 11)

OK great. Let’s get to the source here. Fiol, Hartz and Steger, and Pentland are all articles about “narrative” in business settings. Propp is the source here. Propp is this man:

Vladimir Propp, a Soviet analyst of folktales, and his book is this:

I’ve now examined this book, and find it mostly incomprehensible:

Propp’s 31 functions (summarized here on Wikipedia) are pretty interesting. How a Soviet theorist would feel about his work on Russian folktales being used by Australian economists to assess asset bubbles in capitalist markets is a fun question. Maybe he’d be horrified, maybe he’d be delighted. Perhaps he’d file it under Function 6:

TRICKERY: The villain attempts to deceive the victim to acquire something valuable. They press further, aiming to con the protagonists and earn their trust. Sometimes the villain make little or no deception and instead ransoms one valuable thing for another.

There’s some connection here to Dan Harmon’s story circles.

But when it comes to the definition of what makes a story go, I like the blunter version, expressed by David Mamet in this legendary memo to the writers of The Unit::

QUESTION:WHAT IS DRAMA? DRAMA, AGAIN, IS THE QUEST OF THE HERO TO OVERCOME THOSE THINGS WHICH PREVENT HIM FROM ACHIEVING A SPECIFIC, *ACUTE* GOAL.

SO: WE, THE WRITERS, MUST ASK OURSELVES *OF EVERY SCENE* THESE THREE QUESTIONS.

1) WHO WANTS WHAT?

2) WHAT HAPPENS IF HER DON’T GET IT?

3) WHY NOW?

Cracking the enigma of narrative is a fun project.

ps don’t talk to me about Aristotle unless you’ve REALLY read The Poetics.

God Save Texas by Lawrence Wright

Posted: August 18, 2018 Filed under: Texas Leave a comment

a spontaneous Helytimes Book Prize For Excellence is awarded to God Save Texas by Lawrence Wright. Absolutely fantastic. The Alamo, Marfa, Willie Nelson, Ann Richards, how the legislature works, the Kennedy assassination, Spindletop, everything you’d want to read about in a book about Texas is succinctly, thoughtfully, humorously explored.

Two clips:

What?! and:

A special bonus: this book has a firsthand account of the 1999 Matthew McConaughey “bongos incident.”

Why Ben Graham wouldn’t hire Warren Buffett

Posted: August 18, 2018 Filed under: business, money Leave a comment

If you read anything at all about investing, pretty soon you will hear about Ben Graham, father of value investing and teacher of Warren Buffett.

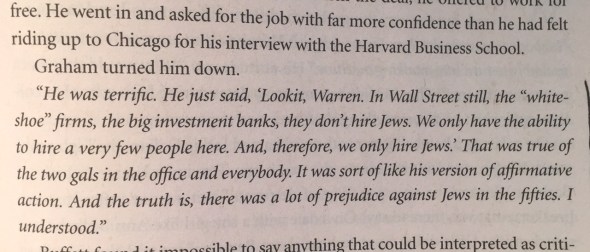

Young Warren Buffett got an A+ in Graham’s class at Columbia Business School, and would later work for Graham. But when he first asked Graham for a job, in fact offered to work for free, Graham (born Grossbaum) wouldn’t hire Buffett. Why? The story in Buffett’s own words:

I’d never heard that one before. It’s in:

Later, Graham would hire Buffett, and he got to wear the signature gray jacket that absorbed ink stains from writing down rows of figures.

I found this book more compelling than I expected. By the time Buffett was in tenth grade he owned a forty acre farm in Nebraska he’d bought with paper route money. You can read an interesting interview with author Alice Schroeder here:

Miguel: Give us advice to becoming better communicators.

Alice: Well…this is not anything profound. But you see that he uses very short parables, stories, and analogies. He chooses key words that resonate with people —that will stick in their heads, like Aesop’s fables, and fairytale imagery. He’s good at conjuring up pictures in people’s minds that trigger archetypal thinking. It enables him to very quickly make a point … without having to expend a lot of verbiage.

He’s also conscientious about weaving humor into his material. He’s naturally witty, but he’s aware that humor is enjoyable and disarming if you’re trying to teach something.

And here’s Michael Lewis reviewing the book.

Ben Graham by the way ultimately got kinda bored of investing and retired to California where he had a relationship with his late son’s girlfriend.

A great detail:

Guess how much Nestlé pays for the water in Arrowhead Water

Posted: August 12, 2018 Filed under: America Since 1945, the California Condition, water Leave a comment

Nestlé gets the water for Arrowhead in the San Bernadino National Forest, owned by you and me, the American people.

In 2016, Nestlé took 32 million gallons of water from the national forest, in an area not known for its abundance of fresh water.

How much did they pay for this? I found the answer in a recent issue of High Country News:

$2,050?! I feel like I’m getting ripped off!

More in the Desert Sun.

Swung by Lake Arrowhead this weekend:

The Tinder King

Posted: August 12, 2018 Filed under: art history, Hans Holbein, painting, pictures Leave a comment

It’s 1539. Henry VIII is 48 years old and single. Wife 1 didn’t work out, Wife 2 got beheaded, Wife 3 died. The Hunt For Wife 4 is on:

King Henry VIII of England was considering a royal marriage with Cleves, so following negotiations with the duchy, Hans Holbein the Younger, Henry’s court painter, was dispatched to paint Amalia and Anne, both of whom were possible candidates, for the freshly widowed king in August 1539.[2] After seeing both paintings, Henry chose Anne.

Anne:

There is a tradition that Holbein’s portrait flattered Anne, derived from the testimony of Sir Anthony Browne.

Is this Amalia?:

Wikipedia says so but the Royal Collection won’t admit it.

When he met Anne in person Henry was bummed:

succinctly put in:

the workings of capitalism

Posted: August 11, 2018 Filed under: America Since 1945, business Leave a comment

found that blunt history, which sounds like it would fit in a socio-anarchist pamphlet, in

Old Tweets

Posted: August 9, 2018 Filed under: writing Leave a comment

Man I went through my old Tweets, and none of them were racist or anything, but they were terrible!

If you don’t look back on your old writing without disgust you’re not growing, so healthy enough I guess. But you’d think for something I spent so much time doing I’d’ve come up with some better ones.

Here are the only ones I felt like might be worth saving, putting them here as much for myself as for my small but influential readership.

When I don’t like writing it’s usually because it’s too writingy.

The Biblical story of Joseph interpreting Pharaoh’s dream: first case of a Jewish psychiatrist?

If there were a restaurant in LA that sold angel meat, Jonathan Gold would eat there.

Today’s surprising Supreme Court Fact: Ruth Bader Ginsburg was a high school cheerleader.

Whenever I’m in New York, I visit this little shop know, down in the Flatiron, and have my shoes professionally tied.

Addition to Hely’s Great Things: When an old person says “blankety-blank” instead of swears.

An airport? A state forest? An interchange? All fine things to have named after you. But only Melba has a peach thing AND a toast.

One thing I’d like to see is a giant eating baked potatoes, one after another, like grapes.

Ate a piece of gum today that was in stick form, instead of hard, candied pill form. It was like visiting Old Sturbridge Village.

If I’m gonna see a play, by the end the stage better be a MESS.

What real-life show is “Game of Thrones” the porn parody of?

The taste of a drop of air conditioner water landing in your mouth. #mynewyork

There’s only one political issue I’m deeply passionate about: colonizing the moon with convicts. I’m opposed.

Let’s argue! I’ll start! All jazz is perfect.

my favorite cob food? corn, no brainer

It’s unreasonable of Don Cheadle to expect the other members of Ocean’s Eleven will understand his ludicrous slang.

Most of my money ($660) comes from my 1992 dance hit “It’s OK To Dress Up (When You’re The Birthday Girl)”

I think I could sell idiots salted coffee.

“Fine, FINE, we’ll just name ANOTHER one after John Muir, then we can all go home.” – another tense meeting at the US Forest Service.

In this age of baby carrots it’s such a power move to eat a regular carrot.

If you’re into immutable laws you pretty much have to go with physics, right?

TRIVIA: What is the most spilled beverage in the world? Give up? It’s water. (Trick question because I was counting waterfalls.)

Vali rolled with it admirably when he came back to our seats at the Arclight and found me telling the history of IKEA to a stranger.

Was bowling invented so teens of different genders could examine each other’s butts?

“I like your shirt!” = “I noticed your shirt!”

LA etiquette: it’s rude to point out that someone’s production company has never produced anything.

The most important ingredient in any recipe is money.

Movie pitch: Fuckboi Academy

Nothing pisses me off more than when some fuckface in my Instagram is having a nice vacation

My best hope for Olympic glory would be as the falling down guy someone helps in a true display of sportsmanship

What did the TV writer say when he arrived in Hell? “How’re the hours?”

You know what sounds terrible but is actually perfectly nice? The stall in the bathroom of the Yucca Valley Walmart, where I wrote this.

in my Quora digest

Posted: August 8, 2018 Filed under: Islam, religion, the California Condition Leave a comment

Droog

Posted: August 6, 2018 Filed under: drugs, war Leave a comment

learned the origin of the word “drugs” from:

an intense book!

Meanwhile, in the Hi-Desert Star

Posted: August 6, 2018 Filed under: the California Condition Leave a commentmessage

Posted: August 5, 2018 Filed under: America Since 1945, New England, politics Leave a comment

sent by Rhode Island desk